- United States

- /

- Capital Markets

- /

- NYSE:SPGI

What S&P Global (SPGI)'s Barclays Partnership and AI Integration Means For Shareholders

Reviewed by Simply Wall St

- S&P Global recently announced a multi-year strategic agreement with Barclays, granting the bank access to a wide range of S&P Global products, data, and solutions through the Capital IQ Pro platform, while also integrating Barclays’ data to enhance cross-asset pricing and valuation services.

- This collaboration, along with S&P Global’s launch of AI-ready metadata products and integration with Anthropic’s Claude, reflects the company's commitment to expanding its data ecosystem and supporting advanced AI-driven analytics across the financial sector.

- We’ll explore how this deepened partnership with Barclays and advancements in AI-ready data are shaping S&P Global’s investment story.

Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

What Is S&P Global's Investment Narrative?

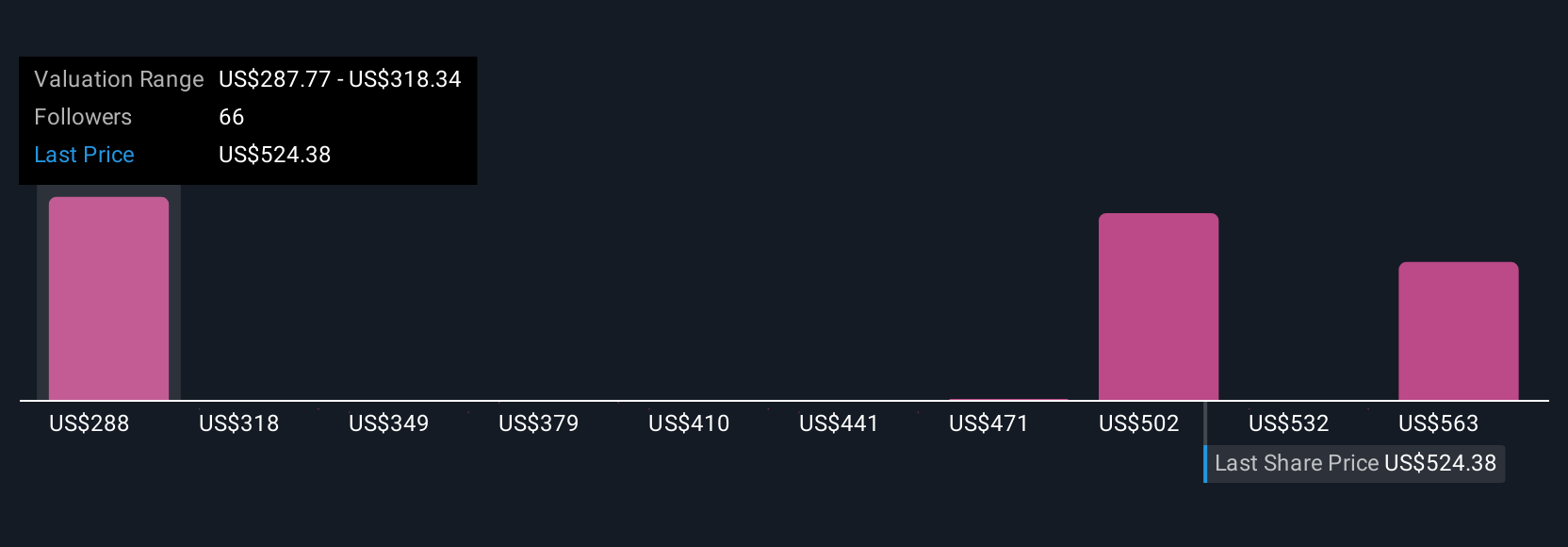

To own shares in S&P Global, you need to believe in the rising value of trusted data, analytics, and the role advanced technology plays in financial markets. S&P’s recent contracts with Barclays and Anthropic reflect a push towards deeper integration in clients’ workflows and an ability to monetize AI-ready data products. While these announcements strengthen the company's ecosystem and may help defend against disruption or margin pressure over time, today's movement in the share price appears modest, which suggests the market does not consider these news items as material near-term catalysts. The biggest risks remain: execution on new AI offerings, maintaining relevance as new competitors emerge, and controlling costs in data infrastructure, all while trading at a valuation premium to many peers. Overall, S&P’s ability to keep evolving its data platform will likely remain vital to its story.

But as much as growth is fueled by innovation, competition in this sector is never far away.

Exploring Other Perspectives

Build Your Own S&P Global Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your S&P Global research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free S&P Global research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate S&P Global's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPGI

S&P Global

Provides credit ratings, benchmarks, analytics, and workflow solutions in the global capital, commodity, and automotive markets.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives