- United States

- /

- Oil and Gas

- /

- NasdaqGS:EXE

How Should Investors View Expand Energy After Recent Partnerships and a 23.8% Price Jump?

Reviewed by Bailey Pemberton

- Wondering whether Expand Energy is genuinely a bargain or just the latest hot stock? You are not alone. Here are the facts that matter most to value-focused investors.

- In the past month, the stock has climbed an impressive 18.3% and is up 23.8% over the past year, which may indicate growing optimism or a shift in how risk is being perceived.

- Some of this price action follows recent industry partnerships and technology announcements that have attracted investors' attention. It is clear that news beyond financials is having a significant influence on market sentiment right now.

- Currently, Expand Energy scores only 2 out of 6 on our valuation checklist. This suggests that much of the price depends on factors still to be explored. We will walk through the most common ways analysts value stocks and introduce a method at the end that may offer even deeper insight.

Expand Energy scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Expand Energy Discounted Cash Flow (DCF) Analysis

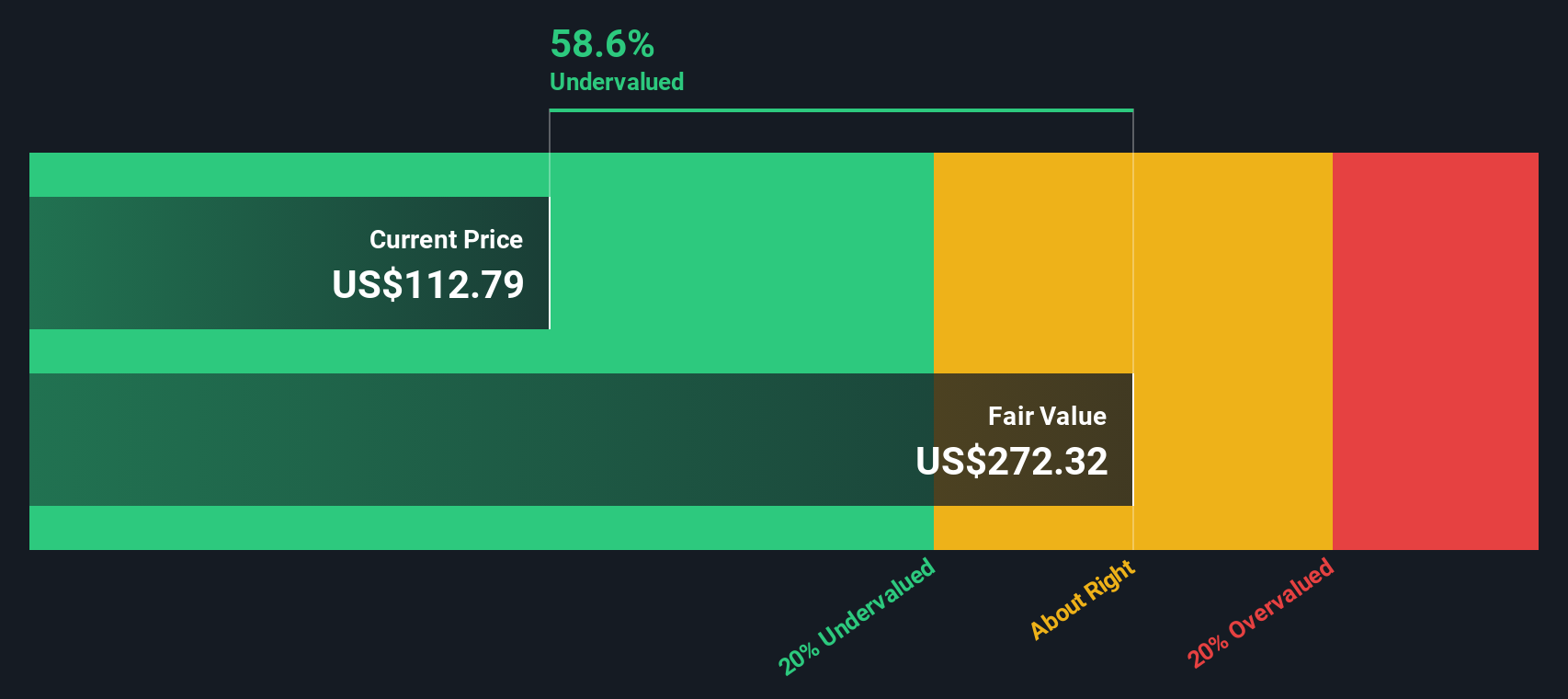

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's value, reflecting the time value of money. This approach provides investors with a detailed understanding of what a business could be worth based on its ability to generate cash rather than relying solely on reported profits.

For Expand Energy, analysts expect the company to generate Free Cash Flow (FCF) of $1.07 billion over the last twelve months. Looking ahead, projections suggest steady growth, with FCF estimates reaching $2.90 billion by 2029. It is important to note that after five years, these cash flow projections are based on trend extrapolations provided by Simply Wall St, as most analysts limit their forecasts to the near term.

Based on the 2 Stage Free Cash Flow to Equity model, the DCF analysis puts Expand Energy’s fair value at $275.13 per share. With the intrinsic discount showing the stock is trading 56.8% below this estimated value, the model suggests Expand Energy is meaningfully undervalued at its current price.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Expand Energy is undervalued by 56.8%. Track this in your watchlist or portfolio, or discover 925 more undervalued stocks based on cash flows.

Approach 2: Expand Energy Price vs Earnings

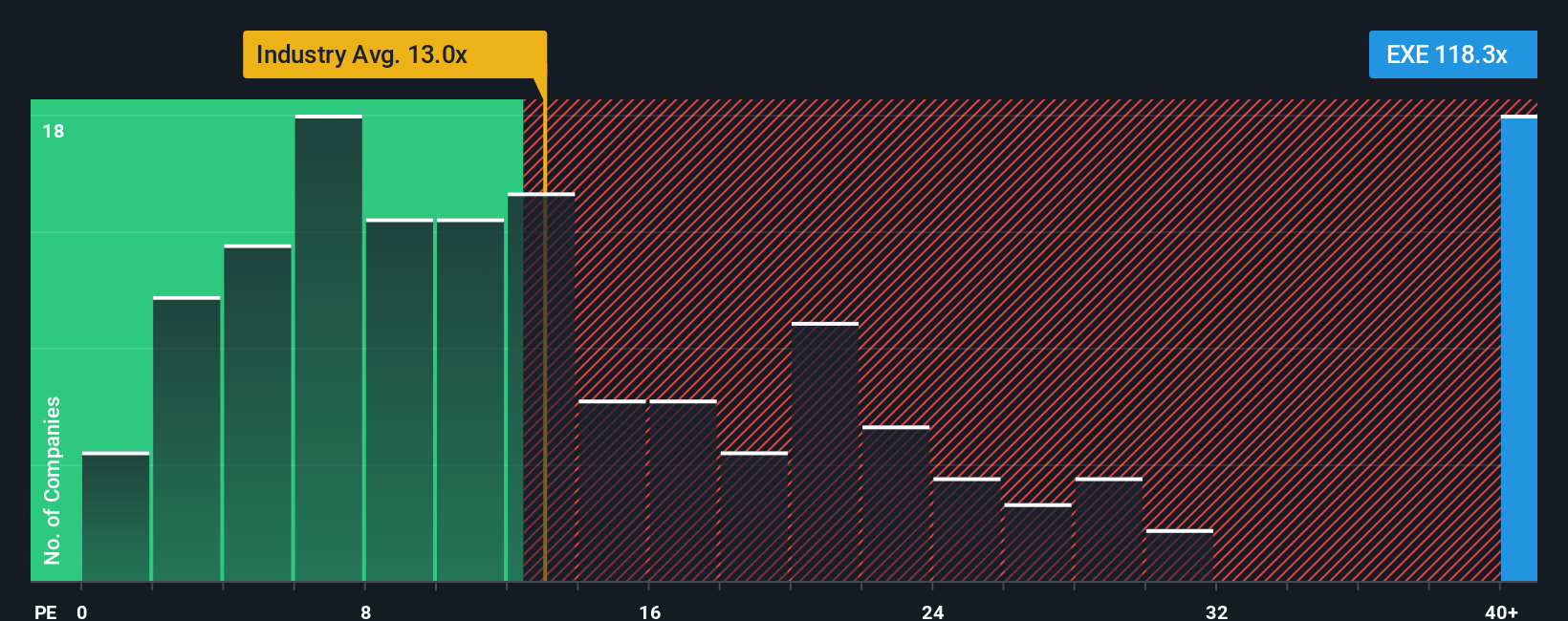

For companies like Expand Energy that are consistently profitable, the Price-to-Earnings (PE) ratio is a widely used and relevant valuation tool. This metric allows investors to gauge how much they are paying today for every dollar of the company’s current earnings.

Market optimism, expected growth rates, and risk profile all factor into what should be considered a “normal” or “fair” PE ratio for a business. Rapidly growing companies, or those seen as lower risk, often command premium multiples. In contrast, slower-growing or riskier firms tend to trade at lower ratios.

Expand Energy’s current PE ratio stands at 32.6x. This is notably higher than the Oil and Gas industry average of 13.3x, as well as the average for its peer group at 14.9x. This initial comparison might suggest the stock is expensive relative to similar businesses.

To provide more tailored insight, Simply Wall St calculates a “Fair Ratio” for each stock, factoring in elements like growth outlook, profit margins, market capitalization, and risks unique to the business and industry. This holistic approach goes beyond standard benchmarks and helps investors avoid misleading conclusions based solely on averages.

For Expand Energy, the Fair Ratio is assessed at 23.0x. Since the company’s actual PE ratio is meaningfully higher, this suggests that, once specific characteristics are adjusted for, the stock may be overvalued based on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1440 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Expand Energy Narrative

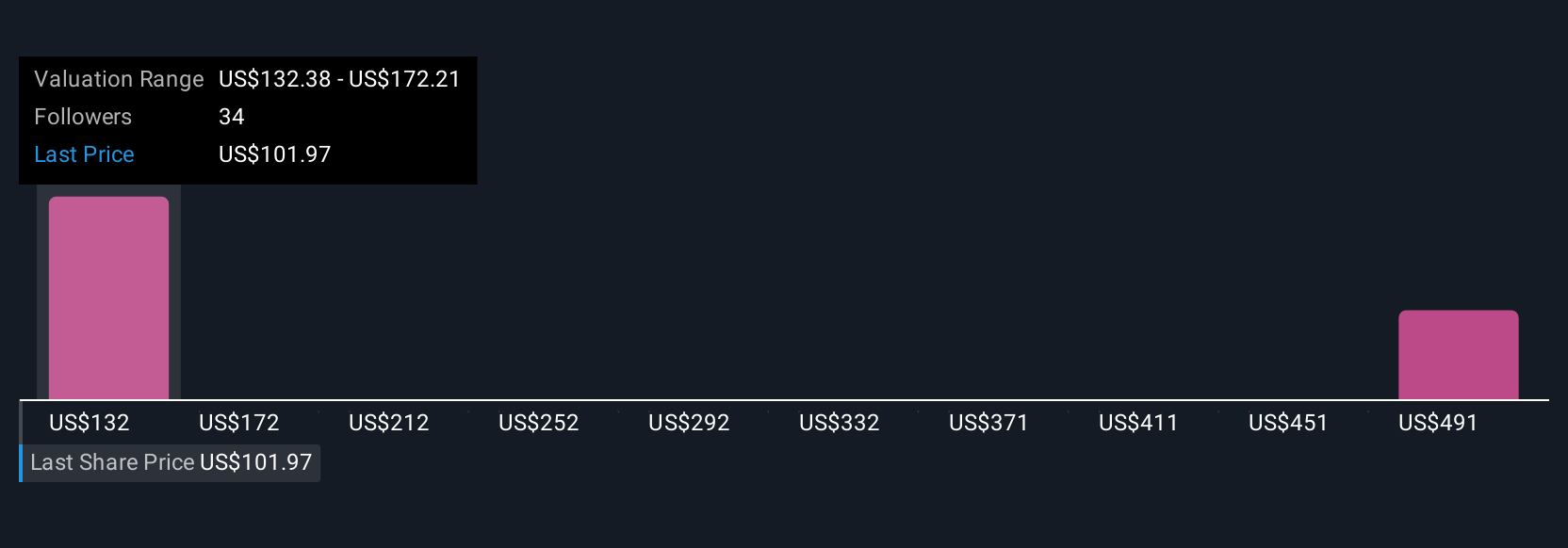

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a concise story you build around a company, combining your own understanding of Expand Energy’s business drivers, future revenues, earnings forecasts, and fair value assumptions, all in one place.

With Narratives, you make your investment decision more robust by connecting the company’s story and its financial outlook directly to what you think its shares are worth. This allows you to move past one-size-fits-all metrics and instead weigh what matters most to you, whether it is innovation, leadership, market dynamics, or risks facing the company.

Narratives are easy to create and track within the Simply Wall St Community page, where millions of investors share their perspectives and updates are made automatically as new news or earnings information arises. By comparing your Narrative-based Fair Value to the current price, you can decide when you think it is the right time to buy or sell.

For example, when looking at Expand Energy, one investor might forecast aggressive margin improvement and set a fair value as high as $154.0, while another, more conservative on future revenue, sets theirs at $98.0. Narratives help you turn expert insight and your beliefs into a clear action plan for investing.

Do you think there's more to the story for Expand Energy? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Expand Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXE

Expand Energy

Operates as an independent natural gas production company in the United States.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)