- United States

- /

- Energy Services

- /

- NasdaqGS:DWSN

Further weakness as Dawson Geophysical (NASDAQ:DWSN) drops 13% this week, taking three-year losses to 19%

While it may not be enough for some shareholders, we think it is good to see the Dawson Geophysical Company (NASDAQ:DWSN) share price up 24% in a single quarter. But that cannot eclipse the less-than-impressive returns over the last three years. Truth be told the share price declined 31% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

With the stock having lost 13% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

View our latest analysis for Dawson Geophysical

Dawson Geophysical isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over three years, Dawson Geophysical grew revenue at 42% per year. That's well above most other pre-profit companies. While its revenue increased, the share price dropped at a rate of 9% per year. That seems like an unlucky result for holders. It seems likely that actual growth fell short of shareholders' expectations. Before considering a purchase, investors should consider how quickly expenses are growing, relative to revenue.

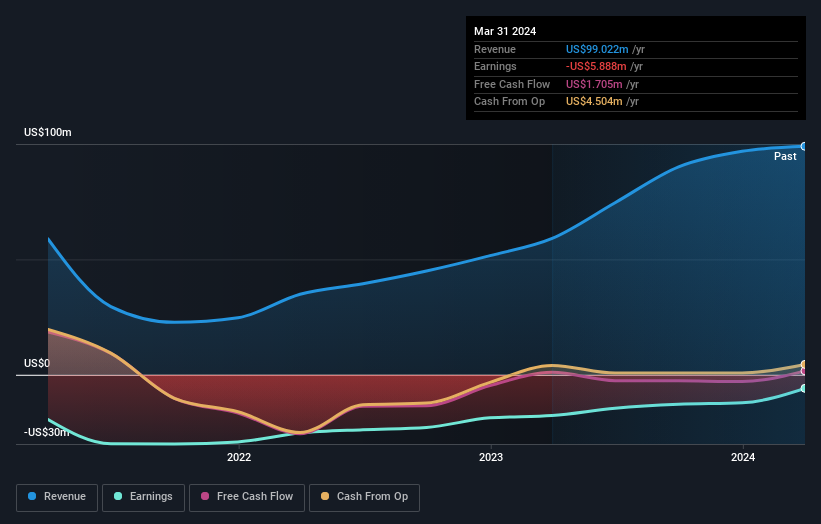

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on Dawson Geophysical's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About The Total Shareholder Return (TSR)?

We've already covered Dawson Geophysical's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Dawson Geophysical's TSR of was a loss of 19% for the 3 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

We're pleased to report that Dawson Geophysical shareholders have received a total shareholder return of 18% over one year. That's better than the annualised return of 0.4% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Dawson Geophysical has 2 warning signs we think you should be aware of.

We will like Dawson Geophysical better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DWSN

Dawson Geophysical

Engages in providing onshore seismic data acquisition and processing services in the United States and Canada.

Good value with adequate balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026