- United States

- /

- Energy Services

- /

- NasdaqGS:BKR

Baker Hughes (NasdaqGS:BKR) Secures Major Multi-Year Completions Contract With Petrobras In Brazil

Reviewed by Simply Wall St

Baker Hughes (NasdaqGS:BKR) experienced a significant share price increase of 12% over the last quarter, likely bolstered by its recent major contract with Petrobras for integrated completions systems in Brazil. This contract highlights Baker Hughes' advanced technological capabilities and commitment to enhancing production in deepwater fields. Additionally, the company's collaboration with NextDecade for LNG technology and a joint initiative with Woodside Energy for low-carbon solutions could bolster investor confidence in its sustainable energy focus. The broader market has seen mixed performances, with a general upward trend in recent weeks, adding context to the company's gains. Meanwhile, the Dow Jones and S&P 500 have experienced fluctuations, reflecting overall economic uncertainty. Amid this backdrop, Baker Hughes' strategic partnerships and financial guidance, projecting increased revenues, stand out as pivotal factors influencing its recent share price momentum.

Buy, Hold or Sell Baker Hughes? View our complete analysis and fair value estimate and you decide.

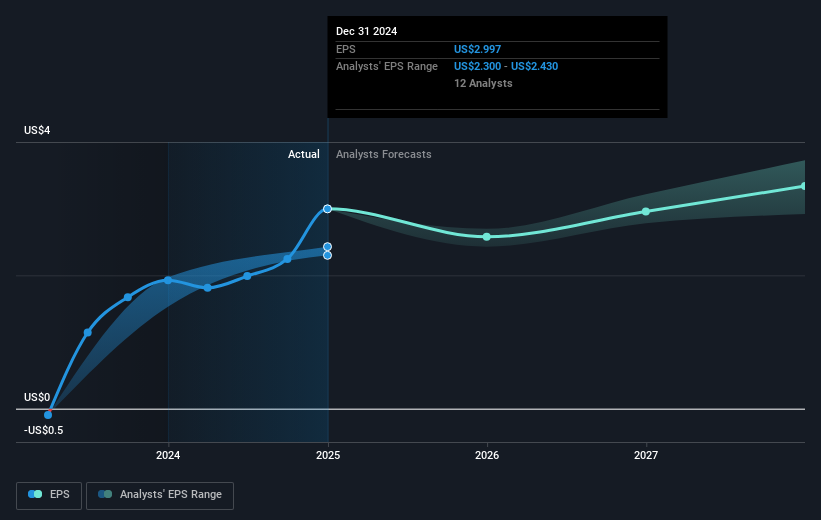

Over the last 5 years, Baker Hughes achieved a remarkable total shareholder return of 343.96%. This performance can be linked to various strategic corporate actions. A critical factor was the company's successful and sustained earnings growth, with an average annual increase of 77.5%. Furthermore, Baker Hughes consistently delivered high-quality earnings and saw an improvement in net profit margins to 10.7% from 7.6% last year. This, along with the company's position relative to market performance—where it outperformed both the US market and Energy Services industry over the past year—likely contributed to long-term shareholder value.

Additionally, Baker Hughes' collaboration with innovative partners and advancement in sustainable technology initiatives marked crucial developments. The multi-year contract with Petrobras highlighted its technological prowess in deepwater fields, while its agreements with NextDecade and Woodside focused on LNG and low-carbon solutions. These initiatives underscore Baker Hughes' commitment to growth in sustainable energy sectors. Furthermore, the ongoing pursuit of strategic M&A opportunities to enhance technological leadership and its substantial dividend increase underscore the company's broader commitment to delivering shareholder value.

Upon reviewing our latest valuation report, Baker Hughes' share price might be too optimistic.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baker Hughes might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BKR

Baker Hughes

Provides a portfolio of technologies and services to energy and industrial value chain worldwide.

Excellent balance sheet with proven track record.