Stock Analysis

- United States

- /

- Professional Services

- /

- NYSE:FC

US Growth Companies With Insider Ownership As High As 31%

Reviewed by Simply Wall St

Amid a backdrop of significant market turbulence, with major U.S. indices like the Nasdaq experiencing sharp declines, investors may find reassurance in companies where insiders hold substantial ownership stakes. High insider ownership can signal strong confidence in the company's future prospects, an appealing trait especially when navigating through volatile market phases.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 22.1% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 25.2% |

| PDD Holdings (NasdaqGS:PDD) | 32.1% | 21.6% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 12% | 34% |

| Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 39.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.5% | 60.9% |

| Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

| BBB Foods (NYSE:TBBB) | 22.9% | 94.7% |

Let's take a closer look at a couple of our picks from the screened companies.

ARS Pharmaceuticals (NasdaqGM:SPRY)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ARS Pharmaceuticals, Inc., a biopharmaceutical company, focuses on developing treatments for severe allergic reactions and has a market capitalization of approximately $999.96 million.

Operations: The company does not currently report any revenue segments.

Insider Ownership: 20.1%

ARS Pharmaceuticals, despite making less than US$1m in revenue, is poised for rapid growth with expected annual revenue increases of 57.7%, significantly outpacing the U.S. market average of 8.6%. While shareholder dilution occurred over the past year, the company's move towards profitability within three years and robust earnings growth projections highlight its potential. Recent positive developments include a CHMP recommendation for marketing authorization in the EU for their adrenaline nasal spray, EURneffy, enhancing its global footprint and future revenue streams.

- Take a closer look at ARS Pharmaceuticals' potential here in our earnings growth report.

- The valuation report we've compiled suggests that ARS Pharmaceuticals' current price could be inflated.

