- United States

- /

- Capital Markets

- /

- NYSE:SCHW

How Investors Are Reacting To Charles Schwab (SCHW) Record Asset Inflows and Forge Global Acquisition

Reviewed by Sasha Jovanovic

- In recent days, Charles Schwab reported record net new assets of US$44.4 billion in October, with total client assets reaching US$11.83 trillion, alongside a completed US$1 billion fixed-income offering and confirmation of acquiring Forge Global, a private share marketplace, to broaden investor access to private markets.

- This surge in client engagement, highlighted by a very large year-over-year jump in new account openings, reveals strong operational momentum as Schwab continues to benefit from heightened retail investor activity in thriving equity markets.

- We’ll examine how record asset inflows and expanding retail engagement reinforce Schwab’s investment narrative amid industry competition and growth initiatives.

The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

Charles Schwab Investment Narrative Recap

As a Charles Schwab shareholder, you need to believe in Schwab’s ability to turn surging retail engagement and persistent asset inflows into long-term growth and earnings stability, even as competitive and technology-related pressures mount. While October's record-breaking US$44.4 billion net new assets and 30% jump in new accounts fuel the main short-term catalyst, retail investor momentum, the biggest risk remains potential fallout from industry-wide fee compression and fintech rivalry, which these results have not yet fundamentally changed.

Among the latest announcements, Schwab’s proposed acquisition of Forge Global stands out for its potential to expand access to private markets through one of the first major brokerage-integrated platforms. This move aligns with efforts to capture a greater share of next-generation investor demand, supporting the very catalysts, like strong asset growth and diverse client engagement, that currently define Schwab’s opportunity set.

Yet, even amid robust inflows, investors should remain focused on the possibility that fee compression and digital-first competitors could upend Schwab’s margin trajectory if...

Read the full narrative on Charles Schwab (it's free!)

Charles Schwab's narrative projects $30.2 billion revenue and $11.0 billion earnings by 2028. This requires 11.8% yearly revenue growth and a $4.2 billion earnings increase from $6.8 billion currently.

Uncover how Charles Schwab's forecasts yield a $111.95 fair value, a 19% upside to its current price.

Exploring Other Perspectives

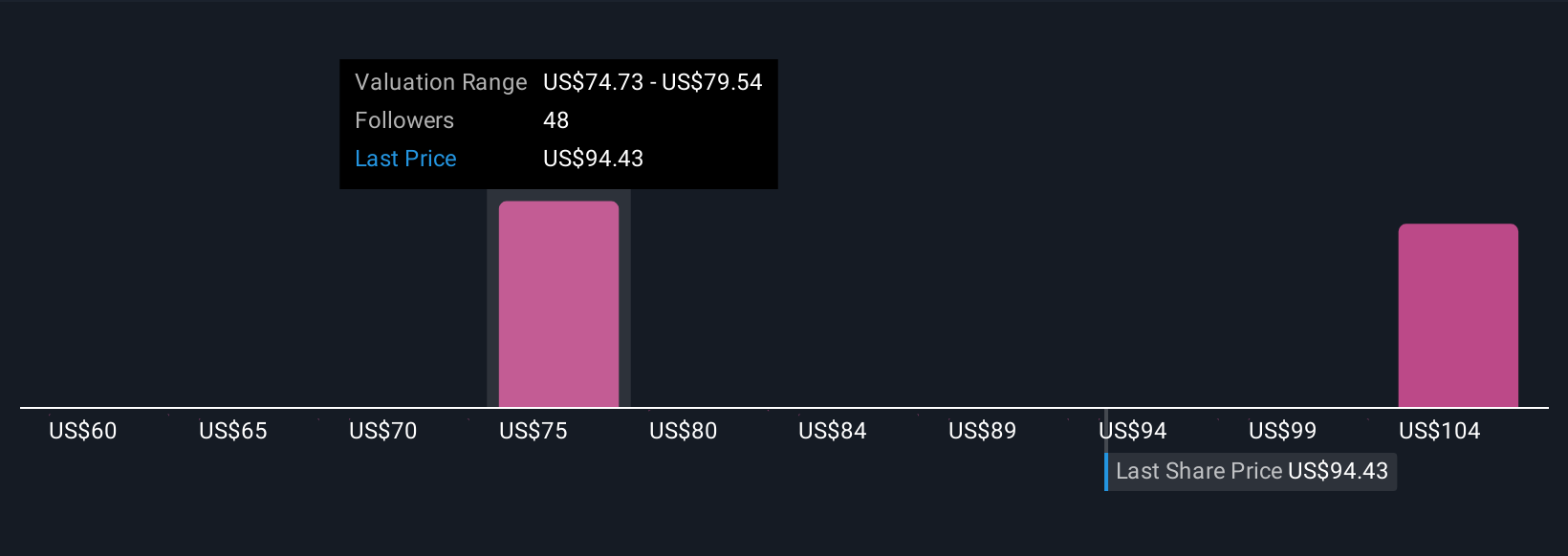

Seven individual fair value estimates from the Simply Wall St Community range between US$79.32 and US$111.95 per share. With competition from low-cost brokerages intensifying, it’s worth exploring how your view matches up with such a broad spread of opinion.

Explore 7 other fair value estimates on Charles Schwab - why the stock might be worth 16% less than the current price!

Build Your Own Charles Schwab Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Charles Schwab research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Charles Schwab research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Charles Schwab's overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SCHW

Charles Schwab

Operates as a savings and loan holding company that provides wealth management, securities brokerage, banking, asset management, custody, and financial advisory services in the United States and internationally.

Proven track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives