- United States

- /

- Oil and Gas

- /

- NasdaqGS:CLNE

Cautious Investors Not Rewarding Clean Energy Fuels Corp.'s (NASDAQ:CLNE) Performance Completely

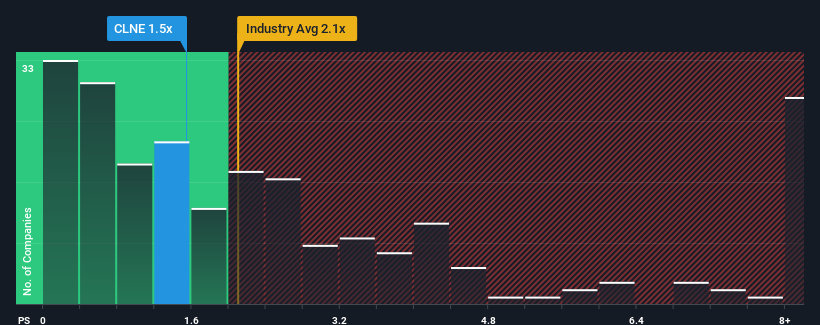

Clean Energy Fuels Corp.'s (NASDAQ:CLNE) price-to-sales (or "P/S") ratio of 1.5x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Oil and Gas industry in the United States have P/S ratios greater than 2.1x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Clean Energy Fuels

What Does Clean Energy Fuels' P/S Mean For Shareholders?

Clean Energy Fuels' negative revenue growth of late has neither been better nor worse than most other companies. Perhaps the market is expecting future revenue performance to deteriorate further, which has kept the P/S suppressed. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. At the very least, you'd be hoping that revenue doesn't fall off a cliff if your plan is to pick up some stock while it's out of favour.

Keen to find out how analysts think Clean Energy Fuels' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Clean Energy Fuels' to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 15%. Even so, admirably revenue has lifted 40% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue should grow by 15% per annum over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 2.2% each year, which is noticeably less attractive.

In light of this, it's peculiar that Clean Energy Fuels' P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On Clean Energy Fuels' P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Clean Energy Fuels' analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Clean Energy Fuels that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CLNE

Clean Energy Fuels

Provides natural gas as alternative fuels for vehicle fleets and related fueling solutions in the United States and Canada.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives