- United States

- /

- Oil and Gas

- /

- NasdaqGS:FANG

Diamondback Energy (NasdaqGS:FANG) Reports Robust First-Quarter Earnings

Reviewed by Simply Wall St

Diamondback Energy (NasdaqGS:FANG) recently announced robust first-quarter earnings with revenue and net income significantly up year-over-year, along with a steadied dividend policy. These positive financial results and a confirmed share repurchase program coincide with the company's stock price increase of 13% over the past month. The market overall rose 4% in the past week, contributing to the bullish sentiment. Additionally, revised production guidance, though a more mixed signal with slight downgrades, adds context to the broader trends. Diamondback Energy's solid returns align closely with the market's momentum, underscoring its strong financial performance.

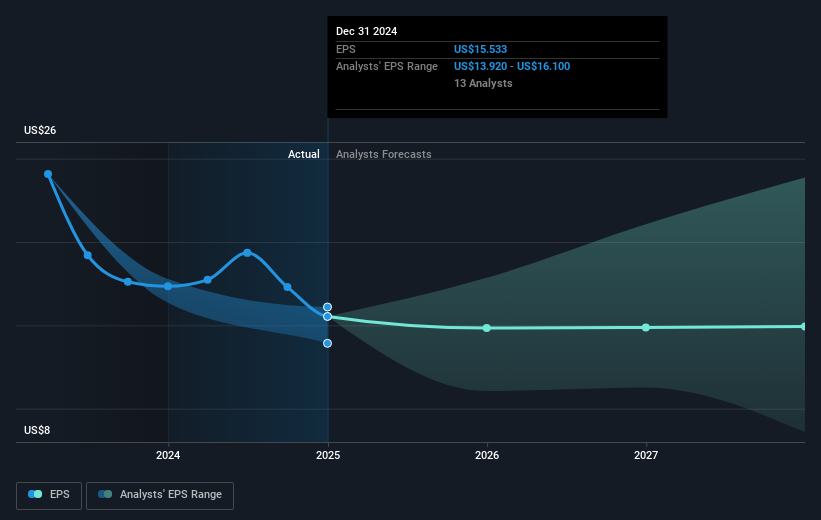

The announcement of Diamondback Energy's robust first-quarter earnings and their decision to reinforce the share repurchase program hold significant implications for the company's overall narrative. By choosing to focus more on share buybacks rather than dividends, Diamondback aims to uplift shareholder value and improve earnings per share. This move aligns with their goal of enhancing capital efficiency while providing some insulation against market volatility. Over the past five years, the company's total shareholder return, including dividends, has been substantial, experiencing a 331.16% increase, showcasing long-term strength and commitment to shareholders. However, over the past year, Diamondback underperformed compared to the US market, which rose 11.6%, though it outpaced the decline seen in the broader oil and gas industry, which fell 5.7%.

In the near term, the revised production guidance and fiscal adjustments suggest a cautious yet focused approach, which could restrain revenue and earnings growth, potentially limiting expansion against current market conditions. The forecasted earnings and revenue projections are expected to grow more slowly than the broader market. With the current stock price at US$131.98 and a consensus price target of US$182.04, there's an implied upside of about 24.54%. This indicates that the stock could still have room to grow despite recent share price increases. As investors weigh the fair value estimates against current market conditions, they should consider how Diamondback's strategic direction might influence future performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FANG

Diamondback Energy

An independent oil and natural gas company, acquires, develops, explores, and exploits unconventional, onshore oil and natural gas reserves in the Permian Basin in West Texas.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives