- United States

- /

- Consumer Finance

- /

- NYSE:SYF

Synchrony Financial (SYF) Valuation in Focus After Fed Signals Rate Cuts and Earnings Beat

Reviewed by Simply Wall St

Synchrony Financial (SYF) is in the spotlight this week after shares jumped 3% to hit an all-time high, sparked by comments from Federal Reserve Chair Jerome Powell hinting at possible interest rate cuts. For consumer credit companies like Synchrony, lower rates mean more attractive lending conditions, reduced funding costs, and typically higher margins. This momentum was further fueled by Synchrony’s second-quarter earnings beat, thanks to better efficiency and lower credit losses, which reassured investors about the company’s resilience in a shifting market environment.

This mix of upbeat economic signals and Synchrony’s strong financial update has turned heads. Over the past year, the stock has surged over 52%, and with a 24% climb in the past three months alone, momentum seems to be building. Management’s decision to return capital through buybacks and dividends, combined with a strong balance sheet and recent upgrades to future earnings expectations, continues to support the positive outlook for the stock, even as net revenue guidance has been trimmed and loan growth is expected to remain flat for now.

With all this in mind, some investors may be considering whether the current rally represents an entry point for long-term investment, or whether the market has already factored in most of Synchrony’s near-term growth potential.

Most Popular Narrative: 8% Undervalued

According to community narrative, Synchrony Financial appears undervalued based on analysts’ latest models and risk-adjusted fair value estimates.

“Renewed and expanded long-term strategic partnerships with major retailers and e-commerce platforms such as Amazon and Walmart provide long-term visibility on program revenues and drive customer retention. This results in a more stable and recurring revenue base as well as lower earnings volatility.”

Curious about what is fueling this bullish narrative? There is a hidden financial engine in Synchrony’s growth story, powered by analyst models and industry-beating assumptions you might not expect. Want to unveil exactly what future projections are driving this surprising valuation? The story behind the numbers might just change your outlook.

Result: Fair Value of $79.68 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks such as flat loan growth resulting from cautious consumer spending, as well as the company’s heavy reliance on a few major retail partners, could quickly change this outlook.

Find out about the key risks to this Synchrony Financial narrative.Another Perspective: SWS DCF Model

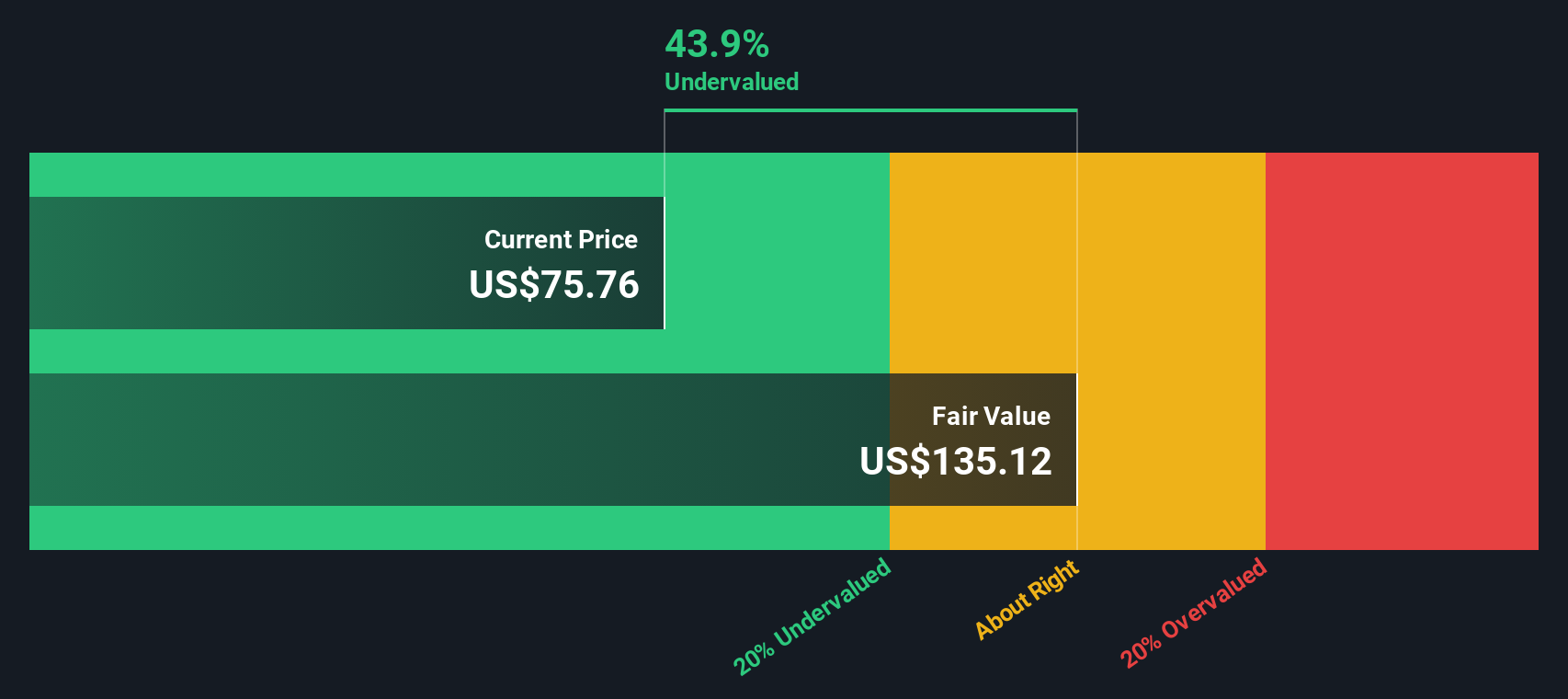

While analysts see upside based on near-term growth and strategic partnerships, our DCF model offers a different lens by weighing future cash flows and long-term assumptions. This approach points to a bigger valuation gap. Does the market agree?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Synchrony Financial Narrative

If you have your own perspective, or prefer to dive into the numbers and form your own conclusions, putting together a personalized view of Synchrony is quick and straightforward. You can do it your way in just a few minutes.

A great starting point for your Synchrony Financial research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Standout Investment Opportunities?

Smart investors never stop at just one idea. The market offers a wide range of unique opportunities, and a single breakthrough stock could enhance your returns. Consider tapping into new trends and companies you might otherwise overlook to position yourself for an advantage in the market.

- Explore future medical innovation by following advances in artificial intelligence for healthcare through healthcare AI stocks.

- Discover value in the market’s hidden gems by focusing on undervalued stocks based on cash flows, which relies on real cash flow analysis.

- Enhance your passive income strategy by targeting stocks offering dividend stocks with yields > 3% and regular returns above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SYF

Synchrony Financial

Operates as a consumer financial services company in the United States.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives