- United States

- /

- Diversified Financial

- /

- NYSE:WD

How Investors May Respond To Walker & Dunlop (WD) Expanding Portfolio Financing and EMEA Leadership

Reviewed by Sasha Jovanovic

- Walker & Dunlop recently announced it arranged US$356.4 million in financing for the acquisition of four properties in major New England metropolitan areas, and expanded its Europe/Middle East operations by hiring Aaron Knight as senior managing director and co-head of Capital Markets - EMEA.

- This combination of substantial portfolio financing and ongoing international team expansion highlights the firm's focus on broadening both its client base and asset class expertise.

- We'll explore how this international hiring and capital markets activity may reshape Walker & Dunlop's investment narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Walker & Dunlop Investment Narrative Recap

For those considering Walker & Dunlop, the central narrative hinges on whether the company can grow its presence beyond US multifamily lending and meaningfully diversify revenues as interest rate and office sector headwinds persist. The recent expansion into European markets, highlighted by the addition of Aaron Knight to lead EMEA Capital Markets, reinforces this international push and could help buffer against certain risks, though it does not materially alter the impact that interest rate volatility remains the foremost short-term concern for earnings and transaction volumes.

Among recent developments, the US$356.4 million portfolio financing arranged for Harbor Group International stands out, underlining Walker & Dunlop's core strength in multifamily originations, a category less susceptible to ongoing structural shifts in commercial real estate. This transaction is directly relevant to the underlying catalyst of multifamily demand, helping offset risks tied to softer office and retail volumes as the company's income remains tethered to healthy transaction pipelines.

For contrast, investors should also be aware of ongoing revenue dependence on government-sponsored entities such as Freddie Mac and the possibility that changes to agency caps or regulation could...

Read the full narrative on Walker & Dunlop (it's free!)

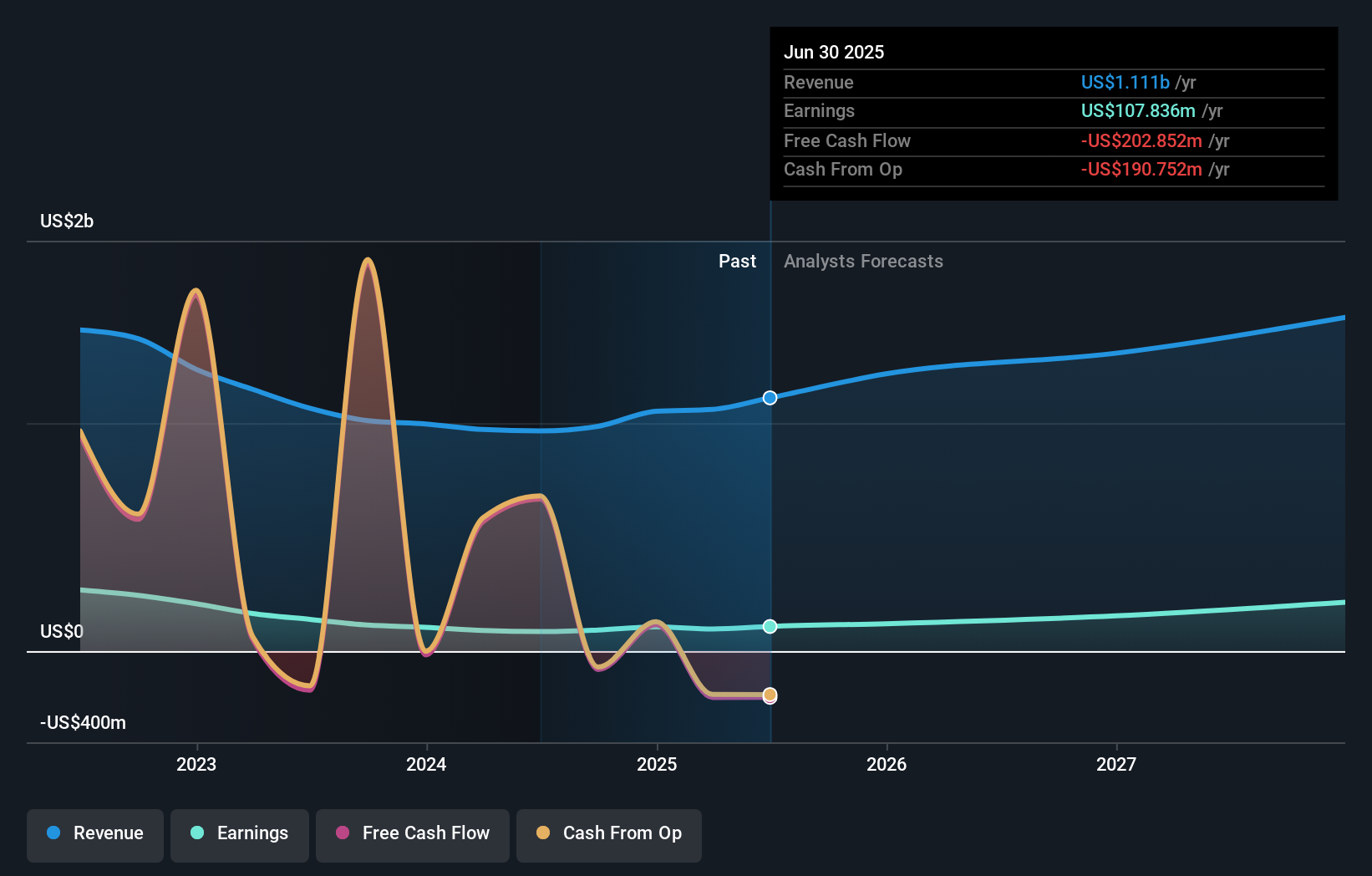

Walker & Dunlop's narrative projects $1.5 billion revenue and $233.2 million earnings by 2028. This requires 11.2% yearly revenue growth and an increase of $125.4 million in earnings from the current $107.8 million.

Uncover how Walker & Dunlop's forecasts yield a $92.50 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community span a wide range from US$34.53 to US$92.50 per share. While many see upside amid expected multifamily loan growth, a persistent reliance on agency lending remains a key variable that could influence future returns; explore varied viewpoints to get the full picture.

Explore 3 other fair value estimates on Walker & Dunlop - why the stock might be worth as much as 13% more than the current price!

Build Your Own Walker & Dunlop Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Walker & Dunlop research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Walker & Dunlop research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Walker & Dunlop's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Walker & Dunlop might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WD

Walker & Dunlop

Through its subsidiaries, originates, sells, and services a range of multifamily and other commercial real estate financing products and services for owners and developers of real estate in the United States.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives