- United States

- /

- Diversified Financial

- /

- NYSE:XYZ

Did Square’s Bitcoin Integration Just Shift Block's (SQ) Competitive Positioning?

Reviewed by Sasha Jovanovic

- Square, a subsidiary of Block, recently launched Square Bitcoin, a fully integrated payment and wallet solution enabling more than four million U.S. merchants to process bitcoin payments directly within the Square ecosystem with no processing fees for the first year and instant settlement options starting November 10, 2025.

- This development aims to simplify bitcoin adoption for small businesses by offering seamless management of both fiat and digital assets on one platform, reflecting Block’s focus on expanding crypto utility among local merchants.

- We'll examine how the integration of bitcoin payments into Square's platform could influence Block’s long-term growth and competitive positioning.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Block Investment Narrative Recap

To be a Block shareholder, you need to believe that the company can sustain engagement and revenue growth through innovation in payments and digital assets, especially as competition in both fintech and crypto intensifies. The launch of Square Bitcoin could influence Block’s transaction growth in the short term, but the most important near-term catalyst remains user expansion and monetization within Cash App, while the biggest current risk is ongoing regulatory uncertainty and earnings volatility linked to crypto initiatives, both of which may be only modestly impacted by this news.

Of Block's recent announcements, the rollout of AI-driven cost management and procurement tools for restaurants stands out as particularly relevant. As Square broadens its food and beverage solutions, it pursues deeper engagement with a core merchant segment, adding meaningful catalysts for transaction growth that may complement or offset risks from its push into Bitcoin payments.

However, investors should also consider that tighter regulatory oversight around digital assets could quickly shift expectations for Block’s earnings, so before buying shares, keep in mind...

Read the full narrative on Block (it's free!)

Block's narrative projects $32.8 billion revenue and $2.4 billion earnings by 2028. This requires 11.3% yearly revenue growth and a $0.6 billion decrease in earnings from $3.0 billion today.

Uncover how Block's forecasts yield a $87.17 fair value, a 17% upside to its current price.

Exploring Other Perspectives

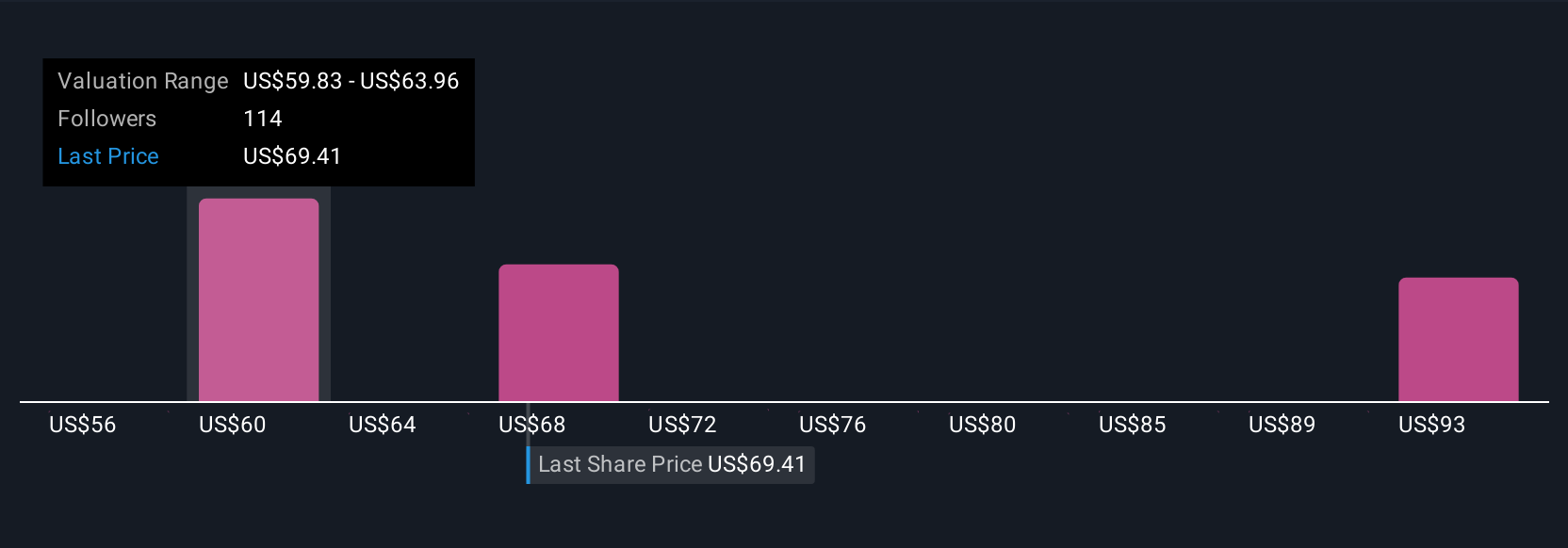

Twenty member analyses in the Simply Wall St Community place Block’s fair value estimates between US$55.70 and US$104.00. With regulatory uncertainty threatening margins and future adoption of bitcoin services, your own outlook may differ widely from these community views.

Explore 20 other fair value estimates on Block - why the stock might be worth 25% less than the current price!

Build Your Own Block Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Block research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Block research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Block's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Block might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XYZ

Block

Block, Inc., together with its subsidiaries, builds ecosystems focused on commerce and financial products and services in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026