- United States

- /

- Capital Markets

- /

- ARCA:SOXL

SOXL: Evaluating Valuation as Volatility and Momentum Return to Semiconductor ETF

Reviewed by Kshitija Bhandaru

Price-to-Book Ratio: Is it justified?

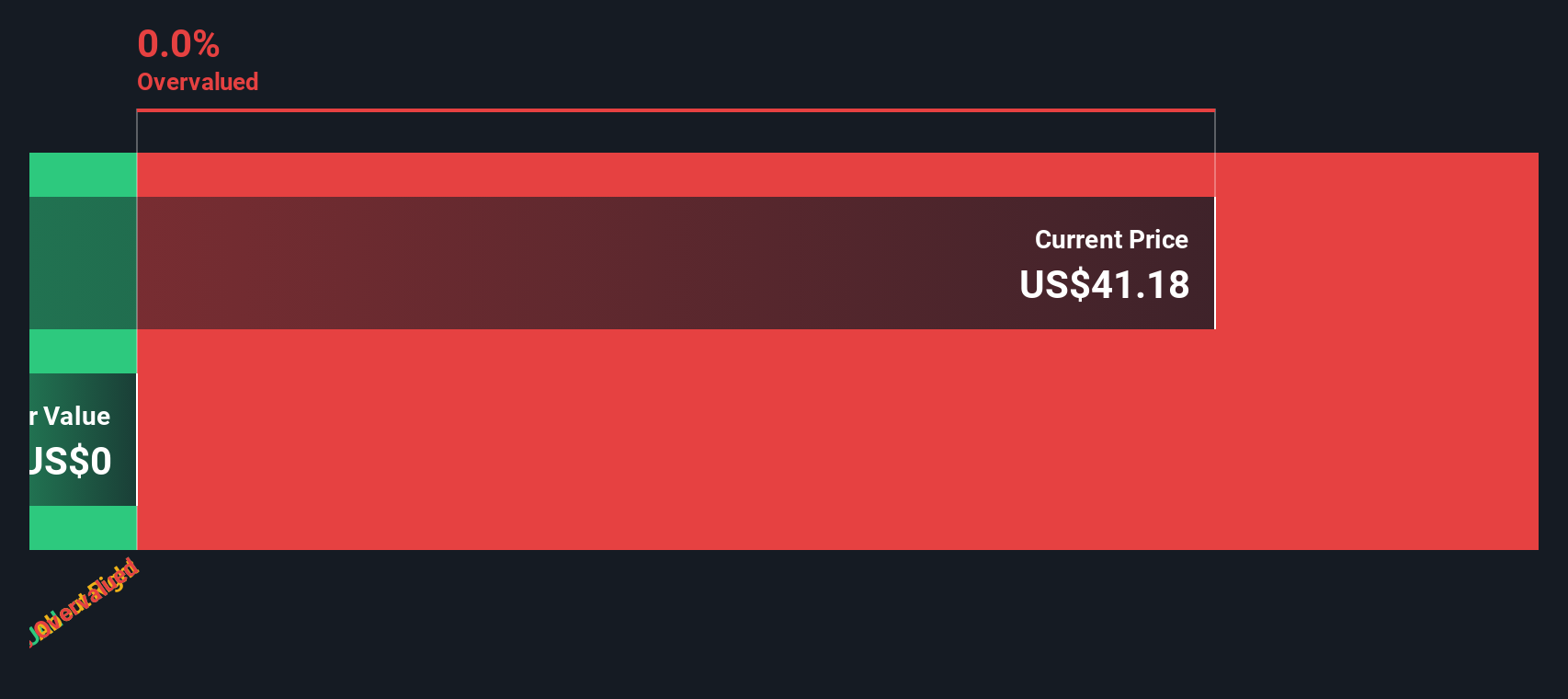

There is currently insufficient data to calculate SOXL's Price-To-Book Ratio and compare it to industry averages, so it is not possible to determine if the fund is undervalued or overvalued on this basis.

The price-to-book ratio is a commonly used valuation metric for funds and companies in the financial sector. It represents how much investors are willing to pay for each dollar of net assets. This ratio can give investors a sense of whether a fund is being priced above or below its actual book value, offering one lens to assess relative value and expectations for growth.

In the case of SOXL, lacking this key multiple leaves investors without a benchmark. This makes it more challenging to gauge whether the current market price is justified by underlying fundamentals. With the market’s attention on momentum and volatility, valuation clarity remains elusive.

Result: Fair Value of N/A (ABOUT RIGHT)

See our latest analysis for Direxion Shares ETF Trust - Direxion Daily Semiconductor Bull 3X Shares.However, recent volatility and the lack of key financial data could quickly shift sentiment. This makes SOXL’s momentum vulnerable to changing market dynamics.

Find out about the key risks to this Direxion Shares ETF Trust - Direxion Daily Semiconductor Bull 3X Shares narrative.Another View: Different Lens, Same Challenge

Turning to our DCF model for a fresh perspective, there is still not enough data to reach a verdict. This leaves investors with more questions than answers. Could hidden value or risk be lurking beneath the surface?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Direxion Shares ETF Trust - Direxion Daily Semiconductor Bull 3X Shares Narrative

If you see things differently or want to dig into the data yourself, you can quickly build your own narrative in just a few minutes. Do it your way

Prefer to form your own view? Our platform makes it easy to explore a stock's fundamentals and create your own narrative in minutes.

Looking for more investment ideas?

Don’t limit yourself to just one opportunity. Now is the time to explore other high-potential stocks and trends shaping the market’s next significant moves.

- Uncover unexpected growth potential by browsing undervalued stocks based on cash flows, which highlights companies the market may be overlooking and that could offer attractive upside.

- Tap into the future of healthcare innovation by checking out healthcare AI stocks, where medical breakthroughs and artificial intelligence come together for tomorrow’s success stories.

- Pursue rewarding payouts by identifying top performers through dividend stocks with yields > 3%, which spotlights businesses delivering dividend yields above 3% and demonstrating strong fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ARCA:SOXL

Direxion Shares ETF Trust - Direxion Daily Semiconductor Bull 3X Shares

An exchange traded fund launched by Direxion Investments.

Minimal risk with weak fundamentals.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)