- United States

- /

- Oil and Gas

- /

- NasdaqCM:AREC

Why American Resources (AREC) Is Up 6.8% After $33.7 Million Institutional Private Placement And What's Next

Reviewed by Sasha Jovanovic

- American Resources Corporation announced a private placement to issue 9,480,000 Class A Common Shares at US$3.55 per share, raising US$33,654,000 with participation from several institutional investors, expected to close on or about October 14, 2025.

- This capital raise highlights strong institutional interest in American Resources and may provide resources for the company's future initiatives.

- We’ll examine how increased institutional backing could shape American Resources’ investment narrative following these recent developments.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

What Is American Resources' Investment Narrative?

Being an American Resources shareholder means believing in the company’s ability to convert high forecast growth and new asset acquisitions into meaningful business expansion, even as it contends with ongoing challenges. The recent private placement, bringing in over US$33 million from institutional investors, has immediate relevance given the company’s limited cash runway and continued net losses, reflected in its most recent filings. Institutional backing could help address financial pressures and support near-term initiatives, possibly taking some heat off immediate compliance threats tied to late SEC filings and Nasdaq listing requirements. However, it may also shift attention toward how the new capital is used and whether operational execution improves, especially with the company remaining unprofitable and still forecasting losses. Any meaningful business momentum hinges on showing progress against these persistent cash burn and compliance risks. On the other hand, compliance hurdles are closer than many investors might realize.

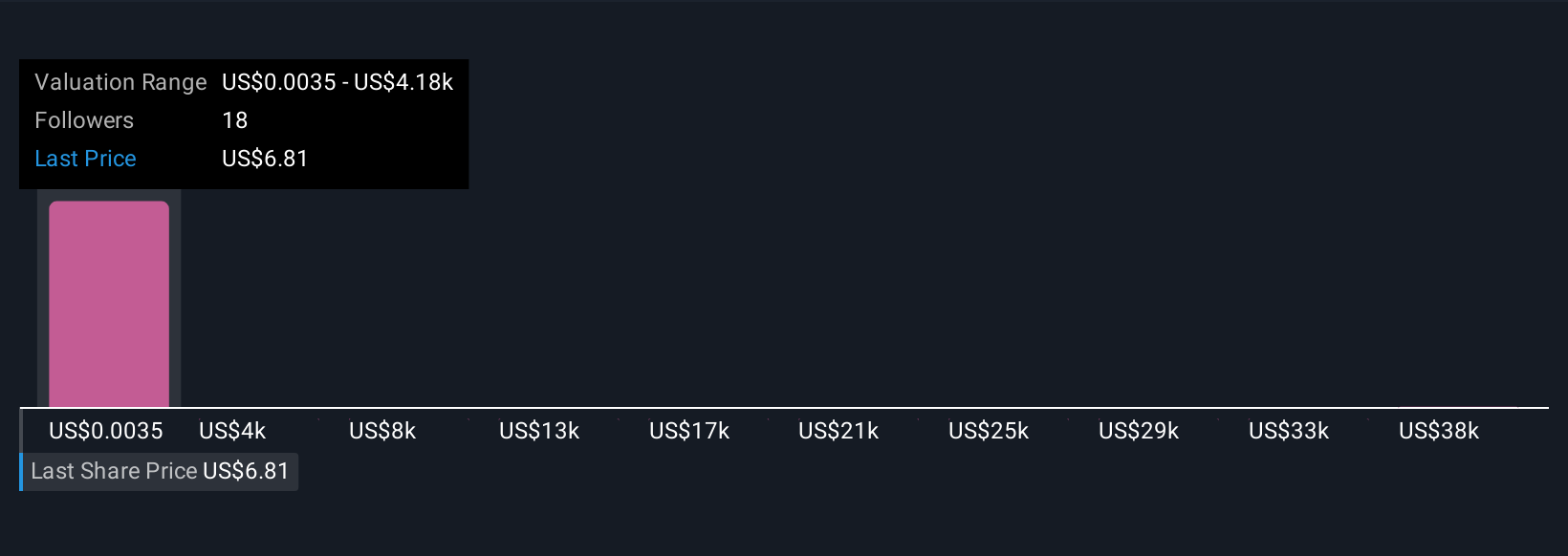

The analysis detailed in our American Resources valuation report hints at an inflated share price compared to its estimated value.Exploring Other Perspectives

Explore 7 other fair value estimates on American Resources - why the stock might be a potential multi-bagger!

Build Your Own American Resources Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American Resources research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

- Our free American Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American Resources' overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:AREC

American Resources

Engages in the production of rare earth and critical mineral concentrates for the infrastructure and electrification markets.

Moderate risk with limited growth.

Market Insights

Community Narratives