- United States

- /

- Mortgage REITs

- /

- NYSE:TWO

Does Recent Net Interest Income Pressure Signal a Strategic Shift for Two Harbors (TWO)?

Reviewed by Sasha Jovanovic

- Two Harbors Investment’s Series B preferred shares went ex-dividend on October 10, 2025, with eligible shareholders set to receive the upcoming dividend payment on October 27, 2025.

- Recent disclosures reveal that Two Harbors Investment continues to grapple with declining net interest income and a decrease in tangible book value per share, reflecting ongoing pressure from unfavorable market conditions.

- We’ll explore how ongoing declines in net interest income are shaping the outlook for Two Harbors Investment’s investment narrative.

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

What Is Two Harbors Investment's Investment Narrative?

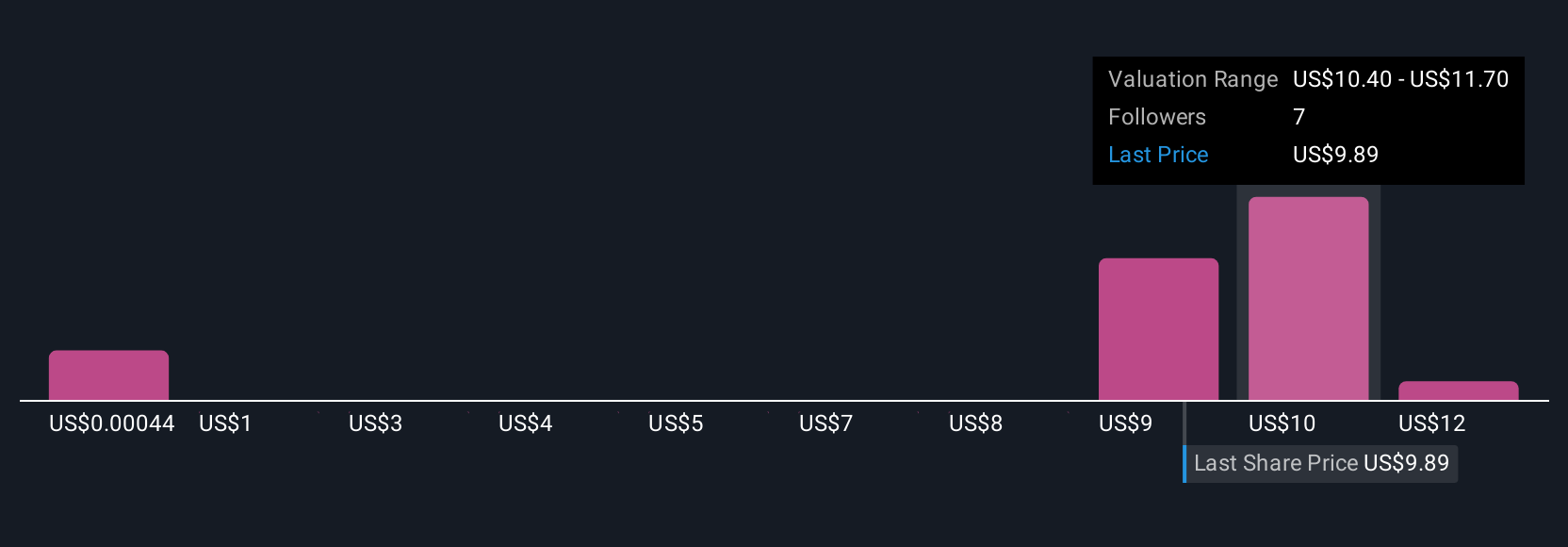

To be a shareholder in Two Harbors Investment right now, you have to trust in the potential for a turnaround despite ongoing earnings volatility, declining net interest income, and pressure on tangible book value. The ex-dividend event for Series B preferred shares is an important moment for income-oriented investors but doesn’t appear to significantly alter the near-term risks or catalysts for the company. The bigger picture remains shaped by ongoing net losses, reduction in regular dividend payouts, and the aftermath of a substantial legal settlement, all at a time when revenue is forecast to dry up and profitability isn’t expected in the coming years. While the stock is trading just below consensus fair value, recent price declines suggest that the market is focused on immediate earnings headwinds rather than modest incremental news like the preferred share ex-dividend. Investors should closely watch for any signs of further pressure on net interest income or unexpected financial shocks, which remain the most material short-term risks.

By contrast, dividend coverage is also a crucial point investors should keep an eye on moving forward.

Exploring Other Perspectives

Explore 6 other fair value estimates on Two Harbors Investment - why the stock might be worth less than half the current price!

Build Your Own Two Harbors Investment Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Two Harbors Investment research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Two Harbors Investment research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Two Harbors Investment's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Two Harbors Investment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TWO

Two Harbors Investment

Invests in, finances, and manages mortgage servicing rights (MSRs), agency residential mortgage-backed securities (RMBS), and other financial assets through RoundPoint in the United States.

Mediocre balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives