- United States

- /

- Mortgage REITs

- /

- NYSE:PMT

PennyMac Mortgage Investment Trust (PMT): Assessing Valuation After Recent Share Price Rebound

Reviewed by Simply Wall St

Short term moves and recent performance

PennyMac Mortgage Investment Trust (PMT) has been drifting slightly lower this week, but the bigger story is its solid rebound, with the stock up about 6% over the past month and 8% over the past year.

See our latest analysis for PennyMac Mortgage Investment Trust.

That gentle pullback around the recent 1 day share price return contrasts with a steadier upward trend, as PMT’s 1 month share price return and 1 year total shareholder return both point to momentum quietly building rather than fading.

If PMT’s move has you thinking more broadly about income and financials, it could be worth exploring other opportunities via fast growing stocks with high insider ownership.

With PennyMac Mortgage Investment Trust trading just below analyst targets but boasting robust multi year returns, the question now is whether investors are looking at an attractive entry point or a market that is already pricing in future growth.

Most Popular Narrative: 4.6% Undervalued

With PennyMac Mortgage Investment Trust last closing at $12.81 against a narrative fair value of about $13.43, the current pricing gap looks modest but meaningful.

The ongoing digital transformation and the ability to organically create securitizations through technology-enabled processes are enabling PMT to efficiently structure and retain higher-yielding credit-sensitive non-agency MBS and CRT assets, which could drive net margin expansion as operational efficiencies scale.

Want to see how shrinking revenues could still align with sharply higher profits and a lower future earnings multiple than peers? The most followed narrative leans on bold margin expansion, shifting loan mix and disciplined valuation assumptions to back this fair value view. Curious which levers matter most in that playbook and how long they need to hold for the math to work? Read on to unpack the full projection stack behind this price target.

Result: Fair Value of $13.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that bullish margin story could unravel if rising rates increase funding costs or credit losses spike on riskier jumbo and non agency loans.

Find out about the key risks to this PennyMac Mortgage Investment Trust narrative.

Another View: Multiples Paint a Tougher Picture

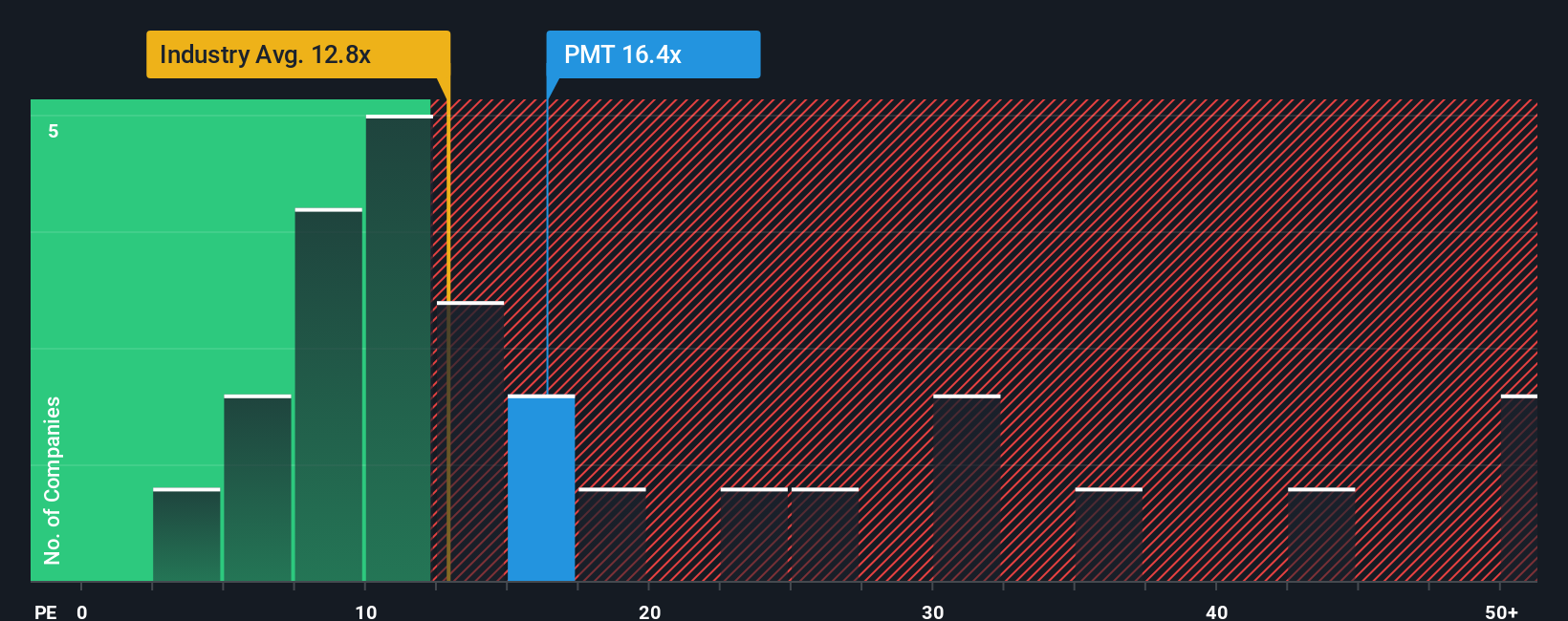

While the narrative fair value suggests mild upside, PMT trades on a price to earnings ratio of about 14 times, richer than the US Mortgage REITs average of 12.8 times and close to its 14.7 times fair ratio. This hints at limited margin for error if growth disappoints.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out PennyMac Mortgage Investment Trust for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 925 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own PennyMac Mortgage Investment Trust Narrative

If you see this differently or want to dig into the numbers yourself, you can quickly build a custom view in just minutes. Do it your way

A great starting point for your PennyMac Mortgage Investment Trust research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Do not stop at a single opportunity. Put Simply Wall Street’s Screener to work now and line up your next round of high conviction investment candidates.

- Capture potential mispricings by targeting companies ranked as these 925 undervalued stocks based on cash flows and position yourself before the crowd recognizes their cash flow strength.

- Tap into powerful long term themes by focusing on these 24 AI penny stocks that could reshape industries with scalable, data driven business models.

- Lock in reliable income streams by zeroing in on these 14 dividend stocks with yields > 3% that may help stabilize returns when markets turn choppy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PMT

PennyMac Mortgage Investment Trust

Through its subsidiary, primarily invests in residential mortgage-related assets in the United States.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026