- United States

- /

- Capital Markets

- /

- NYSE:PX

P10 (PX): Exploring Valuation as Shares Show Recent Modest Moves

Reviewed by Kshitija Bhandaru

P10 (PX) shares have shown modest moves recently, with a slight gain of 1.9% over the past day but a decline of nearly 10% over the past month. Investors may be weighing these shifts against the company’s long-term financial trends.

See our latest analysis for P10.

Even with occasional bursts of optimism, P10’s momentum has faded. Its share price has pulled back over the past month and total shareholder return is flat for the year. Investors seem to be recalibrating expectations in the face of shifting risk appetite and valuation questions.

If you’re looking to expand your watchlist beyond the usual suspects, now could be the perfect opportunity to discover fast growing stocks with high insider ownership

The big question now, after signs of volatility and lackluster returns, is whether P10 represents an undervalued opportunity for savvy investors or if the market has already priced in all of the company’s future growth potential.

Most Popular Narrative: 24.5% Undervalued

P10’s most widely followed narrative suggests its fair value is $14.42, notably above the last close price of $10.89. This gap signals optimism driven by expectations for substantial business expansion and profitability improvements in coming years.

The commitment to more than double their fee-paying AUM over the next five years suggests significant potential for increased revenue, as AUM is directly tied to fee generation. Ongoing investments in key personnel, especially in distribution, are expected to drive revenue growth and improve operational efficiencies. This could potentially enhance net margins over time due to a higher ROI from these human capital investments.

Want the full playbook behind this bullish outlook? The fair value hinges on ambitious business growth, expanding margins and a projected profit trajectory rarely seen for peers in this space. See what future milestones the narrative claims will fuel that price target and why some analysts are betting big on P10’s transformation.

Result: Fair Value of $14.42 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent fee expirations and downward pressure on margins from new strategies could dampen results. This may make P10’s growth story less certain.

Find out about the key risks to this P10 narrative.

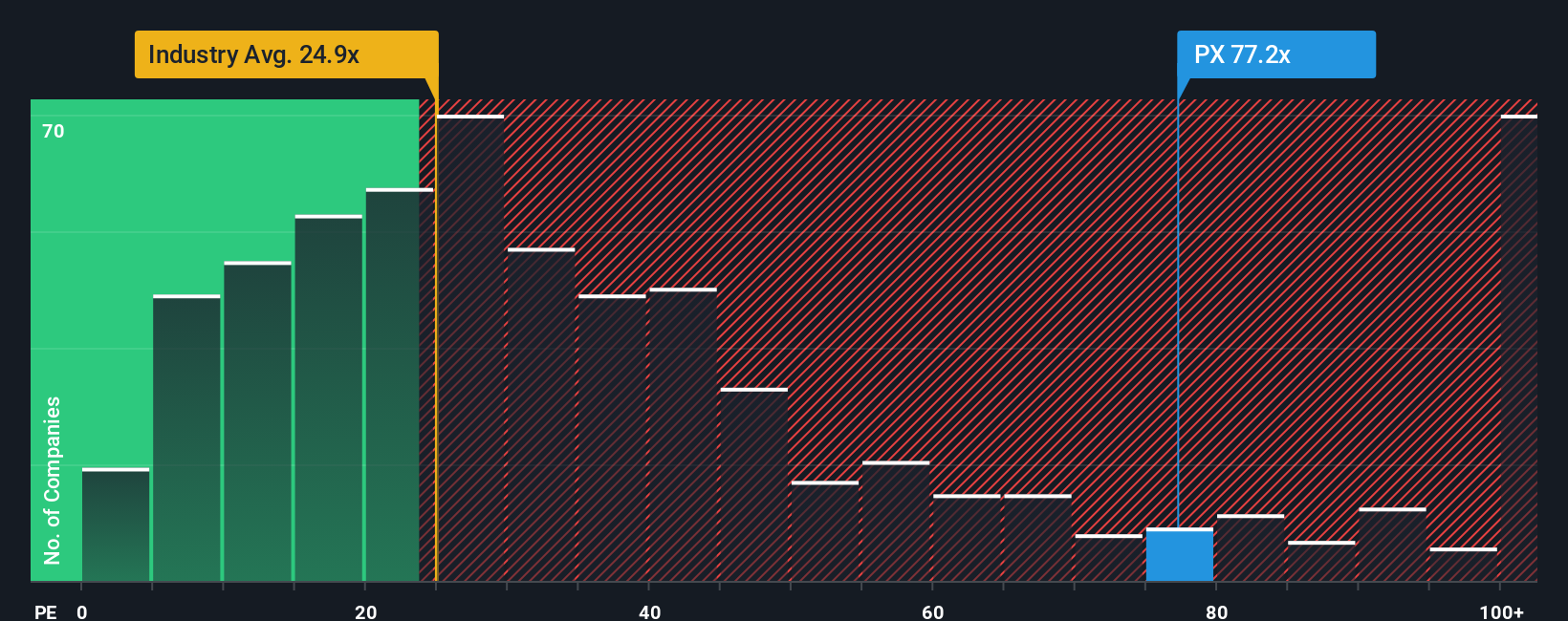

Another View: High Price Tag on Current Profits

Looking at share valuation from a different angle, P10 trades at a price-to-earnings ratio of 82 times earnings, which is dramatically higher than both the peer average of 9.8 and the industry average of 26.2. This premium could signal confidence, or it may warn investors that the market is pricing in a lot of future success already. Will these lofty expectations be met, or could sentiment shift?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own P10 Narrative

If you want to dig into the numbers yourself or think a different story is taking shape, you can craft your own narrative in just minutes. Do it your way.

A great starting point for your P10 research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t miss the opportunity to strengthen your portfolio with stocks others overlook. Turn market uncertainty into your edge by using these powerful tools:

- Start earning better passive income when you tap into these 19 dividend stocks with yields > 3%, which offers solid yields and robust payout histories built for reliability.

- Tap fresh growth trends and revolutionary breakthroughs by seeking out these 24 AI penny stocks, which have proven momentum in artificial intelligence leadership.

- Seize rare pricing opportunities by assessing these 901 undervalued stocks based on cash flows that the market may have missed, before the rest of Wall Street catches up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PX

P10

Operates as a multi-asset class private market solutions provider in the alternative asset management industry in the United States.

Slight risk with acceptable track record.

Similar Companies

Market Insights

Community Narratives