- United States

- /

- Diversified Financial

- /

- NYSE:WD

How New Mixed-Income Deals And Survey Insights At Walker & Dunlop (WD) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- In recent days, Walker & Dunlop arranged a comprehensive financing package for Newark’s 22 Fulton Street and a US$285,000,000 bridge loan for Brooklyn’s Greenpoint Central, while its annual survey at Affordable Housing Finance Live pointed to strong expectations for increased affordable housing investment.

- Together, these transactions and survey findings highlight Walker & Dunlop’s growing role at the intersection of multifamily development, affordable housing policy, and institutional capital deployment.

- We’ll now explore how Walker & Dunlop’s expanding role in financing mixed market-rate and affordable projects may influence its broader investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Walker & Dunlop Investment Narrative Recap

To own Walker & Dunlop, you need to believe that multifamily and affordable housing finance can offset softer activity in other commercial segments and justify the company’s current valuation. The latest deals at 22 Fulton Street and Greenpoint Central reinforce its positioning in mixed market rate and affordable projects, but do not materially change the near term reliance on stable GSE and HUD programs, or the risk that high or volatile interest rates could still weigh on overall transaction volumes.

Of the recent news, the Affordable Housing Finance Live survey stands out because it directly ties Walker & Dunlop’s platform to sentiment around future capital availability for affordable projects. With 90% of respondents expecting higher affordable housing investment and supportive views of HUD’s role, this data point lines up with one of the key potential catalysts for the business: that growing emphasis on affordable and workforce housing could support recurring fee income across origination, servicing, and syndication over time.

Yet against this constructive backdrop, investors should also weigh how any shift in agency caps or GSE policy could...

Read the full narrative on Walker & Dunlop (it's free!)

Walker & Dunlop's narrative projects $1.5 billion revenue and $233.2 million earnings by 2028.

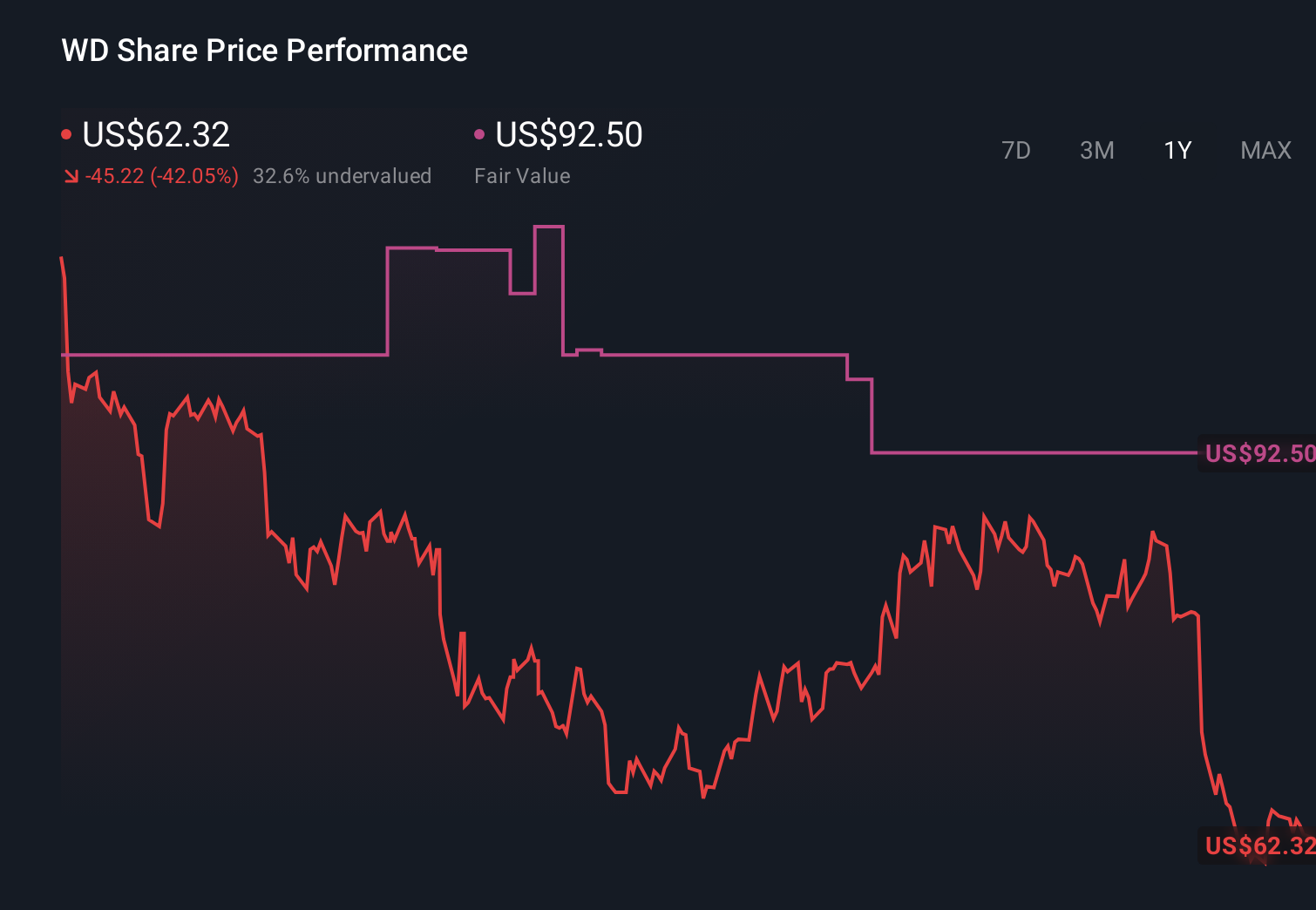

Uncover how Walker & Dunlop's forecasts yield a $92.50 fair value, a 46% upside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community span roughly US$35 to US$92. You can set those views against the company’s growing exposure to affordable housing finance and consider what that might mean for future revenue resilience.

Explore 3 other fair value estimates on Walker & Dunlop - why the stock might be worth as much as 46% more than the current price!

Build Your Own Walker & Dunlop Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Walker & Dunlop research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Walker & Dunlop research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Walker & Dunlop's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Walker & Dunlop might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WD

Walker & Dunlop

Through its subsidiaries, originates, sells, and services a range of multifamily and other commercial real estate financing products and services for owners and developers of real estate in the United States.

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026