- United States

- /

- Capital Markets

- /

- NYSE:SCHW

Schwab’s Surge in Client Assets and Digital Expansion Could Be a Game Changer for SCHW

Reviewed by Sasha Jovanovic

- The Charles Schwab Corporation recently reported third-quarter 2025 results, highlighting a substantial year-over-year increase in both net income to US$2.36 billion and earnings per share, as well as a record US$9.92 trillion in total client assets; the company also affirmed regular dividends and completed a significant share repurchase program.

- Plans to launch direct crypto trading in 2026 and data from Schwab’s Modern Wealth Survey revealing growing interest in alternative assets among American investors underscore Schwab’s focus on capturing younger demographics and diversifying revenue streams.

- We'll look at how Schwab’s robust client asset growth and upcoming digital product launches could influence its investment narrative.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Charles Schwab Investment Narrative Recap

To own shares of Charles Schwab, an investor needs confidence in the firm's ability to sustain client asset growth and expand service offerings while managing risks from market volatility and rising competition. While the recent affirmation of both regular and preferred dividends highlights Schwab's financial stability, these announcements do not materially shift near-term catalysts or address the primary risk from potential changes in interest rates impacting net interest income and earnings volatility.

Among the latest updates, the significant completion of Schwab's share repurchase program, totaling over US$10.8 billion, stands out for its potential to support per-share value, especially as the company looks to launch new digital platforms and products targeting younger investors.

However, what may surprise some investors is…

Read the full narrative on Charles Schwab (it's free!)

Charles Schwab's outlook forecasts $30.2 billion in revenue and $11.0 billion in earnings by 2028. This scenario calls for an 11.8% annual revenue growth rate and a $4.2 billion increase in earnings from the current $6.8 billion.

Uncover how Charles Schwab's forecasts yield a $111.50 fair value, a 18% upside to its current price.

Exploring Other Perspectives

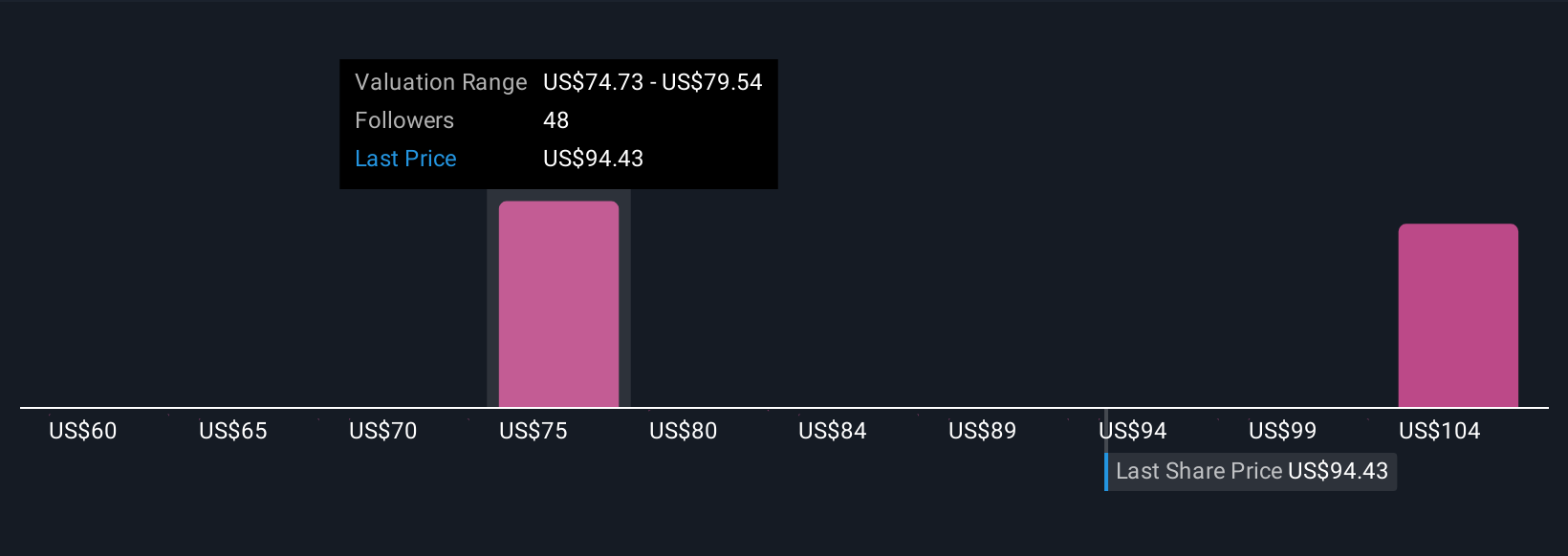

The Simply Wall St Community produced eight unique fair value estimates ranging from US$76.36 to US$111.50 per share. With views this broad amid Schwab’s ongoing transition and dependence on net interest income, you can explore several alternative viewpoints to inform your own outlook.

Explore 8 other fair value estimates on Charles Schwab - why the stock might be worth 19% less than the current price!

Build Your Own Charles Schwab Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Charles Schwab research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Charles Schwab research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Charles Schwab's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SCHW

Charles Schwab

Operates as a savings and loan holding company that provides wealth management, securities brokerage, banking, asset management, custody, and financial advisory services in the United States and internationally.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives