- United States

- /

- Capital Markets

- /

- NYSE:SCHW

Is It Too Late To Consider Charles Schwab After Its Strong 2025 Share Price Rally?

Reviewed by Bailey Pemberton

- If you are wondering whether Charles Schwab is still attractively priced today or if most of the potential upside has already been realized, this breakdown will help clarify what you are really paying for.

- The stock has been on a solid run, up 2.2% over the last week, 6.7% over the past month, and 33.8% year to date, with a 34.6% gain over the last year and 102.6% over five years, reshaping how the market views its risk and growth profile.

- Recent headlines have focused on Schwab’s continued push to grow client assets and deepen its role as a one stop shop for retail investors, along with the ongoing integration of accounts migrated from other platforms after industry consolidation. Together, these moves help explain why sentiment around the business model, and therefore the stock, has stayed relatively positive even through market volatility.

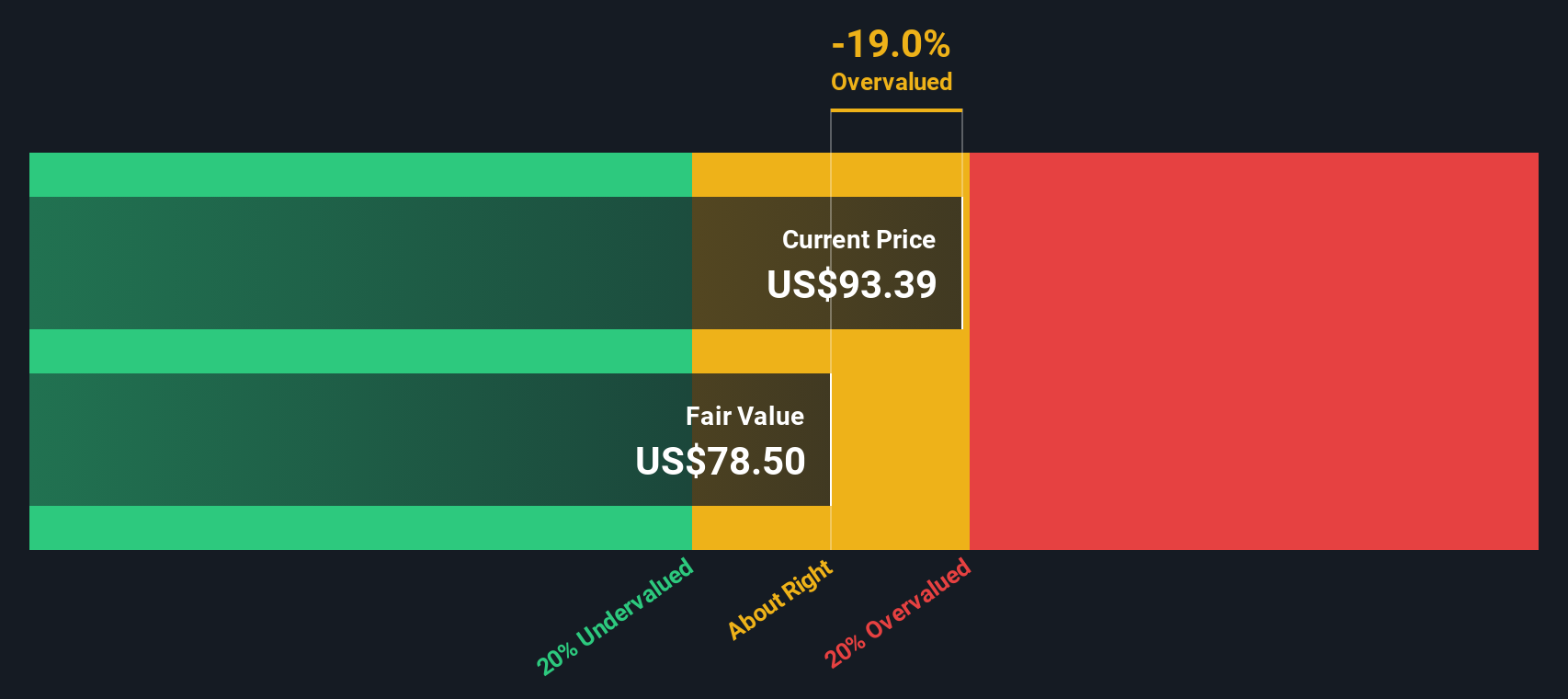

- Despite that backdrop, Schwab only scores 2 out of 6 on our valuation checks. We will unpack what different valuation methods suggest about the current price and then finish with a more nuanced way to think about what the stock may be worth.

Charles Schwab scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Charles Schwab Excess Returns Analysis

The Excess Returns model looks at how much value Charles Schwab creates above the basic return that equity investors require. Instead of focusing on near term earnings, it asks whether Schwab can keep reinvesting shareholders’ capital at attractive rates over time.

In this framework, Schwab’s book value is estimated at $23.85 per share, rising to a stable book value of $30.87 per share based on forecasts from five analysts. Using expected returns on equity from six analysts, stable earnings per share are estimated at $6.12, while the cost of equity is $2.71 per share. That leaves an excess return of $3.40 per share, implying the company is expected to earn meaningfully more than its required cost of capital, supported by an average return on equity of 19.82%.

Putting these assumptions together, the Excess Returns model arrives at an intrinsic value of about $92.40 per share. With the stock price implying it is 6.9% above this estimate, Schwab appears slightly overvalued but within a reasonable band around fair value.

Result: ABOUT RIGHT

Charles Schwab is fairly valued according to our Excess Returns, but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Charles Schwab Price vs Earnings

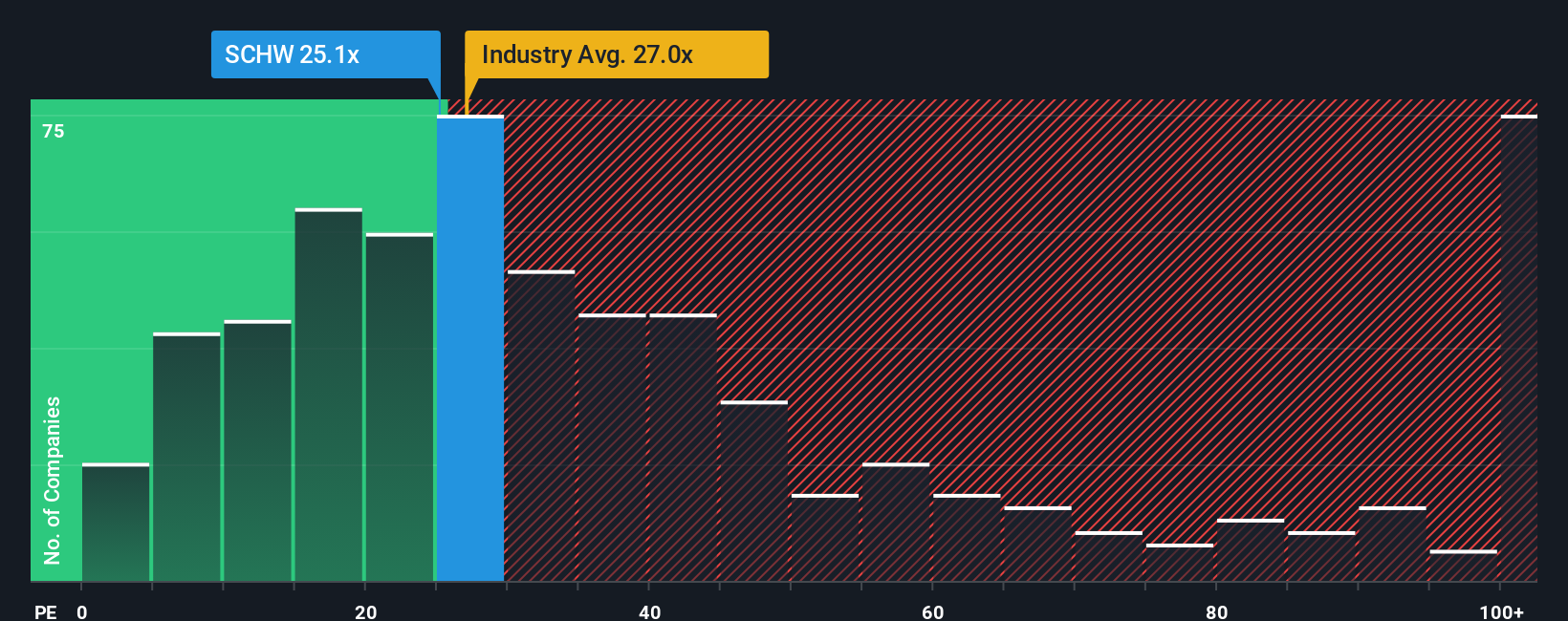

For a profitable and relatively mature business like Charles Schwab, the price to earnings ratio is a useful way to judge whether investors are paying a reasonable price for each dollar of earnings. Higher growth and lower perceived risk typically justify a higher PE ratio, while slower growth or higher uncertainty usually call for a discount.

Schwab currently trades on a PE of 22.61x. That sits below the Capital Markets industry average of about 25.06x and meaningfully below the 29.19x average of closer peers, suggesting the stock is not aggressively priced relative to its space. However, simple peer comparisons only go so far because they do not fully adjust for Schwab’s specific growth outlook, profitability, size, and risk profile.

This is where Simply Wall St’s Fair Ratio comes in. It is a proprietary estimate of what Schwab’s PE should be, given its earnings growth, margins, risk factors, industry, and market cap. For Schwab, that Fair Ratio is 18.41x, which is well below the current 22.61x. On that basis, the stock screens as somewhat expensive versus what its fundamentals alone would justify.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1463 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Charles Schwab Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce Narratives, a simple framework on Simply Wall St’s Community page that lets you attach your own story about Charles Schwab’s future growth, margins, and risks to a financial forecast, link that forecast to a fair value estimate, and then continuously compare that fair value with the live share price to help inform your own decision making. The Narrative automatically updates as new news or earnings arrive. For example, one Schwab investor might build a bullish Narrative around accelerating digital adoption, rising margins near 36% and a fair value close to $132. A more cautious investor could anchor on slower 9 to 10% revenue growth, modest margin improvement, and a fair value nearer $84, and then watch how each Narrative’s potential upside or downside changes as real world data comes in.

Do you think there's more to the story for Charles Schwab? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SCHW

Charles Schwab

Operates as a savings and loan holding company that provides wealth management, securities brokerage, banking, asset management, custody, and financial advisory services in the United States and internationally.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion