- United States

- /

- Capital Markets

- /

- NYSE:SPGI

What Recent Stock Swings Mean for S&P Global’s Market Value in 2025

Reviewed by Bailey Pemberton

Thinking about what to do with S&P Global stock right now? You are definitely not alone. Whether you are weighing a hold, a buy, or just curious, S&P Global remains one of those companies that always seems to be at the heart of market conversations. The company’s recent stock swings say a lot about shifting investor sentiment. Over the past week, the shares have nudged 0.1% higher, but that comes after a bumpy month where the price dropped 11.2%. For the year so far, S&P Global is down 2.5%, and if you zoom out, it is off 8.1% over the last 12 months. Yet, anyone with a long memory will notice that over three years, the stock is up an impressive 66.8%, and it has delivered a solid 49% gain over the last five years.

Some of these shifts reflect broader market moods, especially how investors view risk and long-term growth for finance and data companies. With so many moving parts, the stock’s current valuation is a hot topic. According to our checklist, S&P Global is undervalued in just 1 out of 6 major valuation metrics, earning itself a value score of 1. In the next section, I will break down what that really means, walking through the main ways analysts value a stock like S&P Global, and why the best measure of true value might actually come at the end of this article.

S&P Global scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: S&P Global Excess Returns Analysis

The Excess Returns model provides a different lens on stock valuation. Instead of only looking at profits or dividends, this approach measures how much value a company creates above the minimum return investors demand, known as the cost of equity. Put simply, it examines whether investing in S&P Global’s business generates profits that beat the company’s own cost for using investor funds.

For S&P Global, the numbers are telling. The estimated Book Value stands at $109.37 per share, while analysts forecast a stable Earnings Per Share (EPS) of $18.38, based on a range of future estimates. That compares to a Cost of Equity of $9.30 per share, which means each share is expected to generate an "Excess Return" of $9.07. The firm’s average Return on Equity comes in at a strong 16.33%, and the Stable Book Value is projected to climb to $112.55 per share over time.

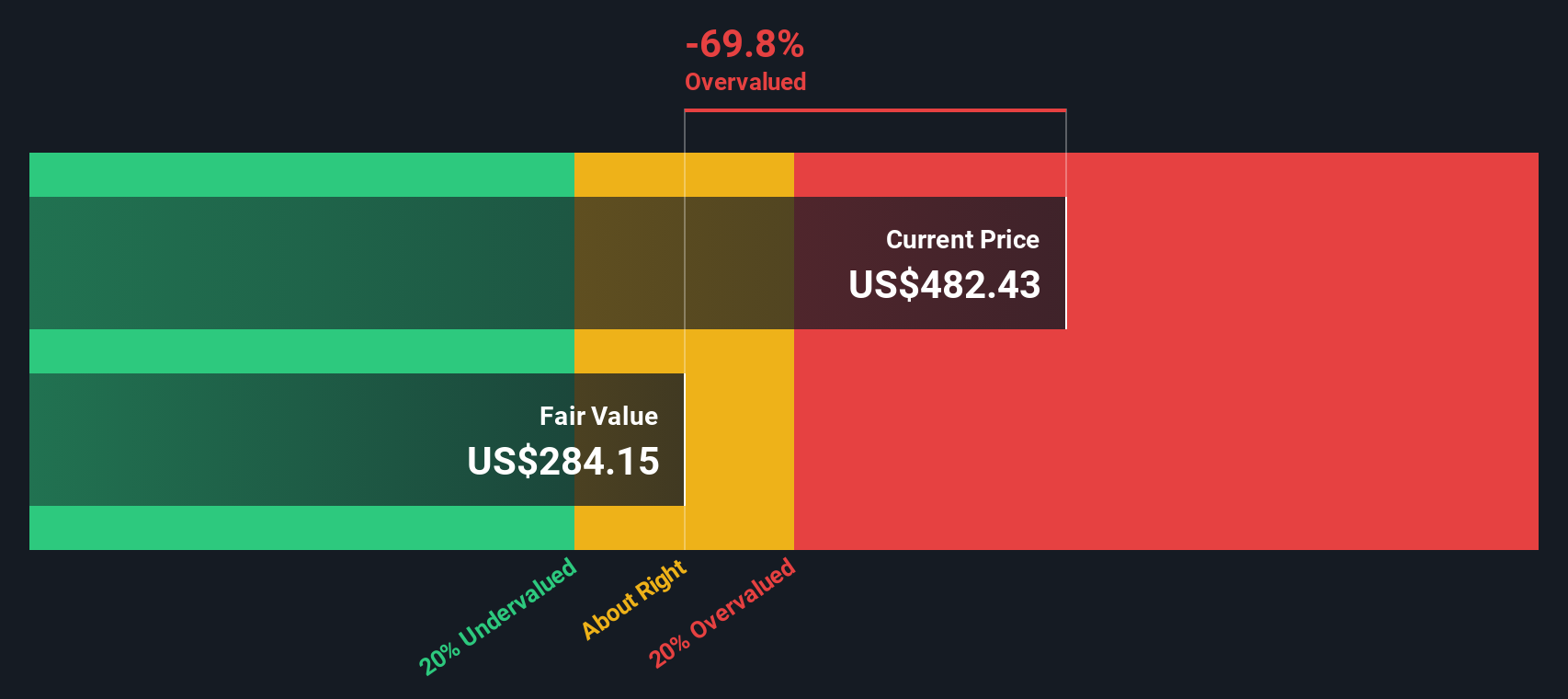

Pulling these figures together, the model estimates S&P Global’s intrinsic value per share at $287.43. Compared to the current market price, the discount implied is -68%, indicating the stock is significantly overvalued using this approach.

Result: OVERVALUED

Our Excess Returns analysis suggests S&P Global may be overvalued by 68.0%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: S&P Global Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used tool for valuing profitable companies like S&P Global because it tells us how much investors are willing to pay for each dollar of earnings. This makes it especially relevant for mature businesses with steady profits.

What the market considers a "normal" or “fair” PE ratio depends a lot on the company’s future earnings potential and the perceived risks. Companies with stronger growth prospects or lower risks often command higher PE ratios, while lower growth or riskier businesses tend to see lower multiples.

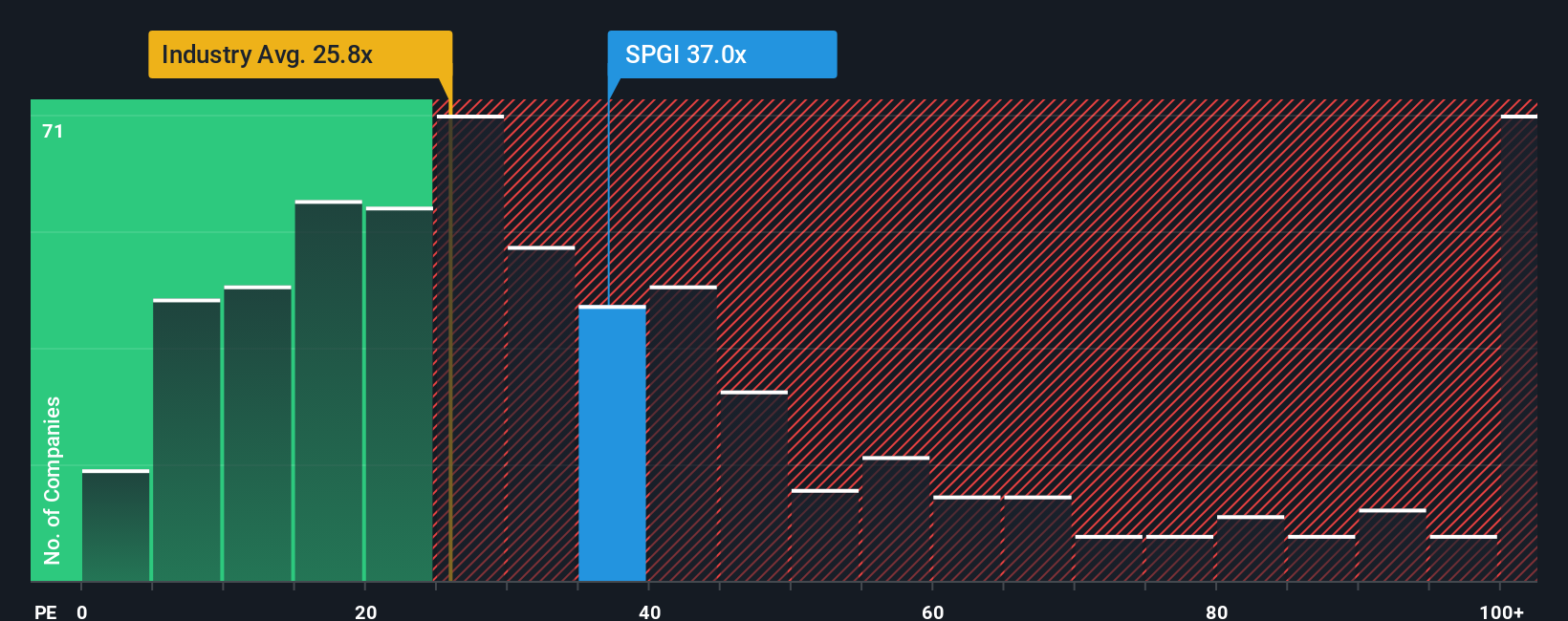

S&P Global currently trades at a PE ratio of 36.8x, placing it well above the Capital Markets industry average of 25.7x and its immediate peer group average of 31.6x. Simply Wall St’s proprietary “Fair Ratio” for S&P Global comes in at 20.2x. This figure is based on a detailed assessment of the company’s earnings growth, profit margins, market cap and risks specific to its industry.

The Fair Ratio offers a more complete picture than just using straight industry or peer averages because it adapts to the company’s unique traits and risk profile. Comparing S&P Global’s current PE to its Fair Ratio suggests the stock is quite a bit more expensive than its fundamentals alone might justify.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your S&P Global Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your own financial story for a company like S&P Global, connecting your assumptions about future revenue, margins, and growth with your view of fair value. Rather than relying only on standard metrics, Narratives let you anchor your investment decisions in a concrete forecast. This makes it easier and more personal to decide what the company is really worth.

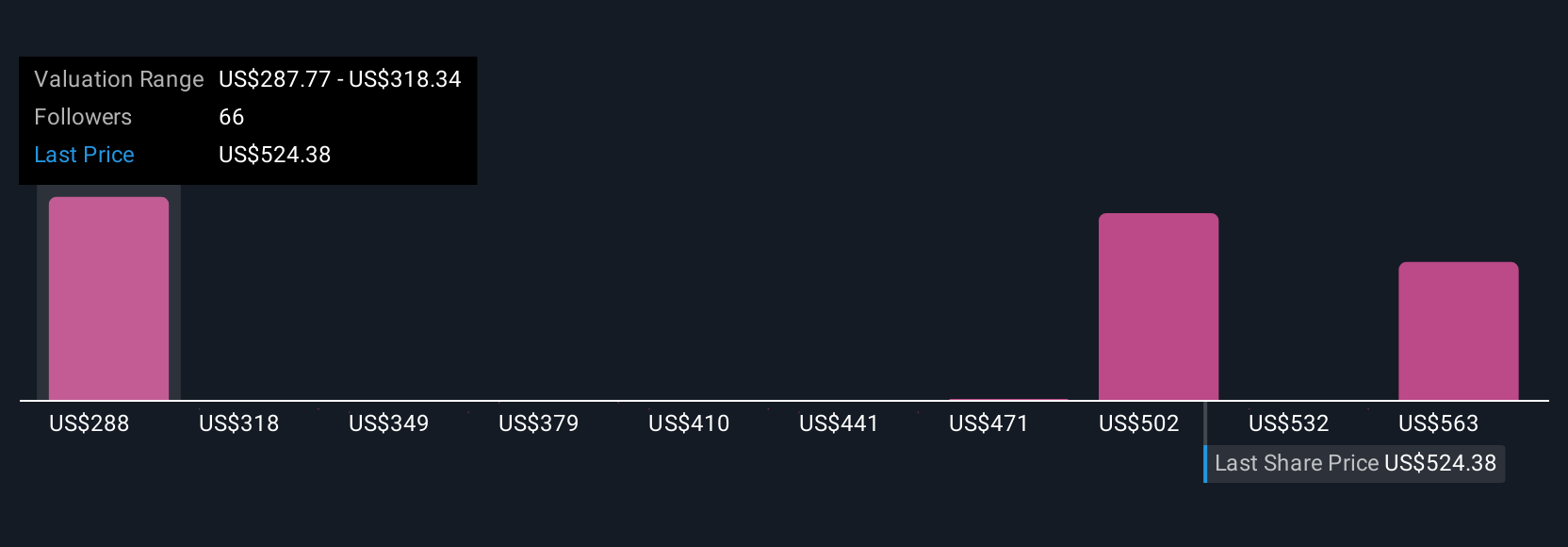

This powerful tool is already available on Simply Wall St’s Community page, where millions of investors share and compare their perspectives. Narratives link a company’s evolving story directly to a dynamic fair value estimate, so you can instantly see how new news or earnings updates may affect your outlook and whether the share price stacks up. For example, one investor might foresee a high growth opportunity and see S&P Global’s fair value at $400, while another with a more cautious view might put it at $250. With Narratives, you decide when the numbers and the story line up for you, making smarter buy or sell choices in real time.

Do you think there's more to the story for S&P Global? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPGI

S&P Global

Provides credit ratings, benchmarks, analytics, and workflow solutions in the global capital, commodity, and automotive markets.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives