- United States

- /

- Diversified Financial

- /

- NYSE:PFSI

PennyMac Financial Services (PFSI): Assessing Valuation After a Strong Multi‑Year Share Price Run

Reviewed by Simply Wall St

PennyMac Financial Services (PFSI) has quietly kept investors interested, with the stock up about 14% over the past 3 months and more than 26% over the past year despite recent pullbacks.

See our latest analysis for PennyMac Financial Services.

That pattern fits the broader story, with a solid 90 day share price return alongside a 3 year total shareholder return well into triple digits, suggesting momentum is still broadly constructive even after the latest pullback.

If PennyMac’s move has you thinking about what else could surprise on the upside, it is a good moment to explore fast growing stocks with high insider ownership.

Given its strong multi year returns and still solid growth in revenue and earnings, investors now face a key question: is PennyMac Financial Services still undervalued or is the market already pricing in its future growth?

Most Popular Narrative Narrative: 4.9% Undervalued

With PennyMac Financial Services closing at $131.82 versus a narrative fair value of $138.57, the story points to modest upside still on the table.

The large and growing servicing portfolio with $700 billion UPB and a significant proportion of loans above current market rates creates a strong recurring revenue base and positions the company for outsized refinancing revenue and higher earnings growth if mortgage rates decline. Strong demographic tailwinds from Millennials and Gen Z entering peak home buying years are projected to drive higher homeownership rates, supporting sustained origination volume and revenue growth opportunities for PennyMac over the long term.

Want to see the full math behind that upside case? The narrative highlights aggressive margin expansion and a future earnings multiple that might surprise you. Curious which assumptions really move that fair value line? Dive in to see the projections that justify it.

Result: Fair Value of $138.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high interest rates and earnings volatility from mortgage servicing rights valuations could quickly erode the assumed margin expansion supporting that upside case.

Find out about the key risks to this PennyMac Financial Services narrative.

Another View: Cash Flow Signals a Different Story

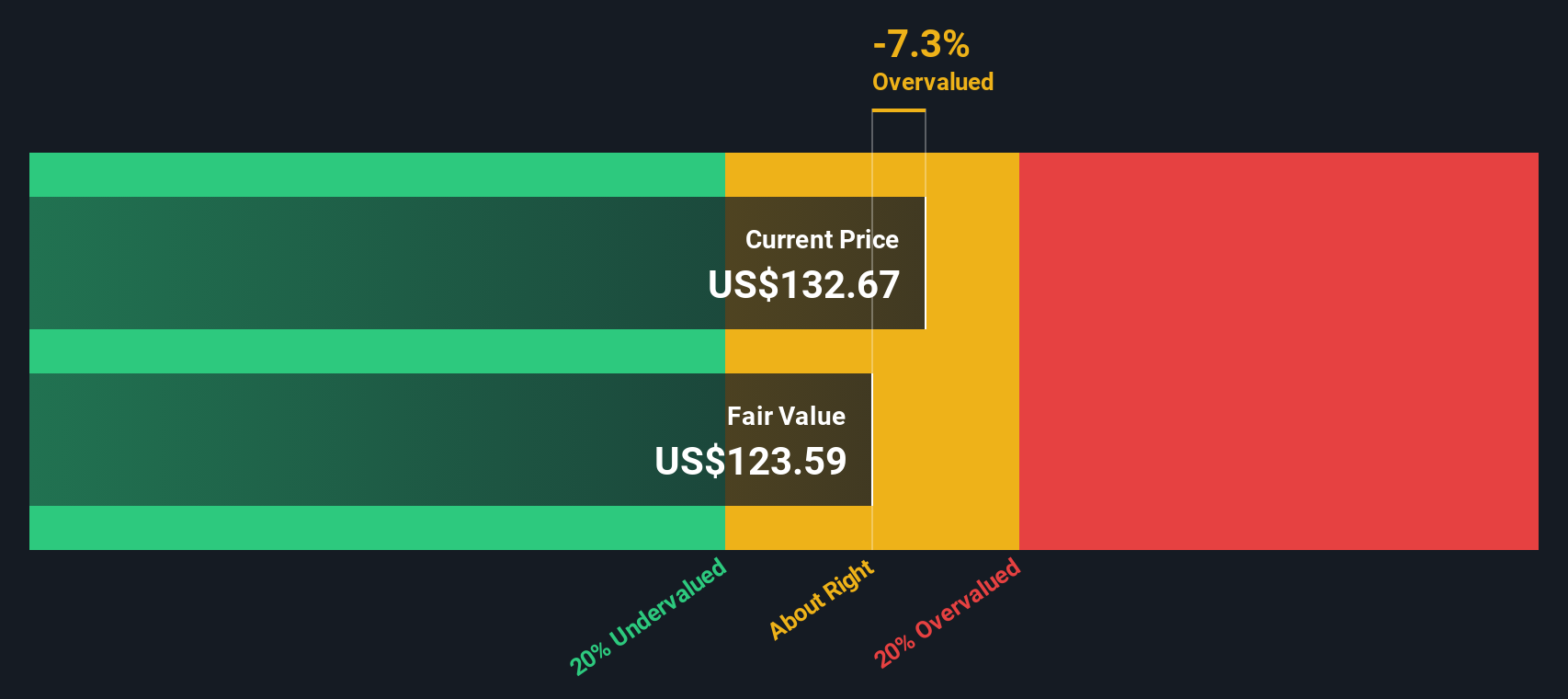

While the narrative fair value suggests upside, our DCF model points the other way. With PFSI trading above an estimate of $125.69, this implies it may be slightly overvalued on cash flows. If the stock is already pricing in strong growth, where is the real margin of safety?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out PennyMac Financial Services for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 933 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own PennyMac Financial Services Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a personalized narrative in just a few minutes: Do it your way.

A great starting point for your PennyMac Financial Services research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you log off, put your research momentum to work and line up your next opportunities with focused screeners built to surface high conviction ideas.

- Capture potential bargains early by targeting companies trading below intrinsic value through these 933 undervalued stocks based on cash flows.

- Ride powerful growth themes by zeroing in on innovation leaders at the edge of automation and machine learning with these 24 AI penny stocks.

- Identify potential income opportunities by screening for stable payouts and attractive yields using these 14 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PFSI

PennyMac Financial Services

Through its subsidiaries, engages in the mortgage banking and investment management activities in the United States.

Proven track record and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026