Visa (V) Valuation in Focus After Recent 1% Dip and Strong Year-to-Date Gains

Reviewed by Kshitija Bhandaru

See our latest analysis for Visa.

Visa’s steady 9% share price return so far this year reflects ongoing optimism about payment industry growth. The 25% total shareholder return over twelve months also shows that investors have been rewarded for staying aboard through recent shifts in sentiment and spending.

If you’re weighing opportunities beyond payments, this could be a smart moment to discover fast growing stocks with high insider ownership.

With shares showing robust returns but only a small recent dip, investors face a key question: Is Visa undervalued today, or are markets already factoring in all of its expected growth?

Most Popular Narrative: 12% Undervalued

Visa’s most popular narrative points to a fair value of $391.46, comfortably above the last close of $343.65. This sets a clear gap and prompts investors to consider whether future growth expectations support further upside.

Ongoing global shift away from cash and increasing e-commerce adoption, evidenced by strong growth in Tap to Pay penetration (at 78% of face-to-face transactions globally) and record growth in tokenized credentials, are poised to expand Visa's addressable market and transaction volumes. These factors could provide a durable tailwind for long-term revenue growth.

Want to know which big digital trends are fueling Visa’s fair value? There is a significant transformation in payments that is driving bold margin and revenue forecasts, but you will need to read more to discover exactly what underlies this valuation.

Result: Fair Value of $391.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, advances in real-time payment systems and rapid regulatory shifts could challenge Visa’s transaction fees and put pressure on profit margins moving forward.

Find out about the key risks to this Visa narrative.

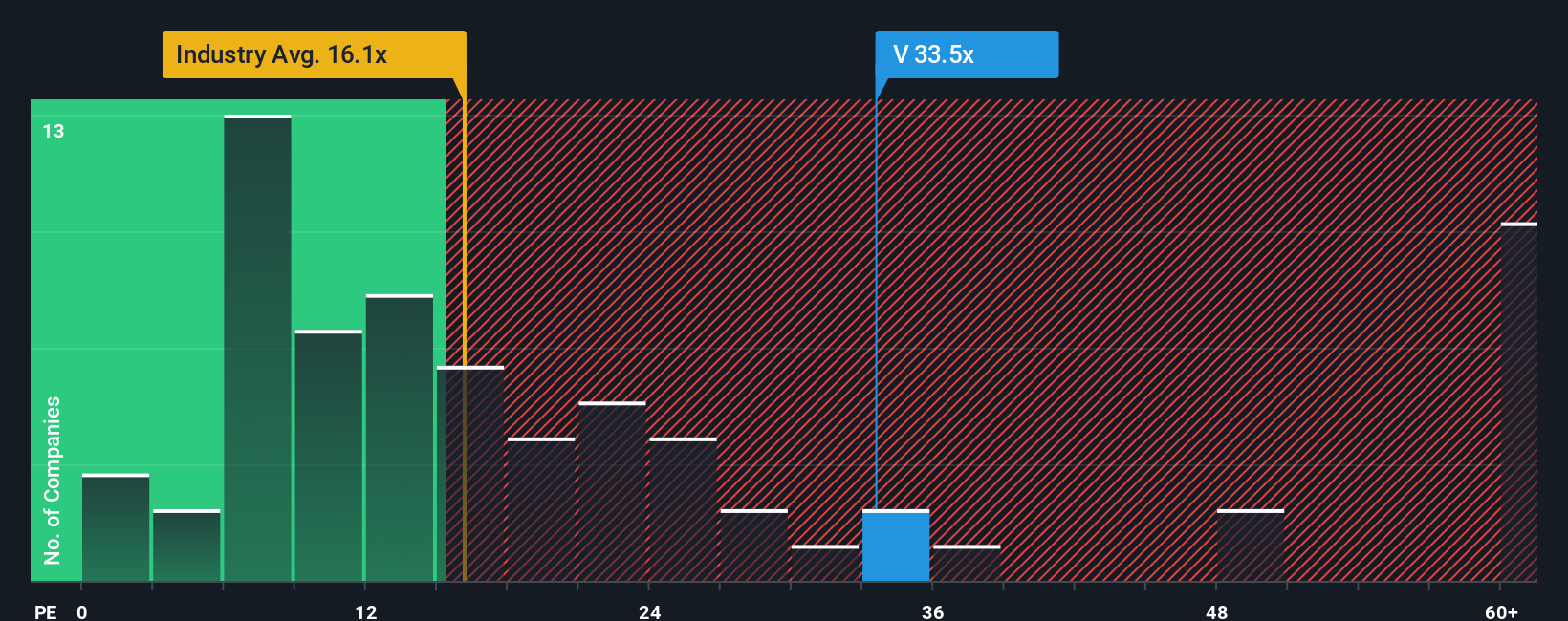

Another View: What About Price to Earnings?

While some see Visa as undervalued based on future earnings forecasts, a look at its current price-to-earnings ratio paints a more expensive picture. Visa’s PE stands at 33x, which is well above the peer average of 21.6x, the industry’s 15.7x, and our fair ratio of 23.2x. This substantial premium means investors are betting heavily on future growth playing out as expected, and it introduces greater valuation risk if results disappoint. Could this premium be justified, or is caution warranted?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Visa Narrative

If you prefer your own analysis or want to dig into the numbers independently, you can quickly develop your own perspective here in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Visa.

Looking for more investment ideas?

Why settle for just one opportunity? Now is the perfect time to discover standout stocks across fresh trends and sectors with Simply Wall Street’s easy-to-use Screener. Don’t let exciting prospects slip by while others act first.

- Uncover potential high-yield opportunities by checking out these 19 dividend stocks with yields > 3% with yields over 3% to strengthen your portfolio’s income stream.

- Get ahead of the crowd in emerging technology with these 24 AI penny stocks, highlighting promising companies at the forefront of artificial intelligence innovation.

- Boost your value radar by reviewing these 891 undervalued stocks based on cash flows to spot stocks trading below their intrinsic cash flow worth before the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:V

Visa

Operates as a payment technology company in the United States and internationally.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives