- United States

- /

- Capital Markets

- /

- NYSE:SPGI

Could S&P Global’s (SPGI) Open Data Push Redefine the Competitive Landscape in Financial Analytics?

Reviewed by Simply Wall St

- In recent days, S&P Global announced a collaboration with Cambridge Associates and Mercer to launch comprehensive private markets analytics by year-end, while also making its Capital IQ Identifiers freely available on the Data Unlocked platform to expand open data access for over 25 million companies globally.

- This initiative highlights S&P Global’s push to reshape data transparency in financial markets and deepen relationships with key industry participants through innovation.

- We’ll explore how the expanded open data initiative shapes S&P Global’s investment narrative and its potential impact on competitive positioning.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is S&P Global's Investment Narrative?

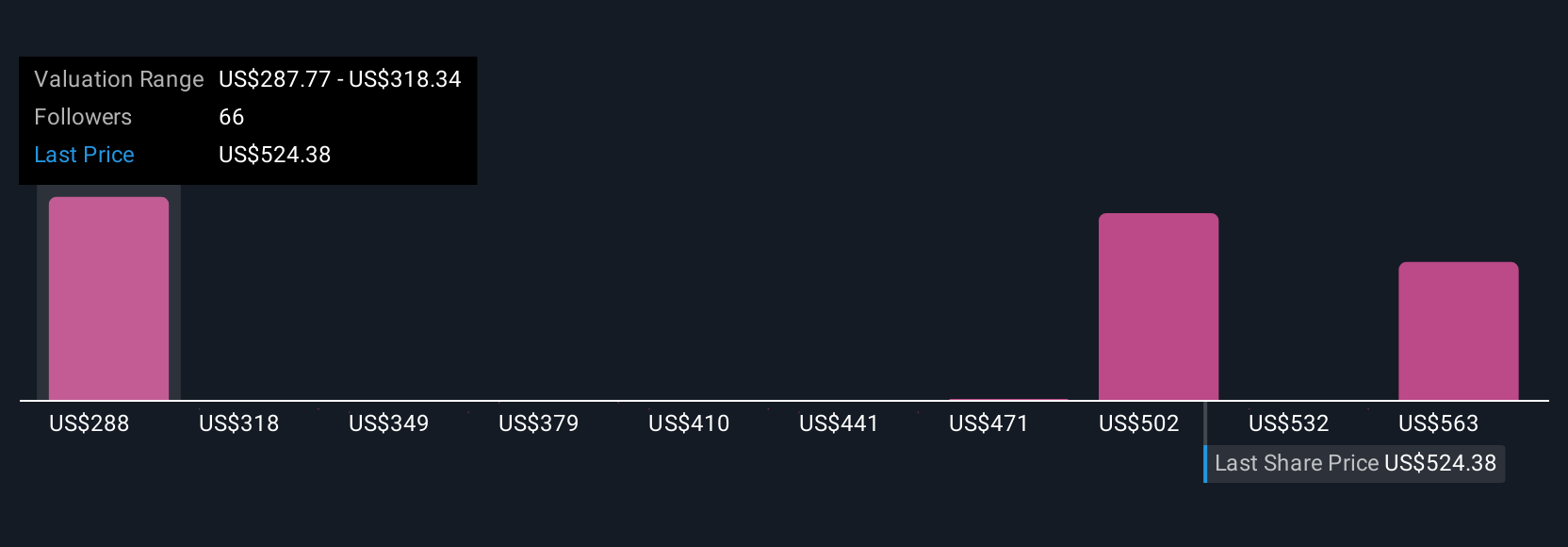

To be a shareholder in S&P Global, you need to believe in the enduring demand for essential financial data, analytics, and transparent market infrastructure as the global economy grows and capital markets evolve. The recent collaboration with Cambridge Associates and Mercer stands out as a step toward making private markets data more robust and accessible, potentially expanding S&P Global’s influence in an increasingly important asset class. At the same time, making Capital IQ Identifiers freely available fits the industry’s push for data access and transparency, yet doesn’t appear likely to drive a material shift in short-term financial performance, especially in light of recent stock price declines and valuation concerns. The most immediate catalysts remain S&P Global’s ability to monetize new analytics offerings and manage costs, while the top risks include rich valuation multiples, slower expected growth versus peers, and meaningful insider selling, factors which seem to outweigh short-term benefits from new releases.

But balancing optimistic innovation with valuation risk is something investors should keep front of mind. S&P Global's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 24 other fair value estimates on S&P Global - why the stock might be worth 44% less than the current price!

Build Your Own S&P Global Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your S&P Global research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free S&P Global research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate S&P Global's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPGI

S&P Global

Provides credit ratings, benchmarks, analytics, and workflow solutions in the global capital, commodity, and automotive markets.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives