- United States

- /

- Capital Markets

- /

- NYSE:PJT

How Rapid Gains in Revenue and Market Share at PJT Partners (PJT) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

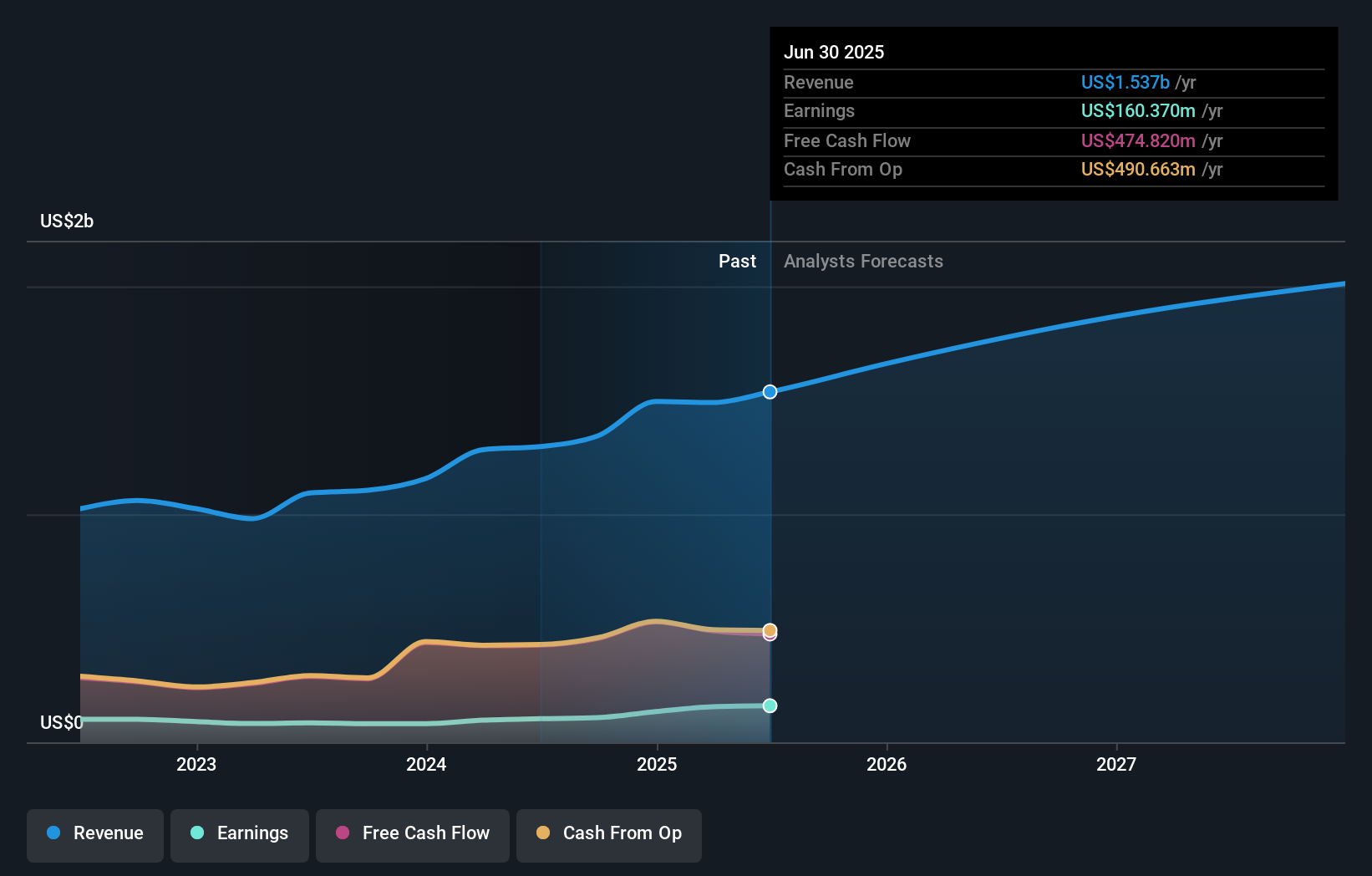

- In recent days, PJT Partners has drawn heightened attention as analysts spotlight the firm's exceptional revenue growth, earnings outpacing those revenue gains, and expanding market share within the investment banking space.

- An interesting insight is that broader analyst and media coverage has reinforced PJT Partners' reputation as a standout player showing strength despite industry cyclicality.

- We’ll explore how sustained growth in both earnings and market share continues to shape PJT Partners’ investment narrative today.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

What Is PJT Partners' Investment Narrative?

For anyone considering owning PJT Partners, the big picture hinges on confidence in the firm’s ability to keep growing both revenue and earnings ahead of broader investment banking cycles, essentially, the belief that PJT’s expanding market share and solid operational results can outpace industry headwinds. The latest analyst and market commentary reinforce this view, highlighting exceptional earnings per share outpacing revenue growth and recognition for resilience in a traditionally cyclical sector. While consensus price targets still suggest a mild potential upside and recent buybacks have supported shareholder value, short-term price returns have softened modestly. The recent increase in analyst coverage hasn’t introduced material new risks or catalysts, so previously identified concerns, such as valuation compared to industry peers and the impact of insider selling, remain front of mind. In short, the core thesis remains about sustained, above-industry performance, without significant shifts following the most recent coverage. However, the issue of insider selling remains something investors should be mindful of as they weigh the opportunity.

PJT Partners' share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 3 other fair value estimates on PJT Partners - why the stock might be worth less than half the current price!

Build Your Own PJT Partners Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PJT Partners research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free PJT Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PJT Partners' overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PJT

PJT Partners

An investment bank, provides various strategic advisory, shareholder advisory, capital markets advisory, and restructuring and special situations services to corporations, financial sponsors, institutional investors, and governments worldwide.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026