- United States

- /

- Mortgage REITs

- /

- NYSE:RITM

Rithm Capital’s 12.4% Drop in 2025 Sparks Fresh Debate on Share Valuation

Reviewed by Bailey Pemberton

Thinking about what to do with your Rithm Capital shares, or eyeing an entry point? You are not alone. The stock has darted through the past year with a mix of resilience and volatility, drawing plenty of attention along the way. While the recent month saw shares slip by 12.4%, it is worth noting that over the last year, Rithm Capital has delivered a healthy 12.8% gain. If you zoom out further, the five-year climb stands at an impressive 116.3%. That kind of long-term performance suggests there is more at play than just near-term noise.

Some of this momentum has come as the market begins to reassess risk across real estate and financial names. Signs of stabilization in underlying assets and a measured response to macro shifts have helped Rithm weather sector-wide turbulence better than many. Investors are beginning to question whether the market is correctly pricing Rithm's growth prospects, especially as conversations swirl around changing interest rates and evolving opportunities in credit markets.

To dig even deeper into whether the current share price offers good value, I ran Rithm Capital through six widely-used valuation checks. The result? It is undervalued on every single one, earning a score of 6 out of 6. That is a standout showing, and it sets the stage for a closer look at how those individual approaches reveal different aspects of value. Stay tuned, as at the end of this article I will also share a perspective you may not see coming when it comes to understanding what “undervalued” truly means for this company.

Approach 1: Rithm Capital Excess Returns Analysis

The Excess Returns model offers a practical way to estimate a company's intrinsic value by focusing on how much profit is generated above the minimum return required by investors. In simple terms, it looks at whether Rithm Capital is putting its capital to work efficiently and exceeding what shareholders could earn elsewhere at comparable risk.

For Rithm Capital, the numbers tell a compelling story. The latest figures show a Book Value of $12.71 per share and a Stable Earnings Per Share (EPS) of $1.51, reflecting the company's average return on equity of 11.10% over the past five years. Analysts forecast a slight lift in Book Value to $13.65 per share going forward. With a Cost of Equity at $1.25 per share, Rithm is producing $0.27 per share in excess returns. This gap, though modest, signals the company is consistently generating profits above its cost of capital.

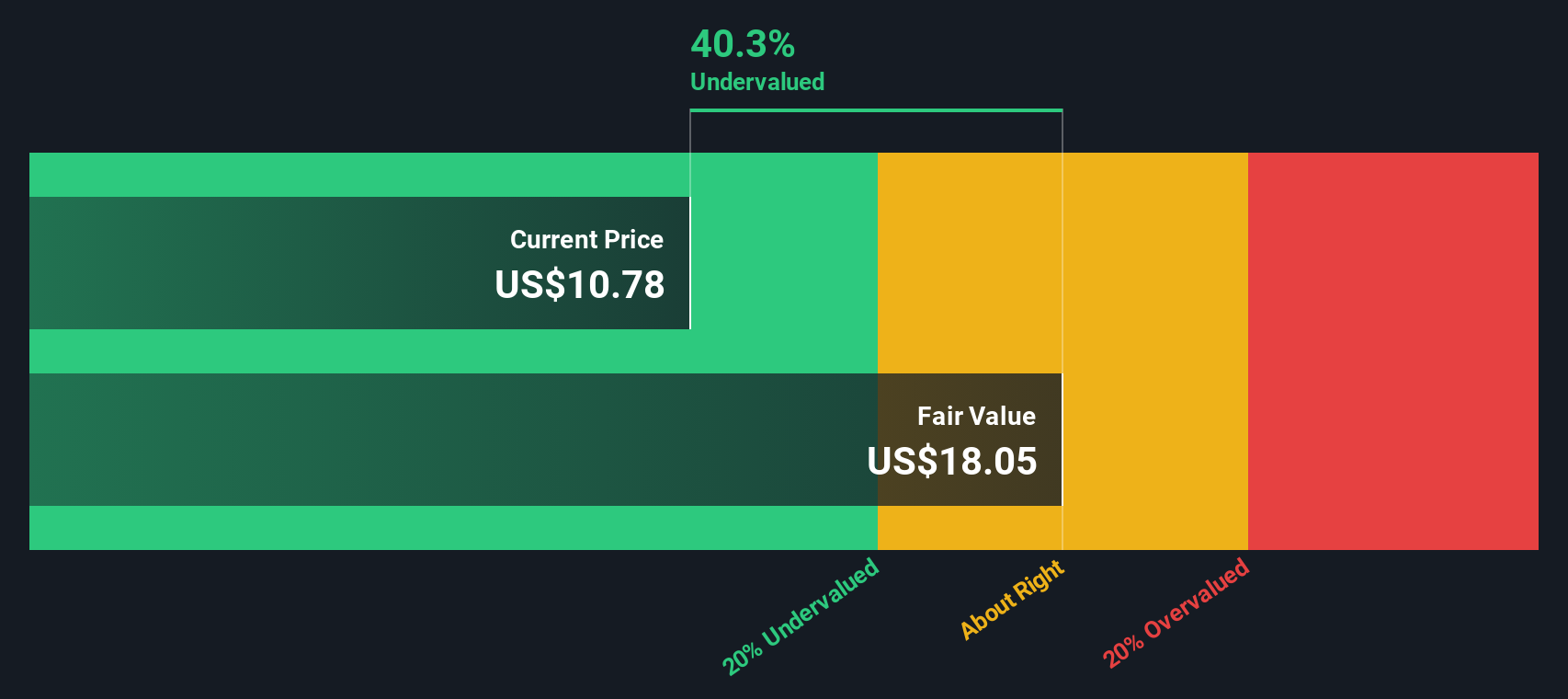

When combined, these metrics yield an estimated intrinsic value that sits 39.3% above the current trading price. In plain English, this valuation suggests the market is significantly undervaluing Rithm Capital relative to its ability to create shareholder wealth over time.

Result: UNDERVALUED

Our Excess Returns analysis suggests Rithm Capital is undervalued by 39.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Rithm Capital Price vs Earnings (PE Ratio)

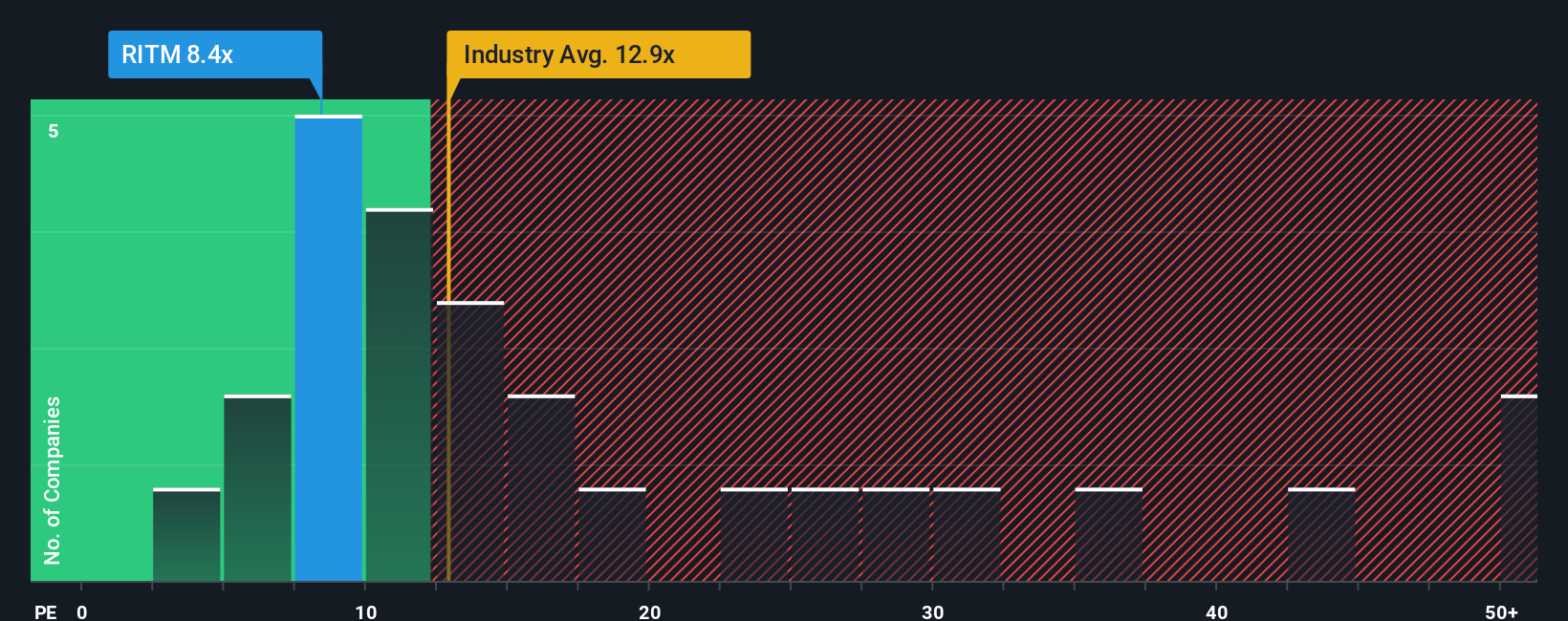

The price-to-earnings (PE) ratio is often the go-to valuation tool for profitable companies because it gauges what investors are willing to pay for each dollar of earnings. When a company is showing consistent profits like Rithm Capital, the PE ratio gives a straightforward snapshot of market sentiment and expectations about future earnings growth.

What counts as a “normal” PE ratio depends on several factors. Companies expected to grow earnings quickly, or those seen as less risky, typically deserve a higher multiple. Slower-growth or riskier firms usually trade at lower multiples. This baseline helps investors decide if a stock’s current valuation is running hot or cold compared to historical norms, industry peers, and growth prospects.

Rithm Capital currently trades at a PE ratio of 8.53x. That is noticeably lower than the Mortgage REITs industry average of 13.27x and well below the closest peer average of 19.40x. To put this in more personalized context, the Simply Wall St “Fair Ratio” for Rithm (which adjusts for earnings growth, risk, profit margins, industry, and market cap) is calculated at 16.92x. This approach goes a step further than generic industry or peer benchmarks because it is tailored to Rithm’s specific strengths and risks instead of treating all companies as being equal.

Since Rithm’s actual PE ratio is significantly below its Fair Ratio, this analysis indicates the stock appears to be trading at a notable discount to where our proprietary model suggests it should be valued, based on its current fundamentals and future prospects.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Rithm Capital Narrative

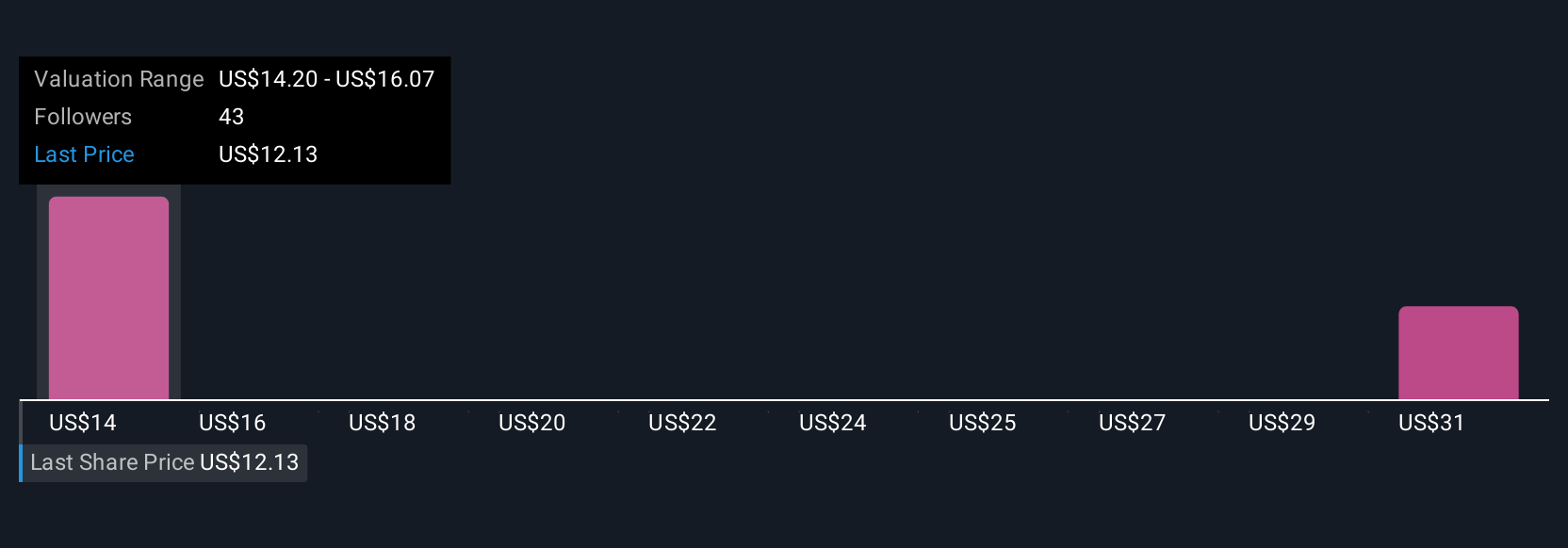

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply the story or thesis you believe about a company, including the key drivers of revenue, earnings, and margins that you expect, and your reasoning for why the company’s fair value should be higher or lower than what the market currently thinks.

Think of a Narrative as the bridge that connects a company’s background and strategy to your own forecasts and a resulting fair value. It helps give meaning to the numbers, letting you visualize where Rithm Capital could go based on its expansion, technology focus, and diversification, or alternatively, your expectations about potential risks or market headwinds.

Narratives are an easy, powerful tool available on Simply Wall St’s Community page, trusted by millions of investors. You can create your own or review others, and see the dynamic impact as new information or results come in. The real power is that you can quickly compare a Narrative’s fair value to the current share price, making it easier to decide when to buy or sell as your perspective evolves.

For Rithm Capital, some investors think its fair value is as high as $16.00, while others see it closer to $12.50, so your own Narrative really matters.

Do you think there's more to the story for Rithm Capital? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RITM

Rithm Capital

Operates as an asset manager focused on real estate, credit, and financial services in the United States.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives