- United States

- /

- Diversified Financial

- /

- NYSE:UWMC

Is UWM Insider Selling After Mixed Q3 Results Altering The Investment Case For UWM Holdings (UWMC)?

Reviewed by Sasha Jovanovic

- SFS Holding Corp, a ten percent owner of UWM Holdings Corp, recently sold 1,836,861 shares of Class A Common Stock under a pre-arranged 10b5-1 trading plan and converted 6,800,000 UWM Paired Interests into Class A shares on December 1, shortly after UWM reported mixed Q3 2025 results with revenue ahead of expectations but earnings per share missing forecasts.

- This combination of a large insider transaction and a divergence between top-line strength and weaker profitability adds an extra layer of complexity to how investors may interpret UWM’s longer-term outlook.

- Now, we’ll examine how the significant insider share sale, alongside mixed earnings, may influence UWM Holdings’ existing investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

UWM Holdings Investment Narrative Recap

To own UWM, you generally need to believe that wholesale brokers, technology and AI tools can drive meaningfully higher mortgage volumes and better margins over time. The recent mixed Q3 2025 results and the sizable SFS Holding share sale do not appear to alter the key near term catalyst of technology driven productivity gains, but they may sharpen attention on the main risk that higher fixed tech and servicing costs are harder to absorb if volumes stay subdued.

The company’s decision to maintain its US$0.10 per share quarterly dividend for a twentieth consecutive quarter is the announcement that most directly frames this news, because it highlights UWM’s ongoing cash commitments at a time when profitability is thin and interest coverage is strained. Against the backdrop of insider selling and earnings volatility, the dividend policy may increasingly be viewed through the lens of balance sheet flexibility and the company’s ability to fund continued AI and servicing investments without overextending itself.

Yet the bigger concern investors should be aware of is what happens if mortgage volumes fail to grow enough to cover rising fixed technology and servicing costs...

Read the full narrative on UWM Holdings (it's free!)

UWM Holdings' narrative projects $3.6 billion revenue and $119.3 million earnings by 2028.

Uncover how UWM Holdings' forecasts yield a $7.00 fair value, a 23% upside to its current price.

Exploring Other Perspectives

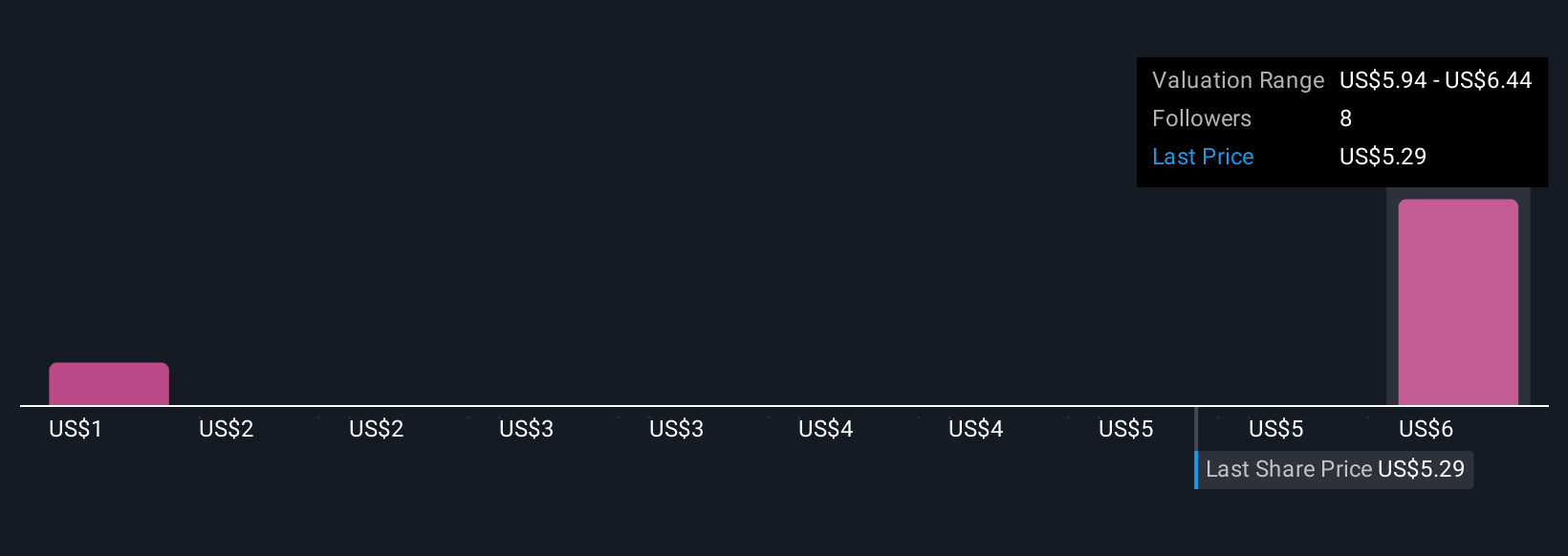

Three Simply Wall St Community valuations span roughly US$1.75 to US$7 per share, underlining how differently individual investors are sizing up UWM’s potential. When you set those views against the risk that higher fixed technology spending may not be matched by sustainable volume growth, it becomes clear why looking at several perspectives on UWM’s future performance can be so important.

Explore 3 other fair value estimates on UWM Holdings - why the stock might be worth less than half the current price!

Build Your Own UWM Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UWM Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free UWM Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UWM Holdings' overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UWMC

UWM Holdings

Engages in the origination, sale, and servicing residential mortgage lending in the United States.

Exceptional growth potential with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026