- United States

- /

- Diversified Financial

- /

- NYSE:XYZ

Purdys Chocolatier Partnership Could Be a Game Changer for Block (SQ)

Reviewed by Simply Wall St

- On August 21, 2025, Purdys Chocolatier announced a new nationwide partnership with Block's Square, rolling out its point-of-sale and business operations technology across more than 80 retail locations in Canada.

- This client win reinforces Square's traction in the retail sector, showcasing broader demand for its integrated payment solutions and expanding hardware offerings.

- We'll examine how Purdys Chocolatier's adoption of Square could impact Block's long-term business positioning and sector relevance.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Block Investment Narrative Recap

For investors in Block, the big picture belief hinges on continued expansion and adoption of its integrated business and payments ecosystem, beyond just Cash App and cryptocurrency, to diversify growth and reduce volatility. The recent Purdys Chocolatier partnership strengthens Square’s presence in brick-and-mortar retail, but does not materially change the short-term catalysts, which remain Cash App user growth and embedded finance penetration; competitive pressure in payments technology is still the leading near-term risk.

The launch and rollout of Square Handheld devices this summer is the most relevant recent development, as it underpins Block’s ability to secure larger retail clients by supporting omnichannel commerce and seamless in-store experiences. This ties directly to the catalyst of Block’s scaling Square for Businesses and illustrates growing demand for integrated, user-friendly payment solutions across different business sizes and regions.

But as Block gains traction with more established clients, investors should be mindful that increasing competition and fee pressure in payment processing means…

Read the full narrative on Block (it's free!)

Block's narrative projects $32.8 billion in revenue and $2.4 billion in earnings by 2028. This requires 11.2% annual revenue growth, but a decrease of $0.6 billion in earnings from the current $3.0 billion.

Uncover how Block's forecasts yield a $85.02 fair value, a 12% upside to its current price.

Exploring Other Perspectives

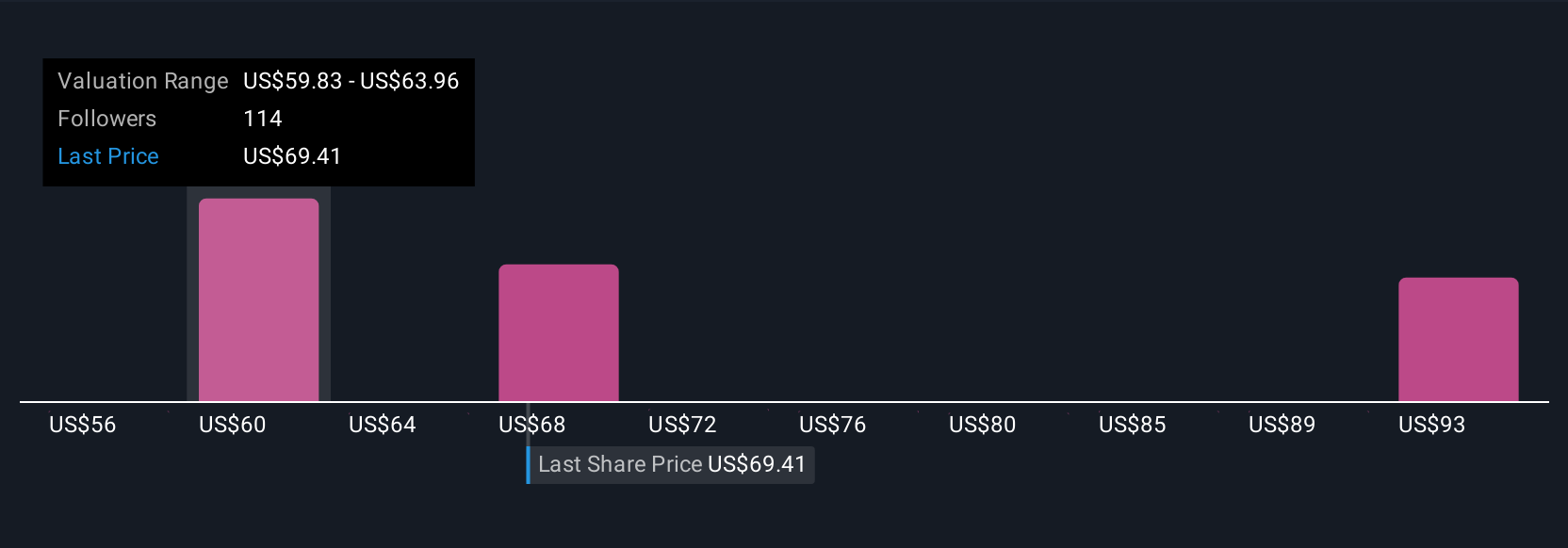

Community fair value views for Block range from US$60.37 to US$100.22, reflecting input from 13 Simply Wall St Community members. While many expect strong execution in business operations, rising competition and commoditization may challenge Block’s revenue growth and margins, so consider alternative perspectives here.

Explore 13 other fair value estimates on Block - why the stock might be worth 21% less than the current price!

Build Your Own Block Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Block research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Block research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Block's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Block might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XYZ

Block

Block, Inc., together with its subsidiaries, builds ecosystems focused on commerce and financial products and services in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives