- United States

- /

- Capital Markets

- /

- NYSE:PIPR

With EPS Growth And More, Piper Sandler Companies (NYSE:PIPR) Is Interesting

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Piper Sandler Companies (NYSE:PIPR). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

See our latest analysis for Piper Sandler Companies

How Quickly Is Piper Sandler Companies Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That means EPS growth is considered a real positive by most successful long-term investors. Who among us would not applaud Piper Sandler Companies's stratospheric annual EPS growth of 54%, compound, over the last three years? Growth that fast may well be fleeting, but like a lotus blooming from a murky pond, it sparks joy for the wary stock pickers.

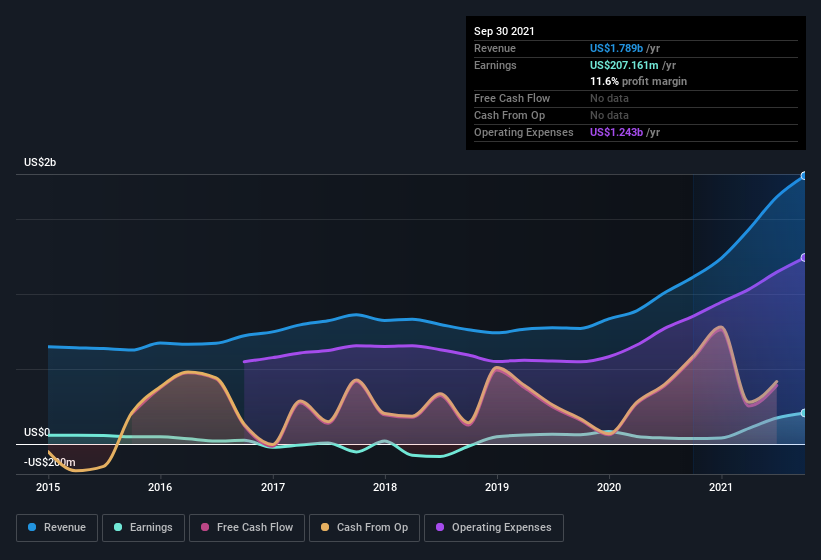

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. I note that Piper Sandler Companies's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. While we note Piper Sandler Companies's EBIT margins were flat over the last year, revenue grew by a solid 61% to US$1.8b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of Piper Sandler Companies's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Piper Sandler Companies Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. So it is good to see that Piper Sandler Companies insiders have a significant amount of capital invested in the stock. Notably, they have an enormous stake in the company, worth US$110m. I would find that kind of skin in the game quite encouraging, if I owned shares, since it would ensure that the leaders of the company would also experience my success, or failure, with the stock.

Is Piper Sandler Companies Worth Keeping An Eye On?

Piper Sandler Companies's earnings per share have taken off like a rocket aimed right at the moon. That EPS growth certainly has my attention, and the large insider ownership only serves to further stoke my interest. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. So yes, on this short analysis I do think it's worth considering Piper Sandler Companies for a spot on your watchlist. Don't forget that there may still be risks. For instance, we've identified 4 warning signs for Piper Sandler Companies that you should be aware of.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Piper Sandler Companies, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:PIPR

Piper Sandler Companies

Operates as an investment bank and institutional securities firm that serves corporations, private equity groups, public entities, non-profit entities, and institutional investors in the United States and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives