- United States

- /

- Mortgage REITs

- /

- NYSE:STWD

Is Starwood Property Trust’s (STWD) Rapid Debt Raising Reshaping Its Investment Profile?

Reviewed by Sasha Jovanovic

- In early October 2025, Starwood Property Trust completed two large private offerings, closing US$500 million in 5.250% senior notes due 2028 and pricing an upsized US$550 million in 5.750% senior notes due 2031, with proceeds aimed at green and social projects as well as general corporate purposes.

- This rapid, successive access to capital underscores the company's ability to finance growth initiatives and support environmental or social lending, while maintaining balance sheet flexibility.

- We'll explore how Starwood's ability to raise substantial unsecured debt may influence its investment narrative and long-term earnings outlook.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Starwood Property Trust Investment Narrative Recap

To be a shareholder in Starwood Property Trust, one needs to believe in the firm’s ability to profit from a shifting commercial real estate market while navigating ongoing sector headwinds and loan book risks. The recent US$1.05 billion debt offerings may help support portfolio expansion and green/social initiatives, but likely have a limited near-term impact on the main catalyst, growth and earnings consistency, or on the most pressing risk, which remains credit quality in challenged loan segments.

Among recent announcements, Starwood’s July 2025 equity raise, bringing in over US$500 million, stands out alongside the new debt issuances, reflecting continued reliance on capital markets to finance growth. This highlights both the company’s access to funding and underscores the importance of maintaining market confidence to support future lending and dividend sustainability as key catalysts evolve.

By contrast, investors should be aware of the lingering exposure to unproductive assets, since the capital raised will not fully address the potential revenue drag if these loans remain on the books...

Read the full narrative on Starwood Property Trust (it's free!)

Starwood Property Trust's narrative projects $3.1 billion revenue and $585.4 million earnings by 2028. This requires 109.0% yearly revenue growth and a $223.3 million earnings increase from $362.1 million.

Uncover how Starwood Property Trust's forecasts yield a $21.86 fair value, a 17% upside to its current price.

Exploring Other Perspectives

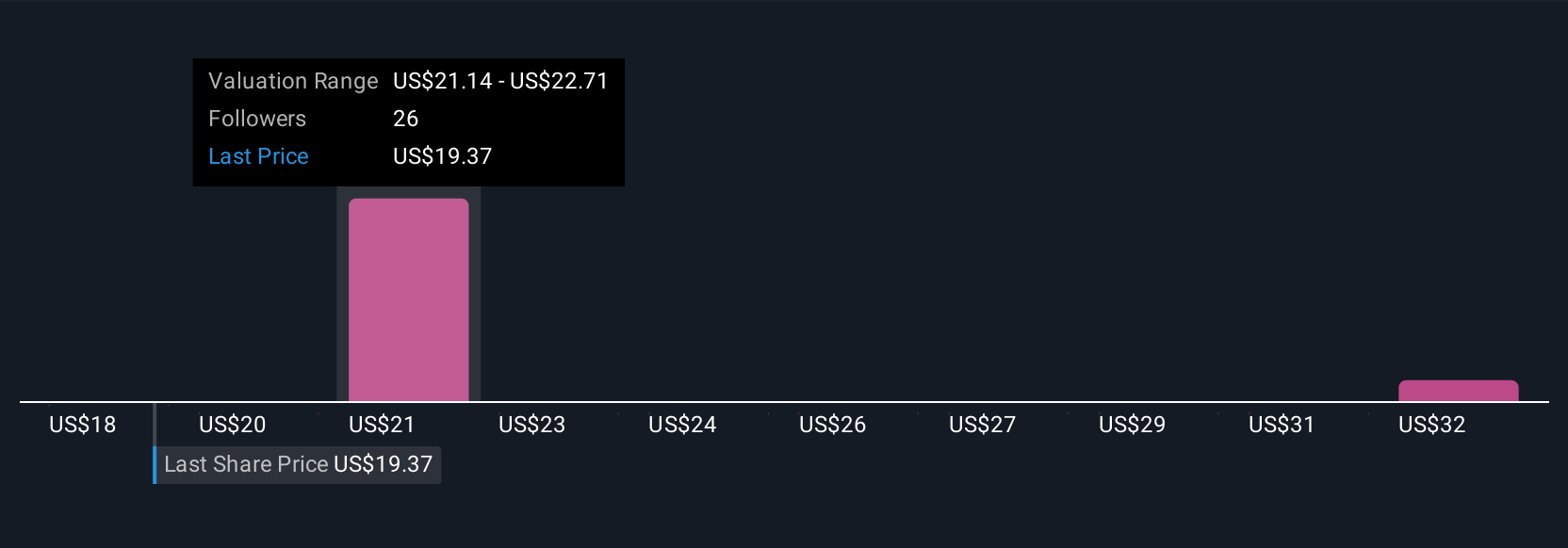

Three perspectives from the Simply Wall St Community span fair value estimates for Starwood Property Trust from US$18 up to US$32.02 per share. With this wide range and ongoing concerns over office sector loan quality, it is worth exploring several viewpoints before making up your mind.

Explore 3 other fair value estimates on Starwood Property Trust - why the stock might be worth just $18.00!

Build Your Own Starwood Property Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Starwood Property Trust research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Starwood Property Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Starwood Property Trust's overall financial health at a glance.

No Opportunity In Starwood Property Trust?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:STWD

Starwood Property Trust

Operates as a real estate investment trust (REIT) in the United States and internationally.

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives