- United States

- /

- Energy Services

- /

- NasdaqGS:BKR

Assessing Baker Hughes (BKR) Valuation After Ananym’s Push for an Oilfield Services Spin-Off

Reviewed by Simply Wall St

Ananym Capital just threw down a clear challenge at Baker Hughes (BKR), publicly urging a spin off of its Oilfield Services and Equipment arm, a move it claims could lift the stock by roughly 60%.

See our latest analysis for Baker Hughes.

The activism push lands as Baker Hughes trades around $50.61, with a 1 month share price return of about 10% and a 1 year total shareholder return near 22%, suggesting momentum is building on top of already strong multi year gains.

If this kind of strategic shake up has your attention, it is also a good moment to explore aerospace and defense stocks for other industrial names with evolving growth stories.

With Baker Hughes trading just below analyst targets but at a discount to some valuation models, and with activism circling, are investors looking at an underappreciated restructuring story or a stock that already reflects its next leg of growth?

Most Popular Narrative: 3.7% Undervalued

With Baker Hughes last closing at $50.61 versus a narrative fair value of $52.57, the story leans toward modest upside driven by specific growth levers.

The company's strong momentum in securing large-scale service contracts, framework agreements, and technology-driven orders (such as for data centers, LNG, CCS, and recurring gas tech services) is driving an all-time high IET backlog, building strong visibility into future revenue and supporting sustained earnings durability.

Curious how slow top line growth, stable margins, and a richer future earnings multiple can still justify upside from here? The narrative leans on surprisingly resilient earnings power and a premium valuation usually reserved for faster growing names. Want to see exactly how those moving parts stack up in the model? Read on to unpack the assumptions behind that fair value call.

Result: Fair Value of $52.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cost inflation and faster than expected clean energy adoption could squeeze margins and weaken long term demand, which would challenge the current upside case.

Find out about the key risks to this Baker Hughes narrative.

Another Angle on Valuation

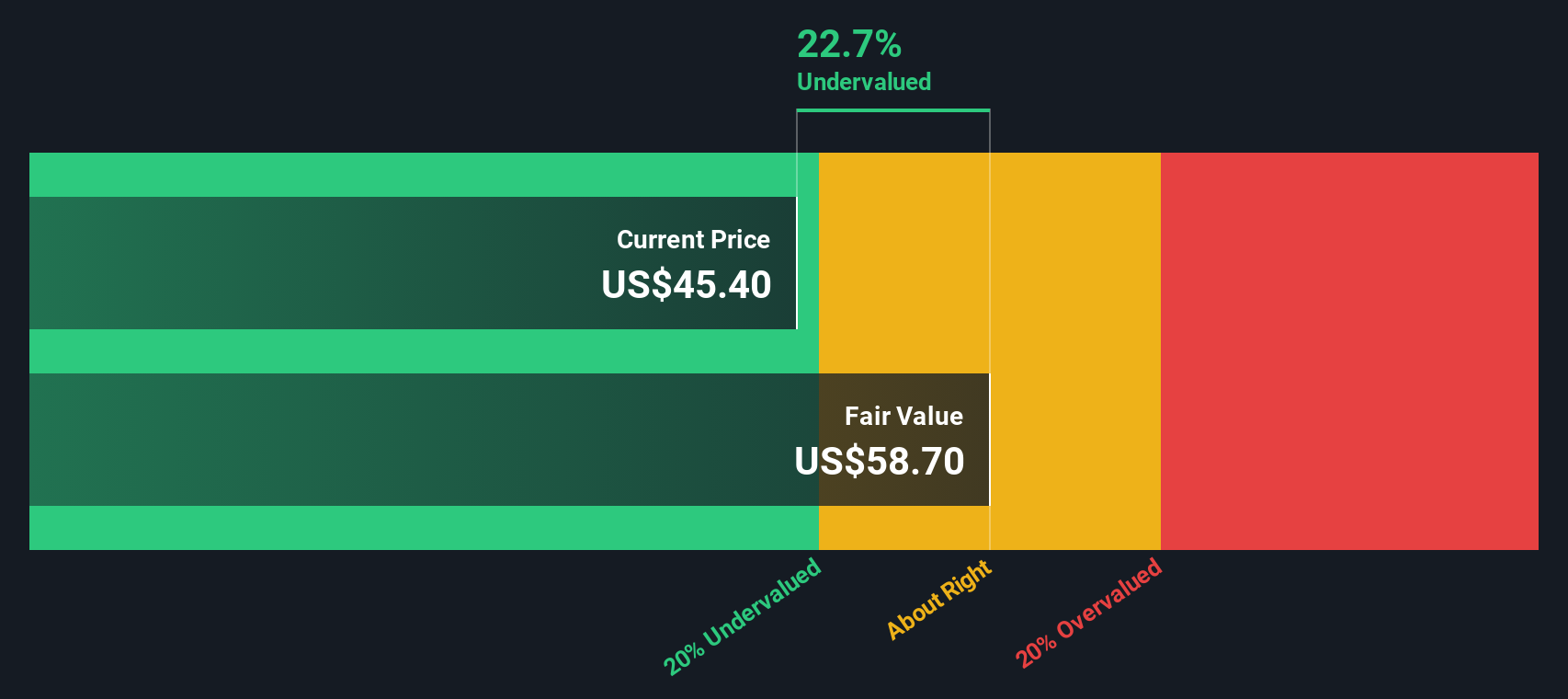

Look past that modest 3.7% upside and our numbers tell a louder story, the SWS DCF model pegs Baker Hughes at about 28.7% below fair value, pointing to a much deeper discount than the narrative fair value suggests. Is the market underestimating long term cash generation?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Baker Hughes Narrative

If this view does not quite fit your thesis or you would rather dive into the numbers yourself, you can build a full narrative in under three minutes, Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Baker Hughes.

Looking for more investment ideas?

Before you move on, consider your next move with fresh opportunities from our stock screeners, so you are not leaving potential gains on the table.

- Explore potential value by targeting companies trading below their intrinsic worth with these 907 undervalued stocks based on cash flows.

- Focus on cutting edge innovators powering automation and intelligent systems through these 26 AI penny stocks.

- Evaluate income focused opportunities by zeroing in on reliable payers via these 14 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baker Hughes might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BKR

Baker Hughes

Provides a portfolio of technologies and services to energy and industrial value chain worldwide.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026