- United States

- /

- Diversified Financial

- /

- NYSE:TOST

Is Toast Still a Smart Bet After Recent Stock Swings in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with Toast stock? You are not alone. The restaurant software specialist has been on quite a ride lately, keeping investors on their toes as price swings keep reflecting the ever-changing sentiment around its growth prospects and risk profile. After jumping 2.0% over the last week, Toast has retraced some earlier gains, with a 6.3% move down in the last 30 days. If you zoom out, the stock still sits up 6.0% year-to-date and a notable 31.3% over the past year. That kind of longer-term momentum hints at a business with real staying power, even if not every week feels like a win.

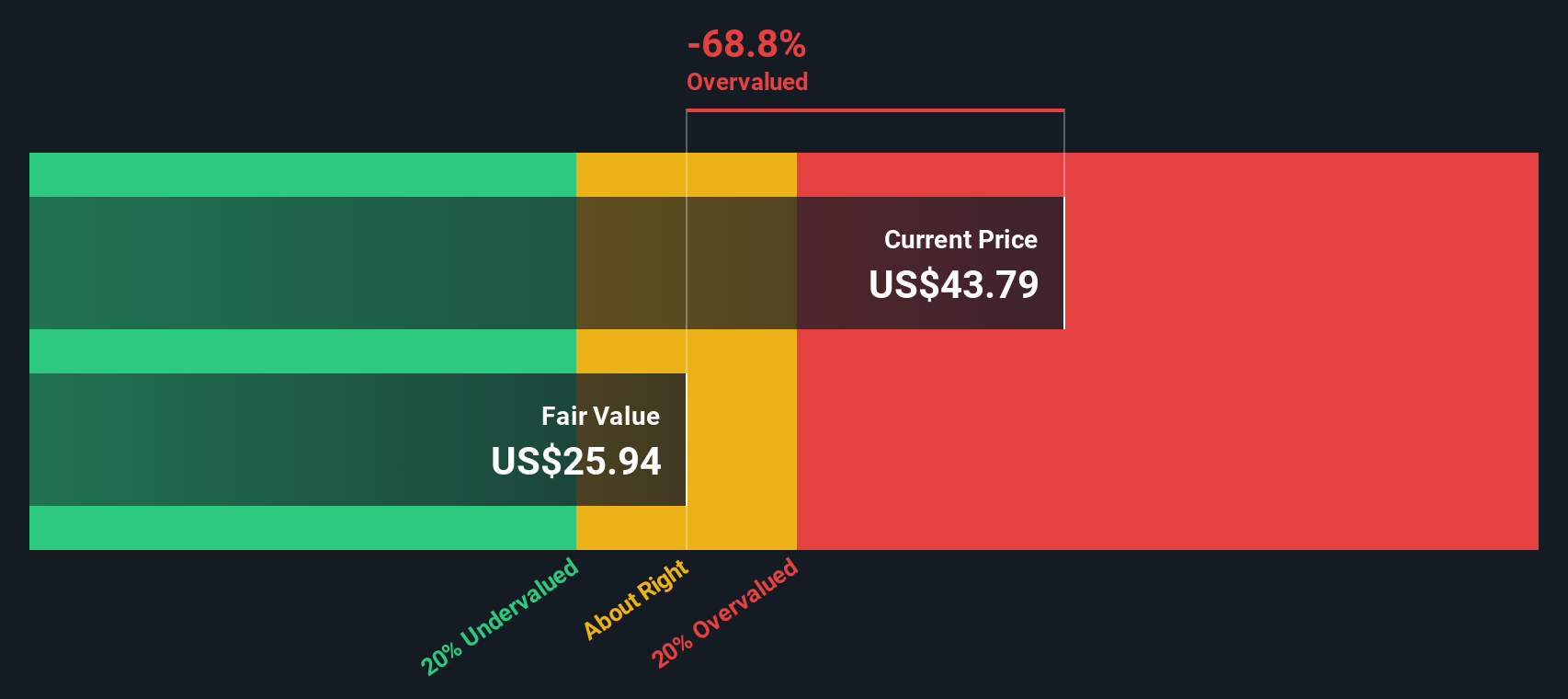

Much of this positive sentiment has come as Toast continues to expand its footprint in the competitive point-of-sale market, rolling out new partnerships and platform features that help restaurants keep operations humming. Investors seem encouraged by signs the company is grabbing market share and finding new ways to broaden its recurring revenue streams. That said, in our latest valuation analysis, Toast only scored a 1 out of 6 on traditional undervaluation checks. This suggests the market may have already priced in a lot of this optimism.

But what do those valuation checks really mean for your decision making, and is there a smarter way to cut through the numbers? Next, let's break down the main approaches investors use to understand Toast's worth and why you might want to go even deeper before making your final call.

Toast scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Toast Excess Returns Analysis

The Excess Returns valuation model estimates a company’s worth by looking at how much return it generates above the cost of its own equity. Rather than just focusing on earnings, this method centers on how effectively Toast turns investor money into profits compared to the risk it takes on. This is especially important when assessing high-growth, technology-driven companies like Toast, where standard valuation multiples can miss key dynamics.

For Toast, the model starts with a Book Value of $3.13 per share and a Stable Earnings Per Share (EPS) estimate of $1.31, drawn from the forecasts of eight analysts. The company’s cost of equity is $0.41 per share, while the excess returns—that is, profit created above the cost of equity—come to $0.90 per share. Toast’s average Return on Equity stands at a robust 23.7%, signaling efficient use of capital. Additionally, the Stable Book Value, as projected by five analysts, rises to $5.52 per share. This highlights expectations for growth in the company's assets.

Despite these positive inputs, the Excess Returns model calculates an intrinsic value below the current price. This implies Toast stock is about 45.1% overvalued based on this methodology. This suggests that, at today’s levels, most of the optimism may already be reflected in the share price.

Result: OVERVALUED

Our Excess Returns analysis suggests Toast may be overvalued by 45.1%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Toast Price vs Earnings

For companies like Toast that are generating profits, the Price-to-Earnings (PE) ratio is a widely used metric to assess valuation. It allows investors to gauge how much they are paying for each dollar of earnings, giving insight into whether a stock is cheap or expensive compared to its profitability.

The "right" PE ratio is influenced by factors such as expectations for future growth and the risks specific to the company or its industry. In fast-growing sectors, higher PE ratios can be justified if investors believe strong profit expansion lies ahead. Conversely, lower ratios often reflect perceived risks or growth concerns.

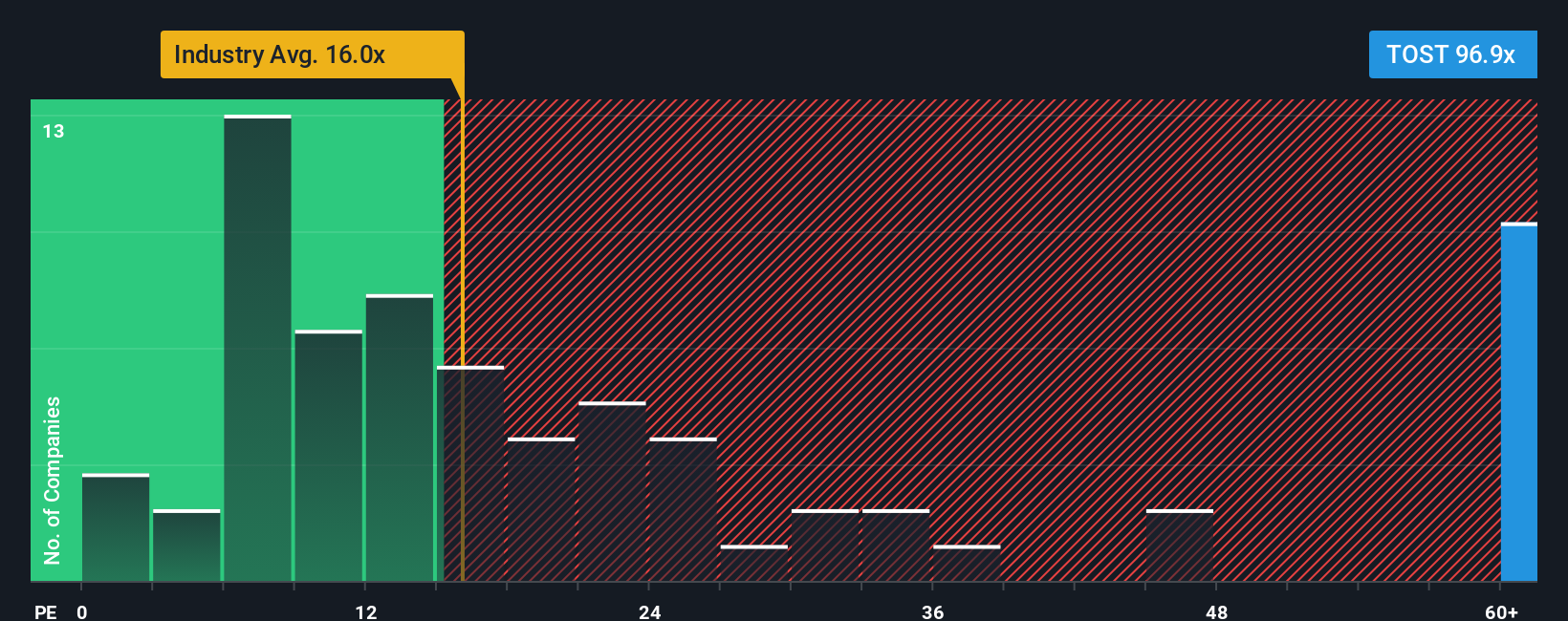

Toast currently trades at a lofty PE ratio of 100.3x. This is well above both the industry average of 16.5x for diversified financial companies and the peer average of 18.7x. To offer an even more tailored benchmark, Simply Wall St calculates a “Fair Ratio” of 23.2x for Toast, which incorporates growth forecasts, profit margins, market cap, and industry context into a single, dynamic figure. The Fair Ratio provides a more holistic comparison than raw industry or peer averages, making it more relevant for companies with unique growth profiles or risks.

Given Toast’s actual PE of 100.3x compared to its Fair Ratio of 23.2x, the stock appears significantly overvalued based on this approach.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Toast Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply the story behind your assumptions about a company, from how you see its business evolving, to the fair value and future growth you expect. Narratives help you connect the company’s real-world story to a set of financial forecasts and ultimately a concrete fair value, providing a more intuitive and personal approach than using ratios alone. On Simply Wall St’s Community page, millions of investors are already leveraging Narratives as a dynamic, easy-to-use tool. They allow you to set your own outlook, see how it stacks up against others, and adjust your view as the latest news or earning results come in. Narratives make it simple to compare your fair value to Toast’s current price so you can decide whether it is time to buy, hold, or sell. For example, some Toast Narratives see robust recurring revenue from product upsells and automation justifying a $60.00 price target, while others focus on inflation, competition, or margin risks and see fair value closer to $36.00. This illustrates how different beliefs lead to different investing choices.

Do you think there's more to the story for Toast? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toast might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TOST

Toast

Operates a cloud-based digital technology platform for the restaurant industry in the United States, Ireland, India, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives