- United States

- /

- Oil and Gas

- /

- NasdaqGS:APA

Sizing Up APA Stock After the Recent 5.8% Jump and Valuation Debate

Reviewed by Bailey Pemberton

Thinking about what to do with APA stock? You’re definitely not alone. It’s one of those names that captures attention, whether you’re glancing at your portfolio for the hundredth time or hunting for fresh opportunities. Recently, APA’s stock has tossed investors a bit of a curveball. After a dip of 2.4% over the past month, it just bounced up 5.8% in the last week. That short-term pop definitely stands out, even as the longer-term returns show more of a winding path, with the 1-year gain sitting at just 1.1%, but a striking 227.8% climb over five years.

What’s triggered this latest shift in sentiment? Recent news around APA’s strategic investments and moves toward operational efficiency seem to be fueling a renewed sense of optimism. There is growing chatter that some market participants are rethinking the risk profile of the company, especially in light of industry developments and APA’s positioning as a nimble energy player. Interest in its growth prospects appears to be heating up again, even if some investors remain wary given the roller-coaster ride of the last three years.

If you’re here for the valuation angles, you’re in good company. APA also stands out, passing 5 out of 6 major undervaluation checks. But which valuation models matter most, and what do they really reveal about APA’s outlook? We’ll break that down next, and stick around, because later on we’ll cover an even more insightful way to size up the company’s value.

Why APA is lagging behind its peers

Approach 1: APA Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a way to estimate a company’s value by projecting its future free cash flows and then discounting them back to today’s dollars. This involves forecasting the money APA is expected to generate over time and determining what that future cash is worth right now.

For APA, the current Free Cash Flow is $1.90 billion. Analysts estimate annual free cash flows will generally rise in the years ahead, based on structured forecasts through 2029. For 2029, the projected Free Cash Flow is about $1.71 billion, then extrapolated into the following decade with moderate annual increases. All cash flows are stated in US dollars.

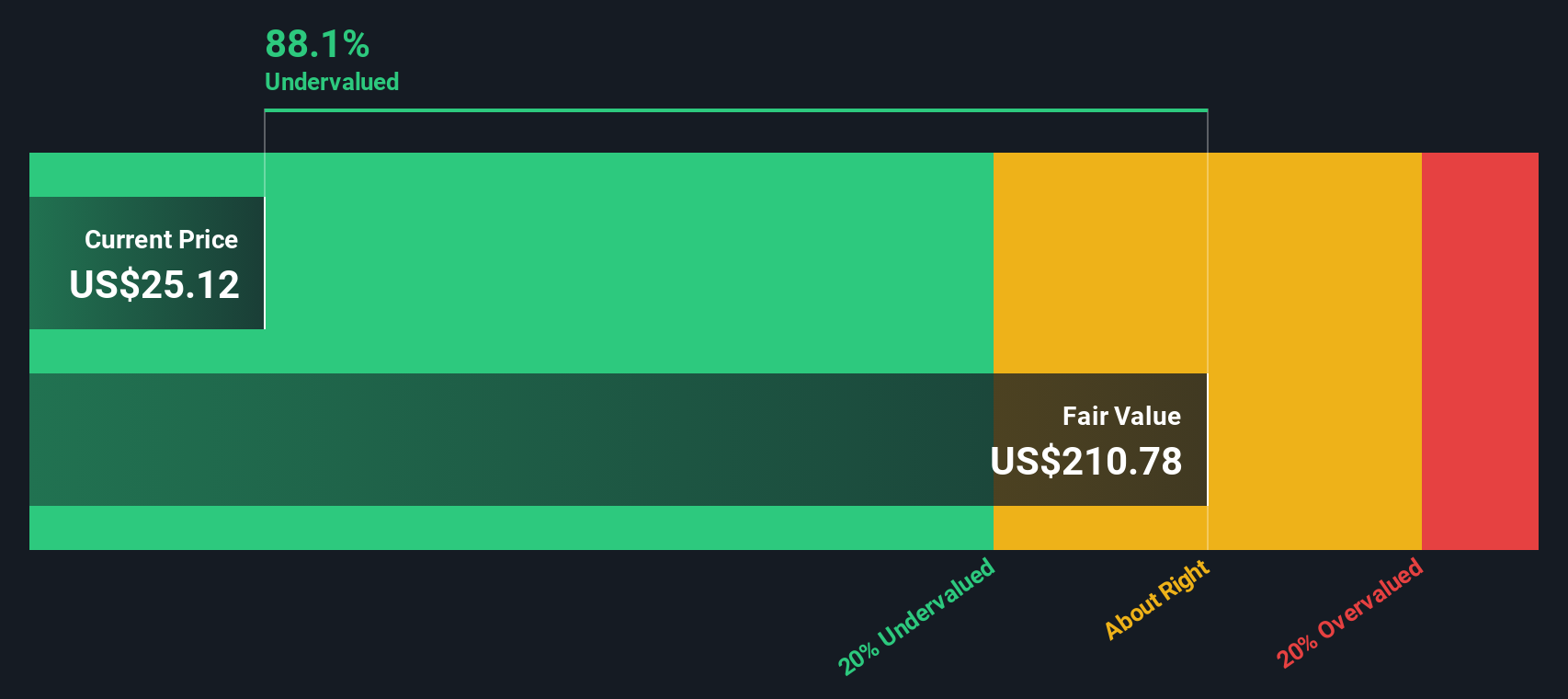

After crunching the numbers, this DCF model suggests APA’s intrinsic value is approximately $113.83 per share. That is a sharp contrast to its current market price, implying the stock is trading at a 79.1% discount to its underlying worth.

If these cash flow assumptions prove accurate, APA may be substantially undervalued at present levels and could represent a compelling opportunity for investors.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests APA is undervalued by 79.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: APA Price vs Earnings

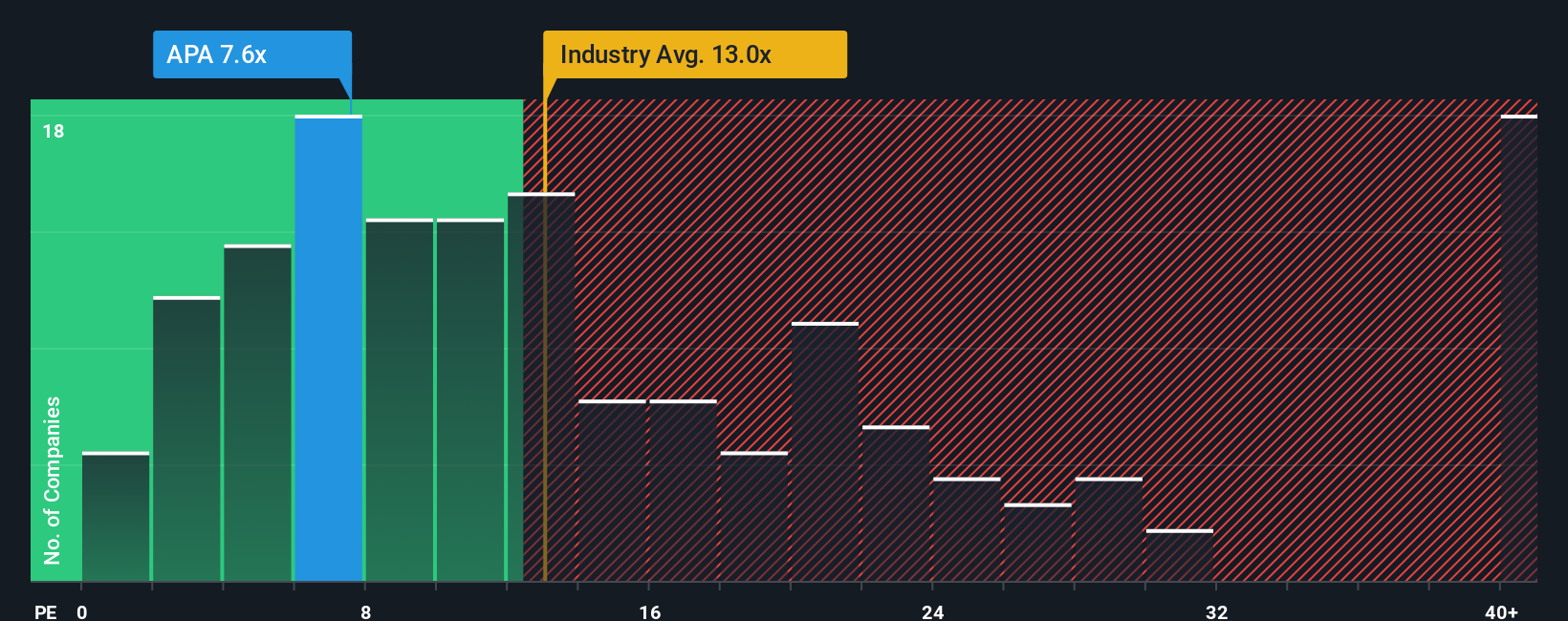

The Price-to-Earnings (PE) ratio is one of the most widely used valuation multiples for profitable companies like APA because it directly reflects how much investors are willing to pay per dollar of earnings. This makes it an especially relevant metric for firms with consistent profitability, as it summarizes the relationship between stock price and core company performance.

Interpreting what constitutes a “fair” PE ratio involves more than just looking at earnings. Expectations for future growth and the company’s risk profile also weigh heavily. Companies with higher expected growth or lower perceived risks tend to justify richer PE multiples. On the other hand, sluggish growth or elevated risks can drag it downward. Industry trends further shape what is considered normal for a given business type.

APA’s current PE ratio sits at 7.9x, noticeably below both the Oil and Gas industry average of 12.8x and the peer group average of 15.2x. At first glance, this suggests APA could be trading at a discount relative to its sector. However, Simply Wall St’s proprietary “Fair Ratio” model paints a more tailored picture. The Fair Ratio for APA is calculated at 15.2x, meaning this is the multiple that best fits APA’s unique combination of profit margin, earnings growth outlook, scale, and industry complexities. Unlike a simple peer or industry comparison, the Fair Ratio adjusts for company-specific factors and provides a more meaningful benchmark.

With APA’s actual PE ratio well below its Fair Ratio, current pricing suggests the stock may be undervalued based on the preferred multiple approach.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your APA Narrative

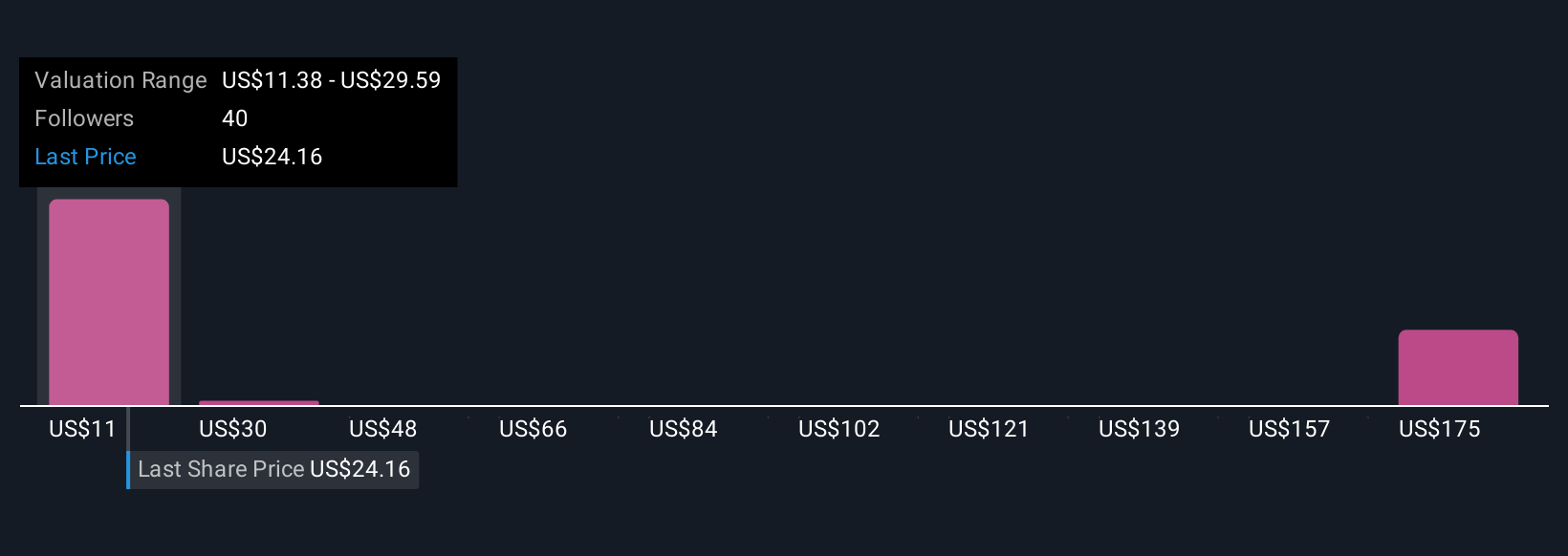

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative goes beyond the numbers by letting investors blend their outlook for a company, such as their assumptions on revenue, margins, and profits, with a story that explains why they believe those outcomes are likely. In other words, a Narrative connects APA’s business journey to a financial forecast and then calculates a fair value based on those inputs.

Narratives are accessible and intuitive, available on Simply Wall St’s Community page, a tool already used by millions of investors globally. By creating or exploring different Narratives, you can see instantly if APA looks like a buy or sell for you simply by comparing your custom Fair Value with the current market Price. Narratives also update in real time when new information is released, such as news or fresh financials, so your analysis never gets stale.

For example, one Narrative on APA might reflect strong optimism in cost savings and gas demand, projecting a fair value as high as $35 per share. Another could take a more cautious view on risks and assign a much lower value, closer to $16 per share. This shows how different perspectives and assumptions can lead to very different conclusions, all grounded in your own reasoning and updated as events unfold.

Do you think there's more to the story for APA? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:APA

APA

An independent energy company, explores for, develops, and produces natural gas, crude oil, and natural gas liquids.

Undervalued average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)