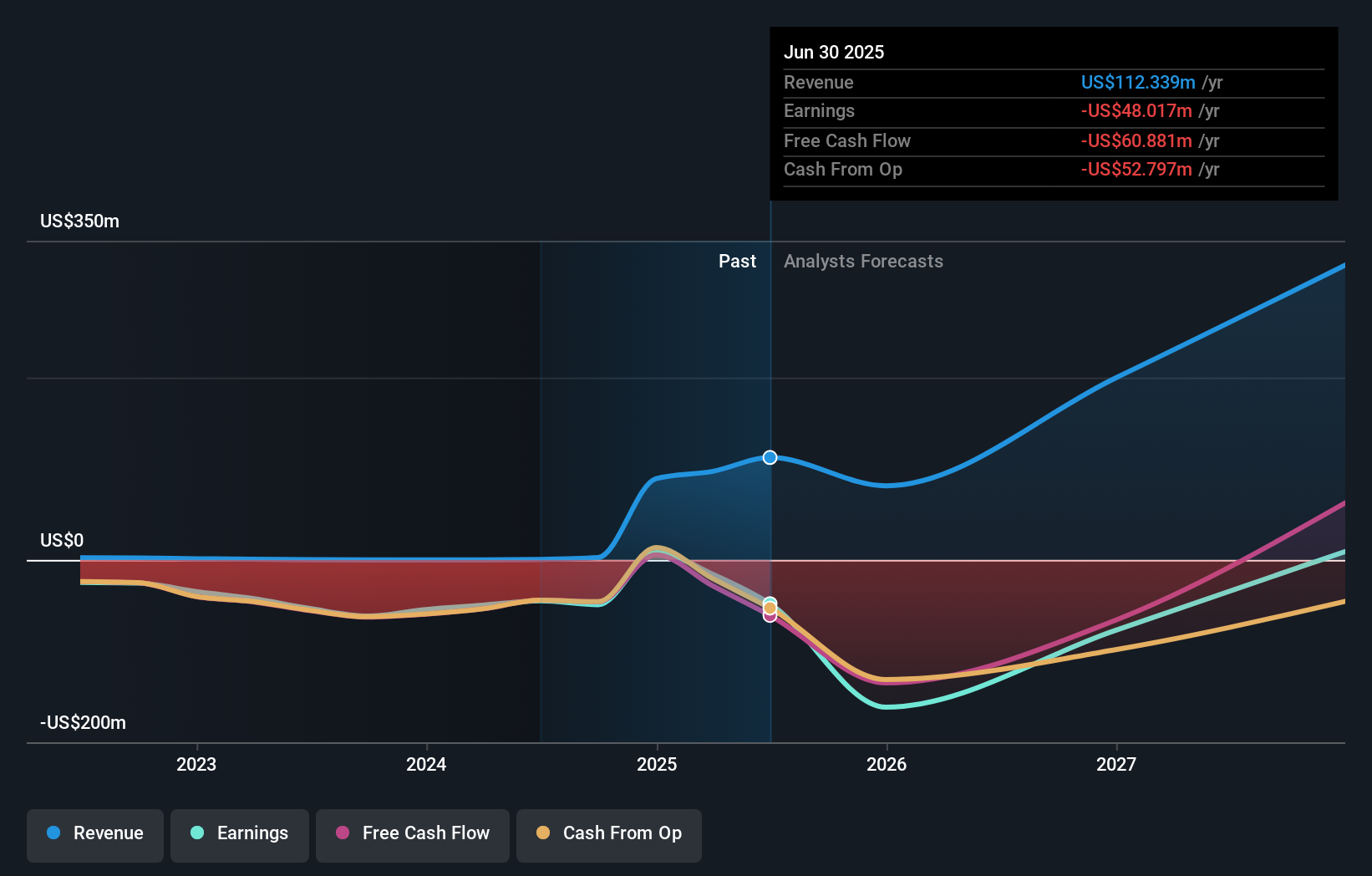

Franklin Covey (NYSE:FC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Franklin Covey Co., with a market cap of approximately $540.80 million, offers training and consulting services globally in execution, sales performance, productivity, customer loyalty, and educational improvement for both organizations and individuals.

Operations: The company generates revenue through its Education Practice ($73.51 million), Direct Offices within the Enterprise Division ($191.34 million), and International Licensees in the Enterprise Division ($11.42 million).

Insider Ownership: 15.5%

Franklin Covey, trading at 71.4% below its estimated fair value, has shown a promising trajectory with a 10.3% earnings growth over the past year and an anticipated acceleration to 30.2% annually. Despite slower revenue growth projections of 10.2%, compared to high-growth benchmarks, recent initiatives like the launch of the FranklinCovey Mobile App demonstrate strategic moves to enhance digital and global reach, potentially driving future profitability and shareholder value in a competitive learning industry landscape.

- Dive into the specifics of Franklin Covey here with our thorough growth forecast report.

- Our valuation report unveils the possibility Franklin Covey's shares may be trading at a discount.

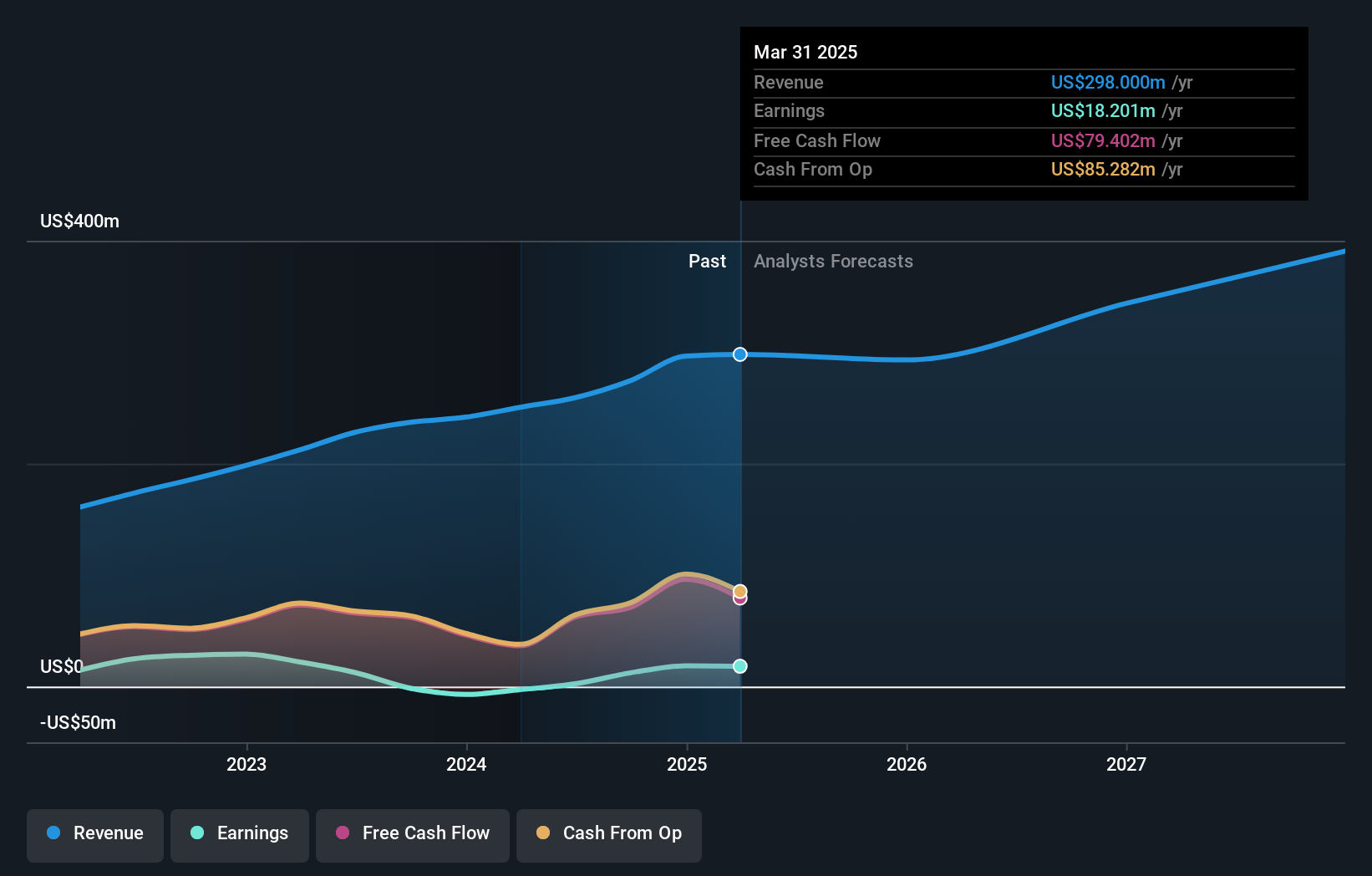

P10 (NYSE:PX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: P10, Inc. is a U.S.-based company that operates as a provider of multi-asset class private market solutions in the alternative asset management industry, with a market capitalization of approximately $1.12 billion.

Operations: The company generates its revenue primarily from asset management, contributing approximately $250.60 million.

Insider Ownership: 31.7%

P10, Inc. has recently shown active financial management, evidenced by multiple shelf registration activities and a strategic buyback program that repurchased 3.17% of shares for US$30.02 million in the first quarter of 2024 alone. Despite moderate revenue growth forecasts at 7.4% annually, P10's insider transactions reflect confidence with substantial buying over selling in the past three months. The company is also navigating leadership transitions effectively, aiming to sustain its growth trajectory amid evolving market indices dynamics.

- Click here and access our complete growth analysis report to understand the dynamics of P10.

- According our valuation report, there's an indication that P10's share price might be on the expensive side.

Make It Happen

- Get an in-depth perspective on all 184 Fast Growing US Companies With High Insider Ownership by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FC

Franklin Covey

Provides training and consulting services in the areas of execution, sales performance, productivity, customer loyalty, and educational improvement for organizations and individuals worldwide.

Solid track record with excellent balance sheet.