- United States

- /

- Diversified Financial

- /

- NYSE:TOST

Adentro Joins Toast (TOST) Partner Ecosystem Connecting Marketing to Sales

Reviewed by Simply Wall St

Toast (TOST) recently integrated Adentro into its Partner Ecosystem, enhancing digital marketing capabilities for restaurants. This integration, announced on July 29, empowers restaurants to directly link advertising efforts to menu item purchases, potentially boosting marketing efficiency. Over the last quarter, the company's stock rose 36%, surging along with substantial market trends that saw major indices like the S&P 500 experience record highs amid optimism over corporate earnings. Concurrent earnings reports and strategic partnerships, such as with Topgolf, provided additional support to Toast's stock performance, counterbalancing index challenges and executive transitions.

Toast has 1 weakness we think you should know about.

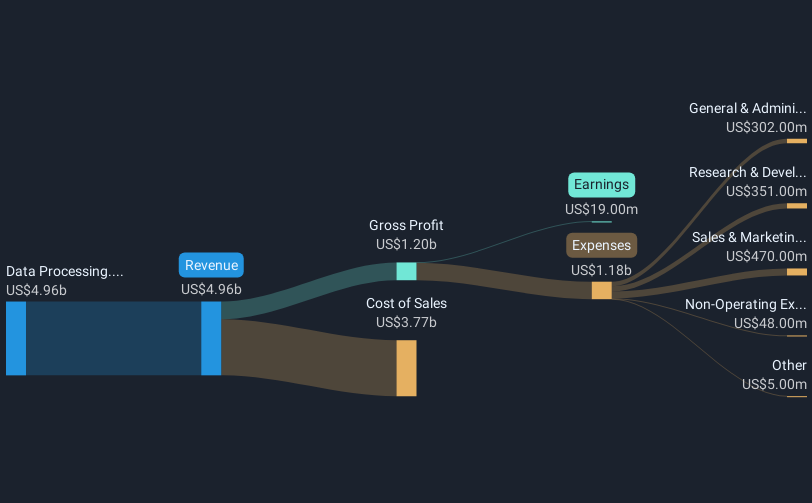

The recent integration of Adentro into Toast's Partner Ecosystem could significantly enhance the firm's digital marketing capabilities, offering restaurants improved links between advertising and sales, potentially translating to greater revenue and earnings. This development supports Toast's narrative of expanding market share in the U.S. and internationally, aligning with their strategy to increase customer adoption through technology such as AI. In terms of market performance, Toast's shares have exhibited substantial growth over a three-year period, with a 204.58% total return, including share price and dividends. This strong performance contrasts the broader U.S. market's return of 17.5% over the past year, highlighting Toast's recent momentum.

However, today's share price of US$48.55 is a slight premium compared to the consensus price target of US$45.88, suggesting a minor 5.5% variance, indicating analysts may consider it somewhat overvalued at present. Despite the positive short-term sentiment driven by strategic integrations and partnerships, the longer-run valuation disparities highlight the need for continued execution in expanding margins and driving profitability. The company's forecasted revenue and earnings growth could be positively impacted by enhanced marketing efficiency, supporting increased gross margins and top-line expansion as they further invest in fintech and R&D. However, persistent challenges, particularly from economic reliance on the U.S. restaurant sector, remain potential hurdles.

Examine Toast's earnings growth report to understand how analysts expect it to perform.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toast might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TOST

Toast

Operates a cloud-based digital technology platform for the restaurant industry in the United States, Ireland, India, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives