- United States

- /

- Diversified Financial

- /

- NYSE:WU

Is Western Union’s Current Stock Price a Value Opportunity After Its 48% Five-Year Decline?

Reviewed by Bailey Pemberton

Trying to make sense of Western Union’s stock lately? If you have been watching the ticker, you have seen a wild ride over the past year, with the share price closing most recently at $8.07. While the company posted an almost flat 0.1% return in the last week, its 30-day drop of 6.6% and a year-to-date slide of 22.7% probably catch the eye of any investor who prefers value over hype. Looking further back, it is hard to ignore the 48.2% decline over the past five years. Does this reflect a shift in sentiment, or has the broader market been too quick to write off Western Union’s core business in a changing payments landscape?

That is where things get interesting for those of us who look deeper than the headlines. On the surface, the numbers seem daunting, but when we evaluate Western Union using our six-pronged value checklist, the company is currently undervalued in five out of six areas, which gives it a strong value score of 5. This hints that the stock might not be as overlooked as it appears. No matter where you stand, these numbers invite a second look, especially as fintech disruptions, global remittance trends, and competition continue to shape risk and opportunity. Next, let’s dig into those valuation methods to see where Western Union stands, and then, I will share what I think is the smartest way to look at value in today’s market.

Why Western Union is lagging behind its peers

Approach 1: Western Union Excess Returns Analysis

The Excess Returns approach focuses on how efficiently Western Union puts shareholder capital to work. In essence, this model looks at whether the company earns returns on its equity that are greater than its cost of equity, which then creates value for its investors.

For Western Union, the numbers look notable. The company’s current book value per share stands at $2.72, with a stable book value projected at $3.39 per share, according to weighted future estimates from four analysts. Analysts also project a stable earnings per share (EPS) of $1.79, based on future Return on Equity (ROE) estimates from five analysts. The cost of equity per share is calculated at $0.26, which leads to an excess return of $1.53 per share. Western Union’s average ROE of 52.79% is high, suggesting the business continues to generate well above its cost of capital.

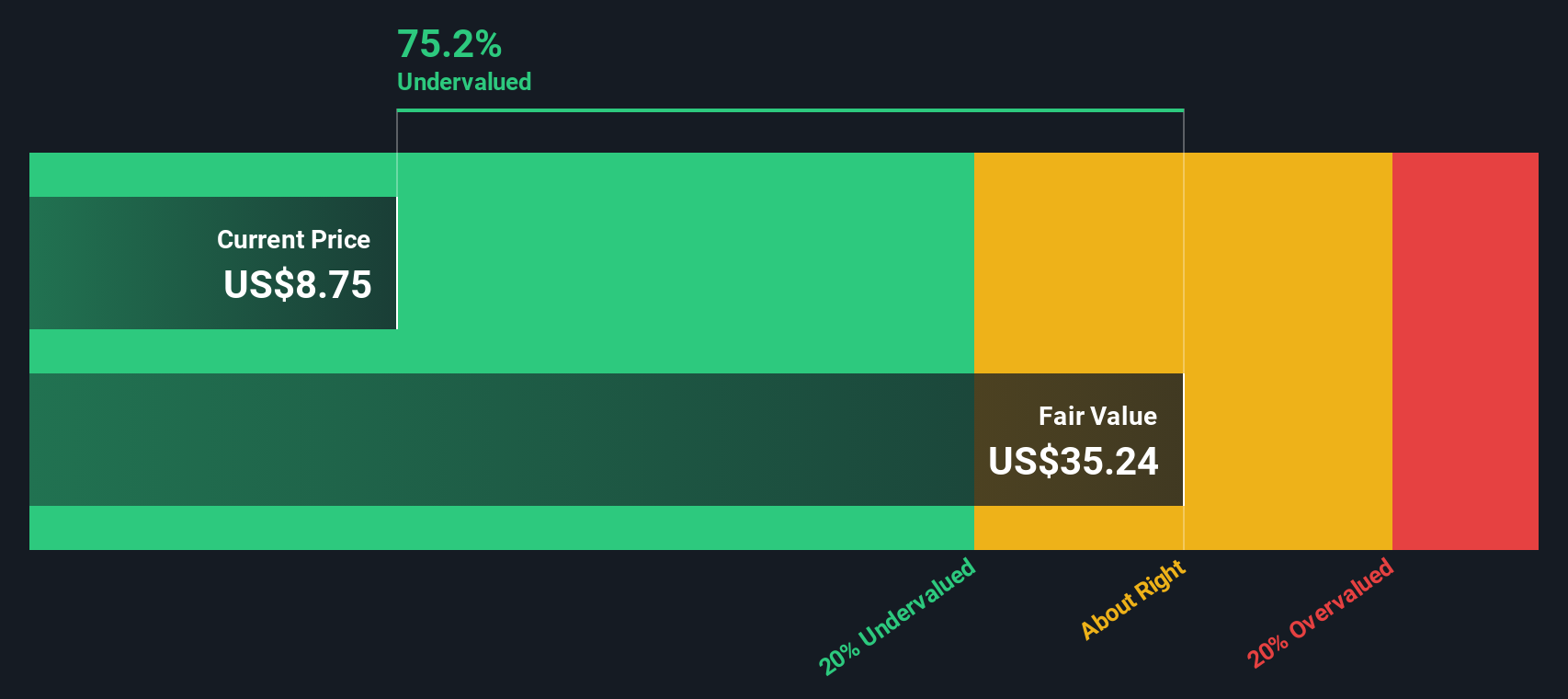

The result of this analysis is that the intrinsic value estimated by the Excess Returns model is $37.16 per share. With the current market price at $8.07, the stock is trading at a substantial discount of 78.3%. This suggests that the market could be underestimating the company’s true value based on its ability to generate returns well above its cost of capital.

Result: UNDERVALUED

Our Excess Returns analysis suggests Western Union is undervalued by 78.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Western Union Price vs Earnings

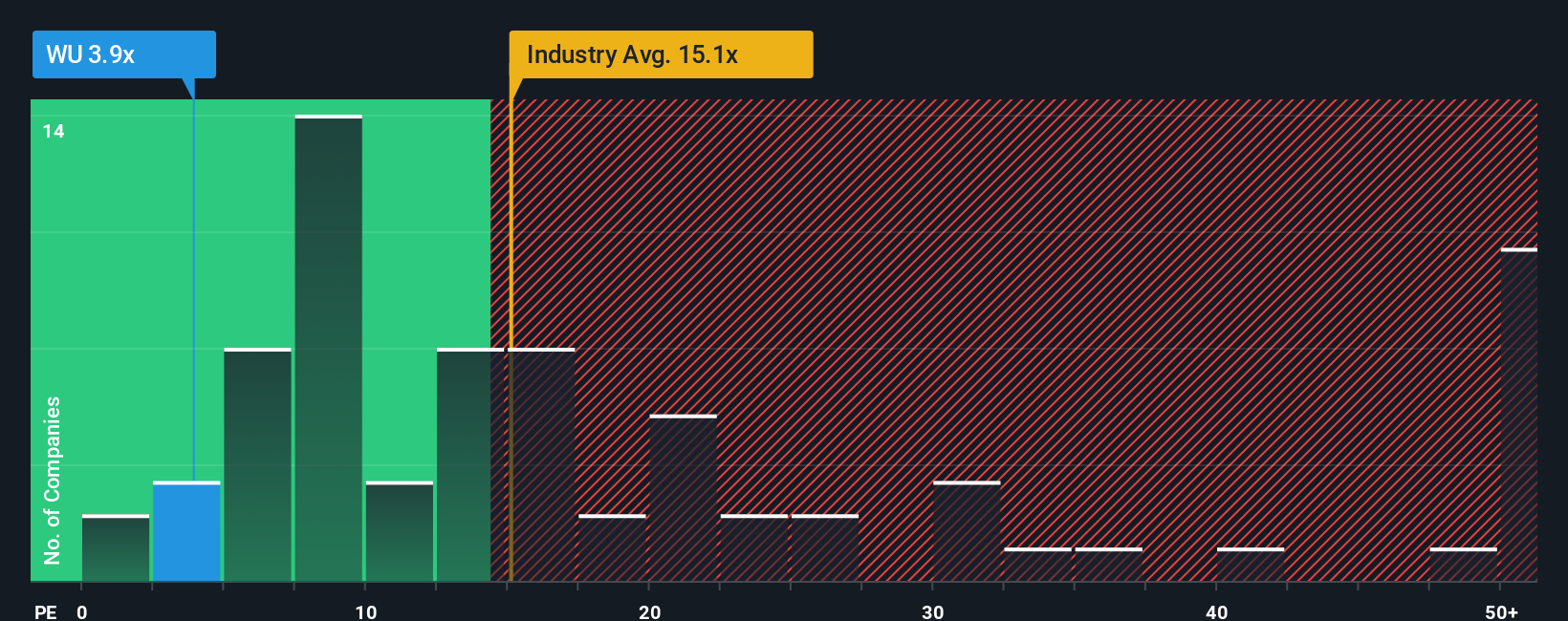

The Price-to-Earnings (PE) ratio is the valuation multiple most widely used for profitable companies like Western Union because it ties the stock price directly to the company’s earnings power. For established companies, a PE ratio quickly shows how much investors are willing to pay for one dollar of current earnings, offering a useful benchmark for value.

Of course, what counts as a “normal” or “fair” PE ratio depends on several factors, such as earnings growth potential, business risks, and how stable earnings are over time. Higher growth companies or those seen as lower risk typically command higher PE multiples, while slower growers or riskier names tend to trade at a discount.

Western Union’s current PE ratio is just 2.91x, which is dramatically below both the Diversified Financial industry average of 16.06x and its typical peer at 13.61x. However, these simple comparisons do not consider the unique characteristics and risk profile of Western Union. That is where the Simply Wall St “Fair Ratio” comes in. For Western Union, this is calculated as 10.63x. The Fair Ratio incorporates not just earnings and industry, but also factors like profit margins, growth outlook, company size, and business risks, making it more tailored than standard industry or peer comparisons.

With Western Union’s PE at 2.91x and the Fair Ratio at 10.63x, the stock appears substantially undervalued against its own fundamentals and risk-reward profile.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Western Union Narrative

Earlier we hinted at an even better way to understand valuation, so let's introduce you to Narratives, a powerful but simple approach where you connect the company’s story with your financial forecast to estimate fair value.

A Narrative lets you spell out your perspective on Western Union. You describe not only what you think is likely for its future revenue, earnings, and profit margins, but also why you believe those outcomes are reasonable based on the company’s business model, competitive position, or market conditions. This approach brings transparency to your assumptions and ties the numbers to meaningful context.

On Simply Wall St’s Community page, Narratives are an accessible tool millions of investors already use. They help you compare your Fair Value estimate directly to the current share price and see whether it is time to buy or sell. Plus, Narratives update automatically when news or earnings go live, keeping your view relevant.

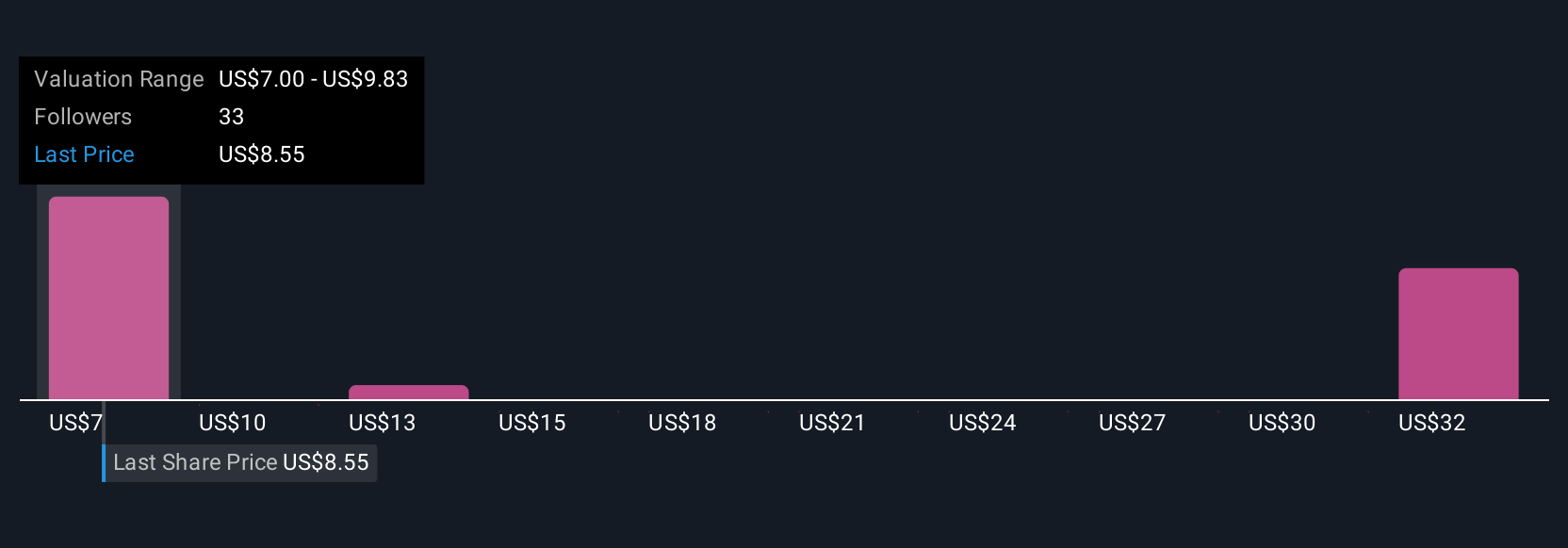

For example, some investors see Western Union as a digital transformation winner, citing new tech and business shifts that support analyst price targets as high as $17.00. Others focus on regulatory risks and competition, ending up with a more conservative fair value near $7.00, highlighting how your story shapes your investment decisions.

Do you think there's more to the story for Western Union? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Western Union might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WU

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives