- United States

- /

- Diversified Financial

- /

- NYSE:WEX

WEX (NYSE:WEX) Leverages Electric Vehicle Investments and AI for Future Growth Potential

Reviewed by Simply Wall St

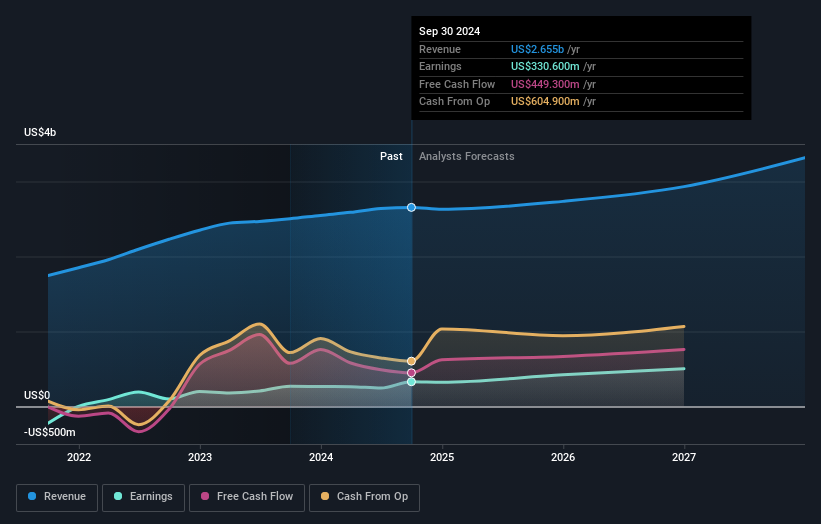

WEX (NYSE:WEX) has demonstrated financial resilience with a 2% revenue increase to $665 million and a 7% rise in adjusted net income per share, highlighting its strong cash flow and strategic capital allocation. Despite challenges in the Mobility segment due to declining fuel prices and operational issues, WEX is actively exploring opportunities in the electric vehicle and AI sectors to drive future growth. This report will explore WEX's competitive advantages, current challenges, future prospects, and the impact of market volatility on its financial performance.

See the full analysis report here for a deeper understanding of WEX.

Competitive Advantages That Elevate WEX

WEX has shown remarkable financial resilience, evidenced by a 2% increase in revenue to $665 million and a 7% rise in adjusted net income per diluted share to $4.35. This performance underscores the company's strong cash flow and strategic capital allocation, which included $544 million in share repurchases by the end of the third quarter. Melissa Smith, Chair and CEO, highlighted the company's focus on maintaining high customer retention and expanding margins, which are key drivers of profitability. Furthermore, WEX's earnings growth over the past year at 22.3% surpasses the industry average, reflecting its high-quality earnings and improved net profit margins. Additionally, the company's current trading at $183.9 is significantly below the estimated fair value of $338.79, suggesting it is undervalued and potentially appealing to investors.

Challenges Constraining WEX's Potential

The Mobility segment has been particularly impacted by a significant decline in fuel prices, leading to revenue challenges. This, coupled with broader softness in same-store sales, has presented hurdles. Operational issues in optimizing pricing structures have also resulted in unplanned charges, affecting financial outcomes. The Corporate Payments segment saw a 6% decrease in revenue, attributed to a model change for a large OTA customer, as explained by CFO Jagtar Narula. Moreover, WEX's revenue growth forecast of 4.9% per year lags behind the US market growth of 9%, indicating potential underperformance relative to the broader market. Interest payments on debt are also not well covered by EBIT, with a coverage ratio of 2.9x, pointing to financial constraints.

Future Prospects for WEX in the Market

WEX is actively pursuing opportunities in the electric vehicle (EV) and hybrid solutions space, positioning itself to benefit from the ongoing transition to EVs. These initiatives are aimed at addressing the evolving needs of mobility customers. The company is also investing in artificial intelligence to enhance operational efficiency and customer experience, with positive impacts already being observed. Additionally, WEX's expansion into new market segments, such as through the 10-4 by WEX app for independent truckers, reflects its commitment to broadening its product offerings and market reach. These efforts are expected to drive future earnings growth, which is forecasted at 20.68% per year.

Market Volatility Affecting WEX's Position

Fluctuating fuel prices continue to pose a risk to the Mobility segment's revenue, with prices moving significantly lower since July, impacting revenue expectations. Economic uncertainty and softness in same-store sales further exacerbate these challenges, as noted by Smith. Additionally, the potential for increased credit losses due to macroeconomic conditions remains a concern, despite recent positive trends in credit losses. The lack of recent dividend payouts may also deter income-focused investors, while minimal insider buying over the past three months could indicate a lack of confidence from insiders. These factors collectively highlight the external pressures that could affect WEX's market position.

Learn about WEX's dividend strategy and how it impacts shareholder returns and financial stability.

Conclusion

WEX's financial resilience, highlighted by revenue and earnings growth, underpins its strategic focus on customer retention and margin expansion, essential for sustaining profitability. Challenges in the Mobility segment due to declining fuel prices and operational hurdles persist, yet WEX's proactive investments in electric vehicle solutions and artificial intelligence position it well for future growth, with earnings expected to rise significantly. While current trading at $183.9 indicates a market price below its estimated fair value of $338.79, suggesting potential investment appeal, the company's ability to navigate external pressures and leverage its strategic initiatives will be crucial for realizing its full market potential.

Where To Now?

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WEX might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WEX

WEX

Operates a commerce platform in the United States and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives