- United States

- /

- Oil and Gas

- /

- NasdaqGM:AMTX

The Aemetis (NASDAQ:AMTX) Share Price Is Up 318% And Shareholders Are Delighted

Aemetis, Inc. (NASDAQ:AMTX) shareholders have seen the share price descend 18% over the month. But over the last three years the stock has shone bright like a diamond. Indeed, the share price is up a whopping 318% in that time. Arguably, the recent fall is to be expected after such a strong rise. Only time will tell if there is still too much optimism currently reflected in the share price.

See our latest analysis for Aemetis

Aemetis wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Aemetis' revenue trended up 9.0% each year over three years. That's pretty nice growth. Some shareholders might think that the share price rise of 61% per year is a lucky result, considering the level of revenue growth. A hot stock like this is usually well worth taking a closer look at, as long as you don't let the fear of missing out (FOMO) impact your thinking.

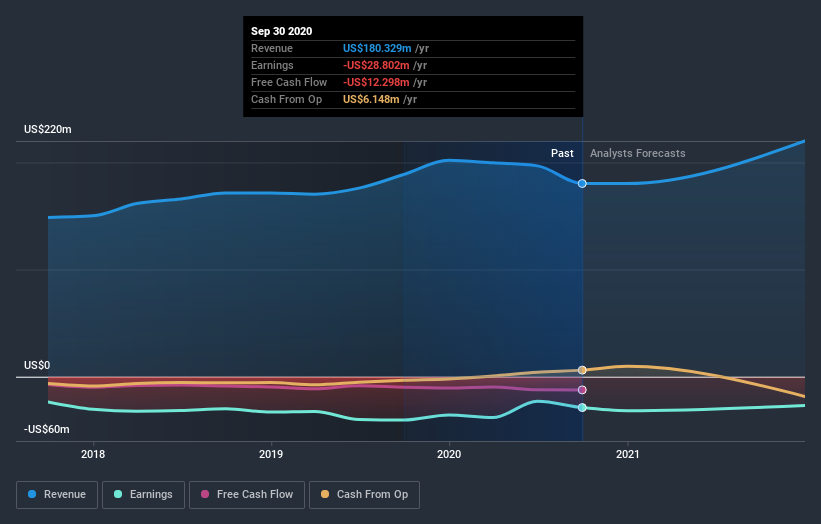

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on Aemetis' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's good to see that Aemetis has rewarded shareholders with a total shareholder return of 186% in the last twelve months. That gain is better than the annual TSR over five years, which is 2%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 5 warning signs for Aemetis (1 is concerning) that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you decide to trade Aemetis, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGM:AMTX

High growth potential slight.

Similar Companies

Market Insights

Community Narratives