- United States

- /

- Capital Markets

- /

- NYSE:PJT

PJT Partners (PJT): Valuation in Focus Following BMO Capital’s New Analyst Coverage

Reviewed by Kshitija Bhandaru

BMO Capital has just initiated coverage on PJT Partners (PJT), highlighting the company’s track record in restructuring and its position in strategic advisory services. This move is drawing attention from investors looking for new momentum.

See our latest analysis for PJT Partners.

PJT Partners has seen subtle but consistent momentum building, with its share price returning 15.2% year-to-date. This trend comes amid attention-grabbing analyst commentary and strong business updates, suggesting growing confidence in both the company’s strategic direction and its long-term prospects. Notably, the three-year total shareholder return of 166.6% stands out as a testament to its ability to reward patient investors, even as market risks and valuation questions continue to surface.

If you're curious to discover what other companies have shown similar breakout trends, now is a great time to broaden your search and uncover fast growing stocks with high insider ownership

With shares pulling back slightly after strong gains and analyst price targets hovering just above recent trading levels, the big question now is whether PJT Partners is presenting a genuine buying opportunity or if the market has already priced in its future growth.

Price-to-Earnings of 27.3x: Is it justified?

PJT Partners trades at a price-to-earnings ratio of 27.3x, notably lower than its peers’ average of 38.6x and closely aligned with the industry average of 27.1x. Based on the last close price of $180.40, this multiple suggests the market values PJT’s earnings at a modest premium, but certainly not at an excessive level.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay per dollar of reported earnings, a standard gauge for assessing value in the capital markets sector. For a firm like PJT, with rising earnings and strong returns on equity, the P/E ratio offers insight into market confidence regarding future profit growth.

Despite its recent outperformance and significant profit acceleration, PJT is priced below the peer group average. This could hint at the market’s more cautious expectations. However, the ratio is marginally above the industry average, which underscores that investors are willing to pay a premium, but not an outsized one, for its strategic positioning and execution. Against the fair P/E ratio estimate of 15.1x, PJT looks richer than fundamentals alone might justify. The market could eventually re-evaluate this level if expectations shift.

Explore the SWS fair ratio for PJT Partners

Result: Price-to-Earnings of 27.3x (ABOUT RIGHT)

However, slower revenue or profit growth in the coming quarters could prompt investors to reassess whether PJT's premium valuation is sustainable.

Find out about the key risks to this PJT Partners narrative.

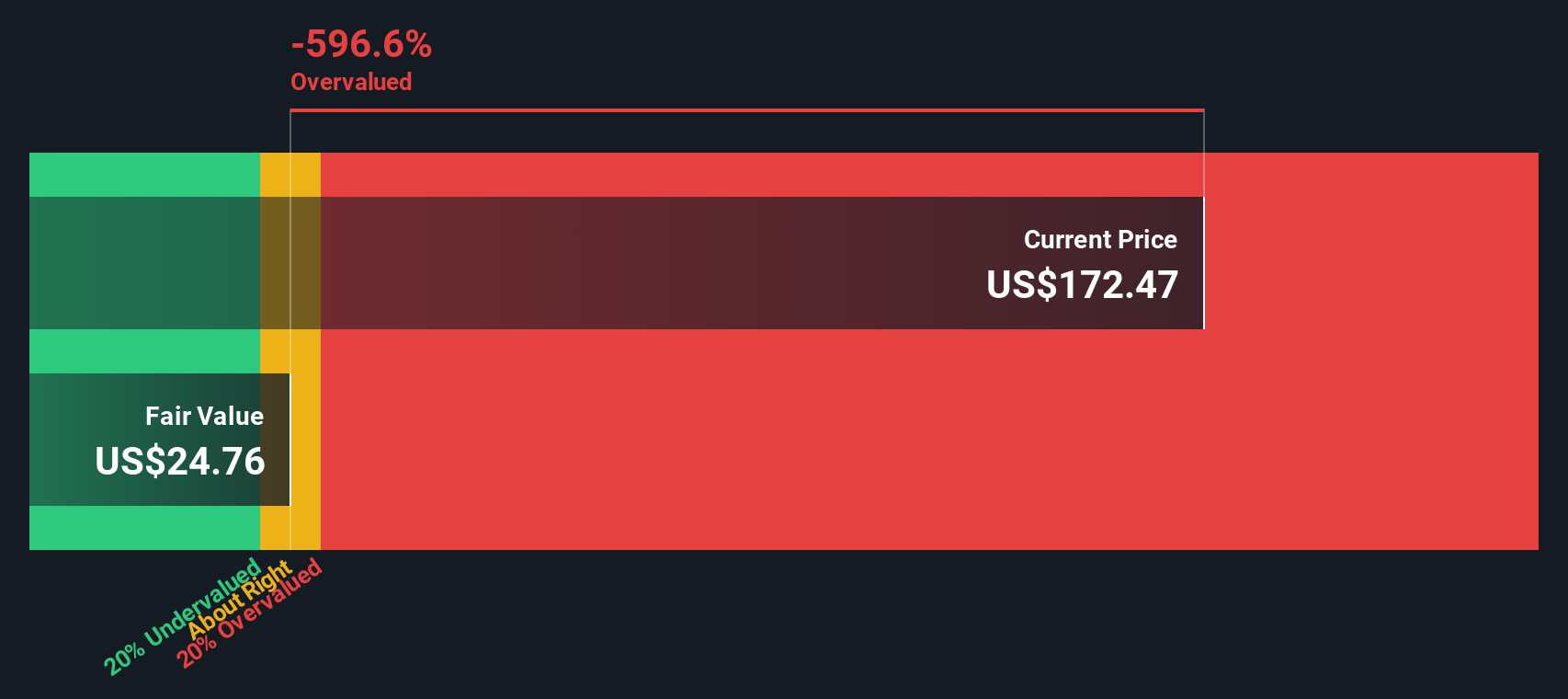

Another View: Discounted Cash Flow Tells a Different Story

While PJT’s price-to-earnings ratio appears reasonable compared to peers, our DCF model suggests a much lower fair value. With shares trading at $180.40 and our DCF estimate at $24.87, the stock looks significantly overvalued from this perspective. Which viewpoint will prove closer to the mark as forecasts evolve?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out PJT Partners for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own PJT Partners Narrative

If you want to interpret the numbers for yourself or think a different angle is worth exploring, you can easily craft your own perspective in just minutes with Do it your way.

A great starting point for your PJT Partners research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Take control of your investment journey and explore beyond the obvious. Target stocks with real growth potential, unique innovations, and attractive income streams. If you want to make smarter moves, don’t miss these top trends:

- Kick-start your portfolio with the potential of these 894 undervalued stocks based on cash flows delivering solid returns, thanks to their attractive cash flow valuations.

- Capitalize on breakthrough tech by tracking these 25 AI penny stocks, shaping the cutting edge of artificial intelligence advancements.

- Boost your passive income with these 19 dividend stocks with yields > 3%, offering market-beating yields above 3% for income-focused investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PJT

PJT Partners

An investment bank, provides various strategic advisory, shareholder advisory, capital markets advisory, and restructuring and special situations services to corporations, financial sponsors, institutional investors, and governments worldwide.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives