- United States

- /

- Capital Markets

- /

- NYSE:RJF

Will Raymond James Financial’s (RJF) New Debt Offering Reveal a Shift in Long-Term Liquidity Strategy?

Reviewed by Simply Wall St

- Raymond James Financial recently completed a US$1.5 billion public offering of senior notes, issuing US$650 million in 4.900% notes due 2035 and US$850 million in 5.650% notes due 2055, with proceeds intended for general corporate purposes.

- This significant capital markets transaction highlights the company's ongoing approach to balance sheet management and reinforces its liquidity position for future growth initiatives.

- We'll now explore how this major fixed-income offering may shape Raymond James Financial's investment narrative, particularly in the context of ongoing liquidity strategy.

Find companies with promising cash flow potential yet trading below their fair value.

Raymond James Financial Investment Narrative Recap

To be a shareholder in Raymond James Financial, you need confidence in the firm's ability to manage capital and liquidity to support sustained growth, even in a complex market environment. The recent US$1.5 billion senior notes offering reinforces Raymond James’ liquid balance sheet but does not materially alter the near-term catalysts or risks; potential headwinds from market uncertainty and volatile fixed income revenues remain central to the outlook.

Among recent developments, the appointment of David Solganik as head of AI strategy stands out, as Raymond James expands its significant annual technology investments. This move is relevant as operational efficiency and digital transformation are viewed as key catalysts for future margin improvement, yet the financial impact of such investments could take time to realize.

However, investors should also be mindful of the possibility that, despite strong liquidity and continued technology investment, prolonged market or interest rate volatility could...

Read the full narrative on Raymond James Financial (it's free!)

Raymond James Financial's narrative projects $17.3 billion revenue and $2.7 billion earnings by 2028. This requires 8.0% yearly revenue growth and a $0.6 billion earnings increase from $2.1 billion.

Uncover how Raymond James Financial's forecasts yield a $173.27 fair value, in line with its current price.

Exploring Other Perspectives

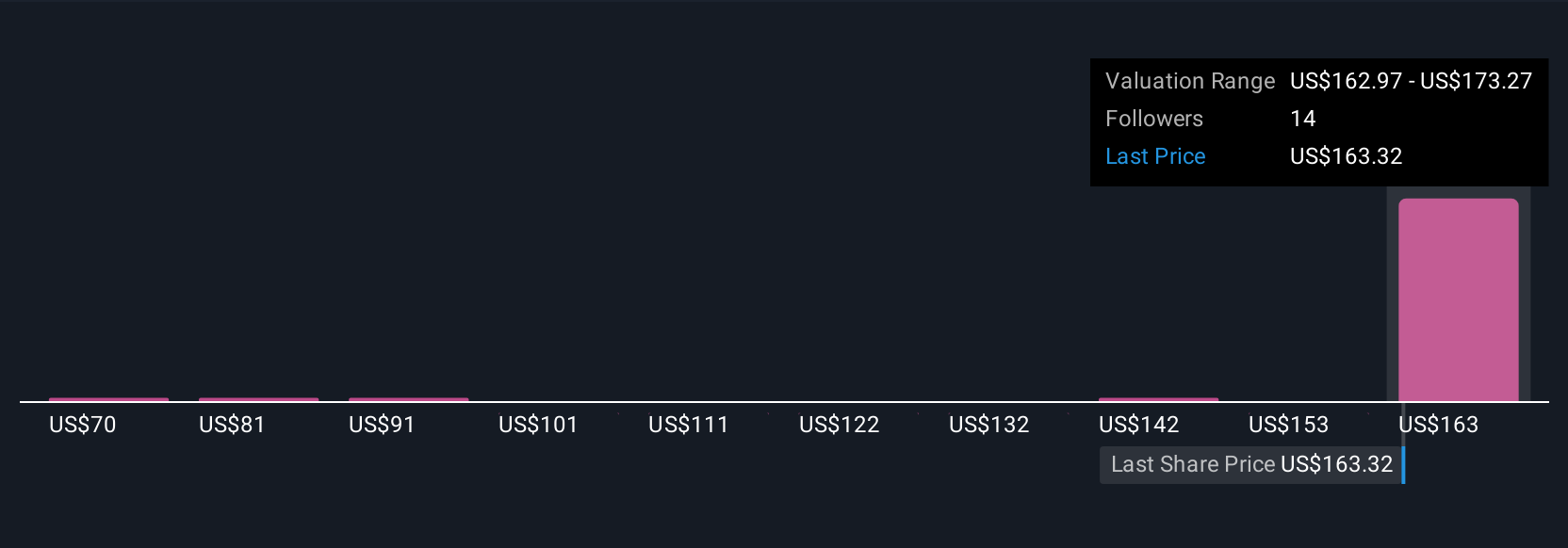

Simply Wall St Community members provided six fair value estimates for Raymond James Financial ranging from US$70.20 to US$173.27. While opinions differ, the short-term uncertainty in fixed income markets remains a key consideration for any investment view, and you can explore several contrasting perspectives on what this means for the company’s future.

Explore 6 other fair value estimates on Raymond James Financial - why the stock might be worth less than half the current price!

Build Your Own Raymond James Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Raymond James Financial research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Raymond James Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Raymond James Financial's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 29 companies in the world exploring or producing it. Find the list for free.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RJF

Raymond James Financial

A diversified financial services company, provides private client group, capital markets, asset management, banking, and other services to individuals, corporations, and municipalities in the United States, Canada, and Europe.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives