- United States

- /

- Diversified Financial

- /

- NYSE:WU

Will Western Union’s (WU) Index Shift Reveal New Insights Into Its Competitive Positioning?

Reviewed by Sasha Jovanovic

- On October 2, 2025, The Western Union Company was removed from both the S&P 400 and S&P 400 Financials indexes and was added to the S&P 600 and S&P 600 Financials indexes, reflecting a shift in its market capitalization classification.

- This index transition can prompt significant trading activity, as index funds and investors adjust their holdings to match new index compositions.

- We'll examine how Western Union's move from the S&P 400 to the S&P 600 may affect its investment outlook and index-driven demand.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Western Union Investment Narrative Recap

To be a Western Union shareholder, you need to believe the company can successfully accelerate its digital transformation and regain momentum in both digital and retail channels, as it faces rising competition and shifting consumer preferences. The recent shift from the S&P 400 to the S&P 600 reflects a change in market capitalization but does not meaningfully impact the key catalysts or the primary risk, the pace at which digital initiatives offset core channel declines.

Among Western Union’s recent announcements, the strategic alliance with dLocal to expand digital payment options in Latin America stands out, directly targeting the digital growth catalyst. Expanding digital capabilities could help address revenue pressures and offset competitive headwinds, though results from this partnership will take time to materialize.

By contrast, what remains front-and-center for investors is the risk that even with these moves, Western Union’s core retail channel continues to weaken while digital growth lags...

Read the full narrative on Western Union (it's free!)

Western Union's narrative projects $4.3 billion in revenue and $543.0 million in earnings by 2028. This requires 1.3% annual revenue growth and an earnings decrease of $353.1 million from current earnings of $896.1 million.

Uncover how Western Union's forecasts yield a $9.32 fair value, a 14% upside to its current price.

Exploring Other Perspectives

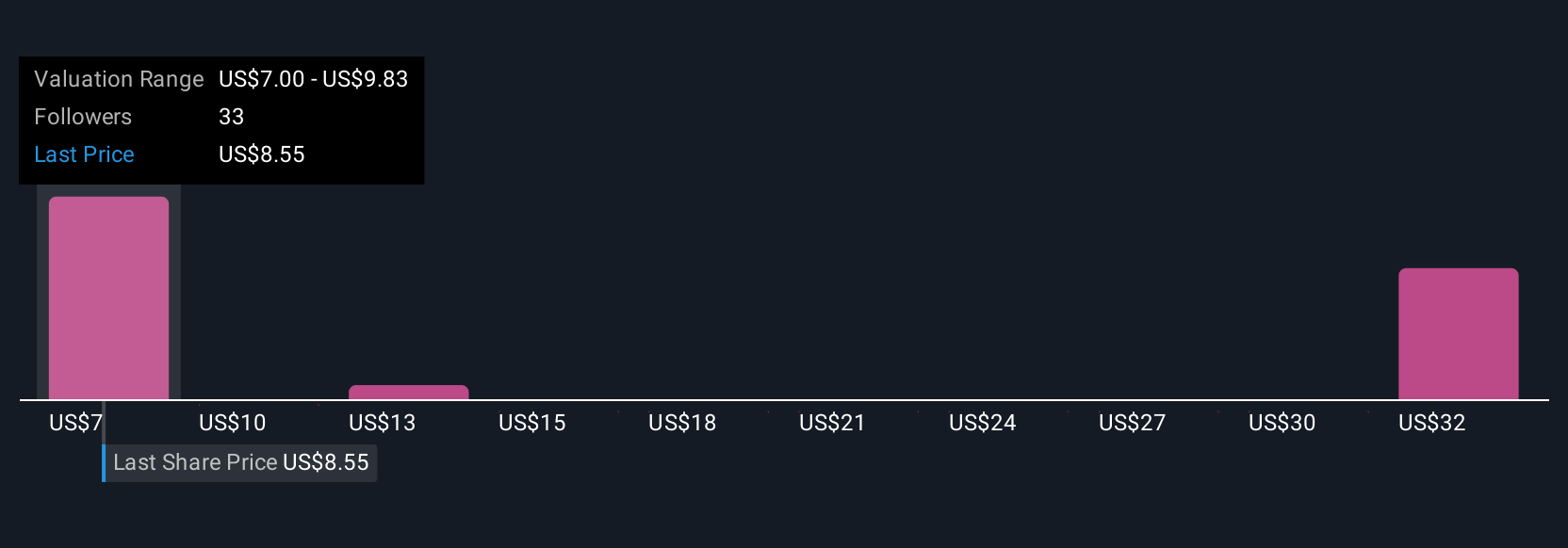

Fair value estimates from 10 Simply Wall St Community members range widely from US$7.00 to US$36.71 per share. While opinions vary, the impact of digital-first disruptors on Western Union’s growth potential is a central concern you should research further.

Explore 10 other fair value estimates on Western Union - why the stock might be worth 14% less than the current price!

Build Your Own Western Union Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Western Union research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Western Union research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Western Union's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Western Union might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WU

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives