- United States

- /

- Food and Staples Retail

- /

- NYSE:DDL

February 2025's Top US Penny Stocks To Watch

Reviewed by Simply Wall St

As of February 2025, the U.S. stock market is experiencing a notable upswing, with the S&P 500 reaching record highs and major indices showing positive momentum. In this context, penny stocks—often seen as investments in smaller or newer companies—remain a relevant area for potential growth opportunities. While the term "penny stocks" might seem outdated, these investments can still offer significant returns when backed by strong financial health and strategic positioning. Let's explore several penny stocks that could pair balance sheet strength with long-term potential.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.8625 | $6.39M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $127.27M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2698 | $9.16M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.79 | $84.63M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.4389 | $46.53M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.46 | $24.65M | ★★★★★☆ |

| PHX Minerals (NYSE:PHX) | $4.10 | $154.8M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.89 | $78.41M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.69 | $383.33M | ★★★★☆☆ |

Click here to see the full list of 709 stocks from our US Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Dingdong (Cayman) (NYSE:DDL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Dingdong (Cayman) Limited is an e-commerce company operating in China, with a market capitalization of approximately $754.10 million.

Operations: The company generates revenue primarily through its online retail operations, amounting to CN¥22.15 billion.

Market Cap: $754.1M

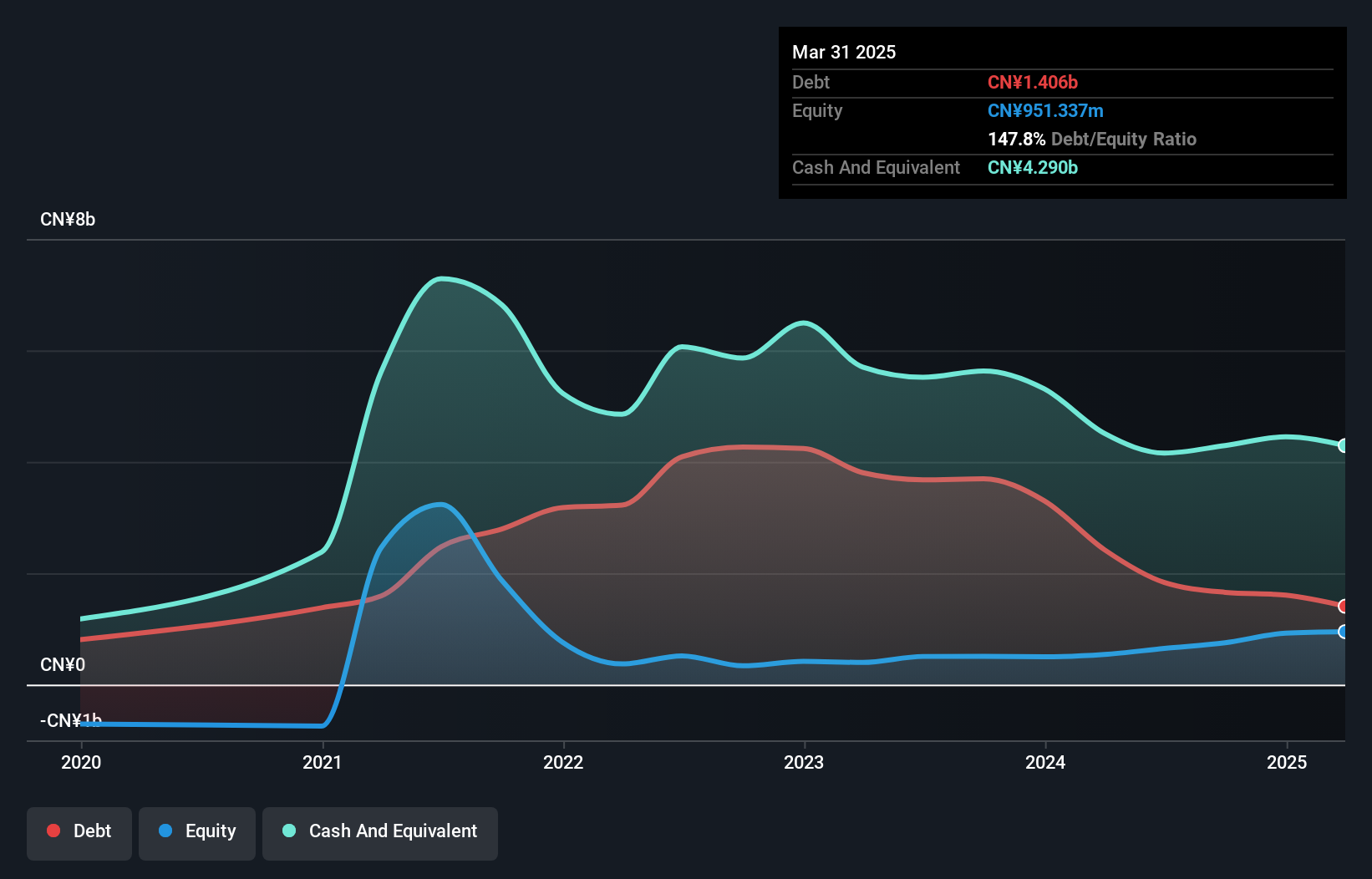

Dingdong (Cayman) Limited, with a market cap of US$754.10 million, has recently turned profitable, marking a significant shift in its financial trajectory. The company's earnings are projected to grow by 44.22% annually, indicating strong potential for future expansion. Its debt is well managed, with more cash than total debt and operating cash flow covering 51.8% of its liabilities. Despite stable weekly volatility at 9%, the stock trades significantly below estimated fair value. Recent closure of a buyback plan suggests strategic financial management aimed at enhancing shareholder value without meaningful dilution over the past year.

- Take a closer look at Dingdong (Cayman)'s potential here in our financial health report.

- Examine Dingdong (Cayman)'s earnings growth report to understand how analysts expect it to perform.

Qudian (NYSE:QD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Qudian Inc. is a consumer-oriented technology company based in the People's Republic of China, with a market cap of approximately $621.24 million.

Operations: The company's revenue is primarily derived from its Installment Credit Services segment, which generated CN¥228 million.

Market Cap: $621.24M

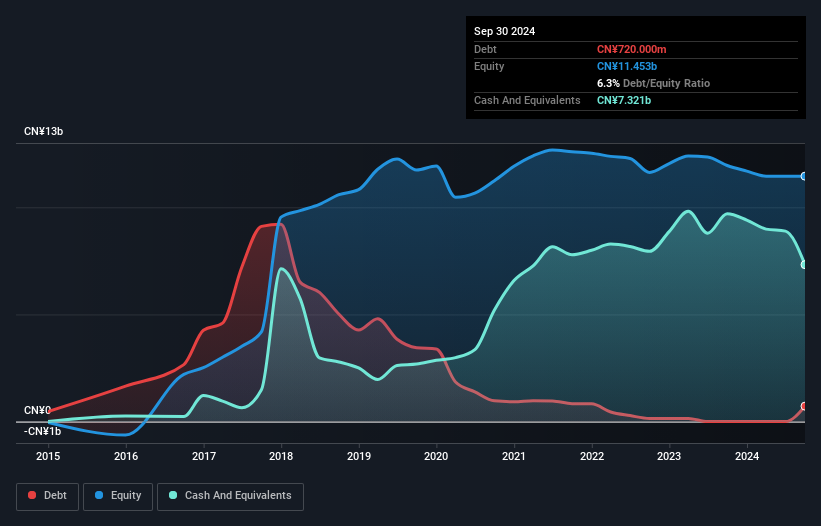

Qudian Inc., with a market cap of approximately US$621.24 million, demonstrates financial resilience by maintaining more cash than total debt and covering its short-term and long-term liabilities with substantial assets. Recent earnings results show improved net income, reversing previous losses, although profit margins have declined compared to the prior year. The company completed a share buyback of 12.1 million shares for US$25.3 million, indicating strategic capital allocation without significant shareholder dilution recently. However, its stock remains highly volatile and exhibits negative earnings growth over the past year amidst auditor changes that could impact investor confidence.

- Unlock comprehensive insights into our analysis of Qudian stock in this financial health report.

- Explore historical data to track Qudian's performance over time in our past results report.

Seritage Growth Properties (NYSE:SRG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Seritage Growth Properties, with a market cap of approximately $200.88 million, is primarily involved in the ownership, development, redevelopment, management, sale and leasing of diversified retail and mixed-use properties across the United States.

Operations: The company's revenue primarily comes from its commercial real estate investment trust (REIT) activities, generating $56.36 million.

Market Cap: $200.88M

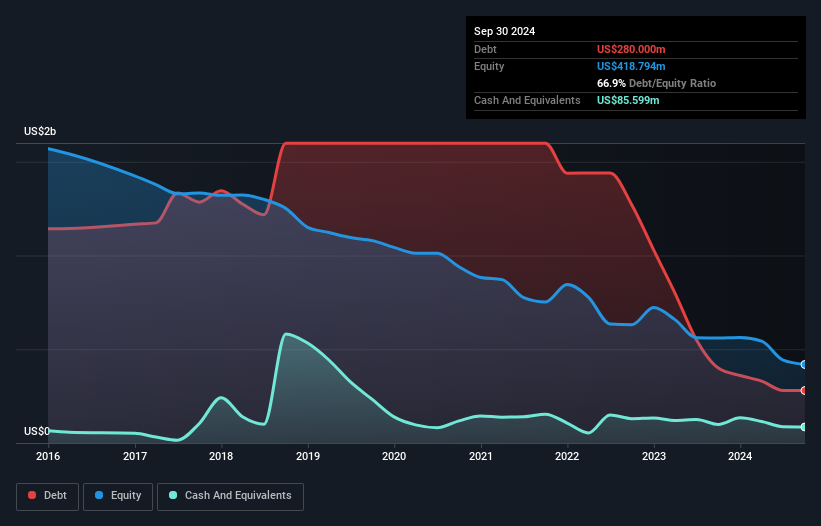

Seritage Growth Properties, with a market cap of approximately US$200.88 million, remains unprofitable and faces challenges with its long-term liabilities exceeding short-term assets. Despite a stable weekly volatility of 4%, the company has seen earnings decline by 7% annually over five years and holds a negative return on equity at -33.07%. However, Seritage has made significant strides in debt reduction, cutting its term loan facility from Berkshire Hathaway Life Insurance Company by US$1.36 billion since December 2021, which substantially lowered annual interest expenses by approximately US$95.2 million. The management team is considered experienced with an average tenure of 3.8 years.

- Dive into the specifics of Seritage Growth Properties here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into Seritage Growth Properties' track record.

Summing It All Up

- Click through to start exploring the rest of the 706 US Penny Stocks now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DDL

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives