- United States

- /

- Oil and Gas

- /

- NasdaqGS:EXE

A Fresh Look at Expand Energy (EXE) Valuation Following New $3.5 Billion Credit Facility

Reviewed by Kshitija Bhandaru

Expand Energy (EXE) revealed a major step forward in its financial strategy on September 30, securing a $3.5 billion unsecured revolving credit facility with the option to increase it by another $1 billion if needed. This move signals increased liquidity and flexibility for the company.

See our latest analysis for Expand Energy.

Expand Energy’s move to secure a larger credit facility comes at a time when its shares have seen some volatility, with a 1-month share price return of 6.7% helping to reverse some of the recent dip. Over the last year, however, total shareholder return stands at an impressive 22.4%, which highlights building momentum as investors respond positively to signs of enhanced financial stability and fresh growth potential.

If financial flexibility is on your radar, now is a good opportunity to broaden your perspective and discover fast growing stocks with high insider ownership

With shares trading well below analyst targets and recent financial gains fueling optimism, is Expand Energy now trading at a discount that offers upside for investors? Or is the market already pricing in the company’s growth story?

Most Popular Narrative: 20.3% Undervalued

Compared to Expand Energy's most widely followed narrative, the current share price looks notably lower than its projected fair value. This sets the stage for a valuation debate focused on ambitious growth expectations and financial transformation.

Major, recurring operational efficiencies and rapid well productivity gains, driven by advanced digitalization and AI integration, are resulting in reduced drilling and completion costs and increasing net margins. These improvements are expected to compound over time and directly benefit future earnings.

Curious about the math behind this bullish outlook? The narrative’s fair value relies on aggressive forecasts for skyrocketing profits, massive revenue expansion, and a dramatic reset in how much investors are willing to pay for future earnings. Want to uncover the bold projections that fuel this price target? Dive in to see what makes this valuation stand out.

Result: Fair Value of $128.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, structural policy shifts toward decarbonization and asset concentration in mature regions could present challenges to the positive growth outlook and may put pressure on long-term profitability.

Find out about the key risks to this Expand Energy narrative.

Another View: Valuation by Earnings Ratio

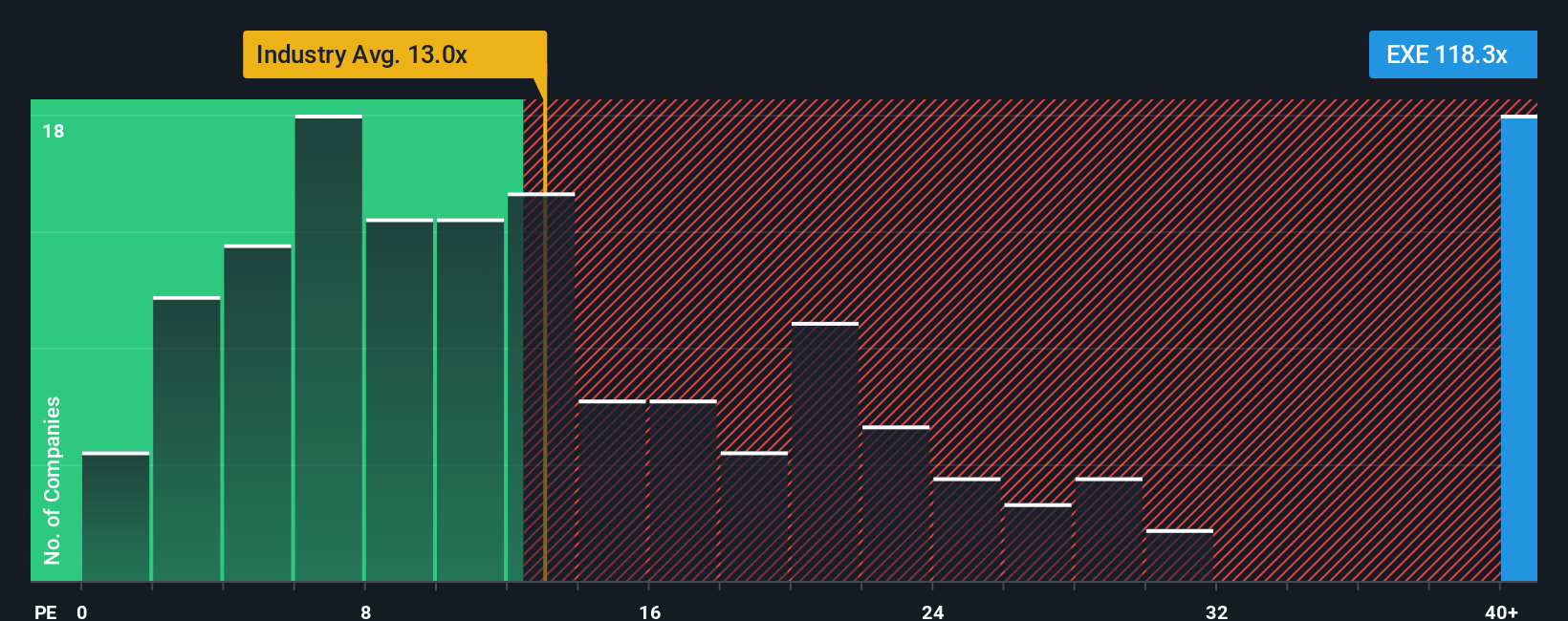

Taking a step back from fair value models, Expand Energy looks expensive when judged by its price-to-earnings ratio. Shares currently trade at 118.3 times earnings, far above both peer (16.2x) and industry (13.2x) averages, and even above the fair ratio of 24.6x that the market could one day move toward. This signals real valuation risk if multiples revert down. Is the premium justified, or is caution needed?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Expand Energy Narrative

If you have a different take on Expand Energy, or want to dig into the numbers and trends on your own, you can quickly craft your perspective and share your insights. Do it your way

A great starting point for your Expand Energy research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Expand your horizons and find your next opportunity by tapping into smart, high-potential stock picks you might not have considered yet. Don’t miss these market movers:

- Uncover income opportunities quickly by checking out these 18 dividend stocks with yields > 3%, which offers steady yields for those who prioritize reliable returns.

- Accelerate your portfolio growth by targeting these 25 AI penny stocks, as these companies are harnessing artificial intelligence for tomorrow’s breakthroughs.

- Tap into value investing by scanning these 893 undervalued stocks based on cash flows to find stocks that show financial strength and attractive pricing in today’s market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Expand Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXE

Expand Energy

Operates as an independent natural gas production company in the United States.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives