- United States

- /

- Diversified Financial

- /

- NYSE:PFSI

How PennyMac Financial’s Leadership Changes and Annaly Deal Have Shifted Its Investment Story (PFSI)

Reviewed by Sasha Jovanovic

- PennyMac Financial Services recently appointed Kevin Ryan as Chief Strategy Officer and promoted Marshall Sebring and Shiva Iyer to new leadership roles, while Annaly Capital Management and PennyMac announced a subservicing and master purchase agreement in which Annaly will acquire a portfolio of mortgage servicing rights from PennyMac, with PennyMac subservicing the loans.

- These developments highlight PennyMac's drive to enhance its executive leadership and reinforce its presence as a prominent mortgage lender and servicer through collaborative industry partnerships.

- We'll explore how the addition of experienced executive leadership supports PennyMac's expansion and future direction in the competitive mortgage sector.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

PennyMac Financial Services Investment Narrative Recap

To own shares of PennyMac Financial Services, an investor needs to believe in the company’s ability to sustain and grow its position as a leading mortgage originator and servicer, even as industry profit pools face pressure from interest rate uncertainty and competitive threats. The latest executive appointments, including the addition of Kevin Ryan as Chief Strategy Officer, may enhance leadership bench strength, but have limited immediate impact on mitigating the key short-term risk: the potential for further volatility in mortgage servicing rights valuations if rates stay elevated.

The recent agreement with Annaly Capital Management, where PennyMac will sell mortgage servicing rights but continue as the subservicer, is particularly relevant. This move reinforces PennyMac’s recurring revenue model, a core catalyst for the business, while highlighting its ongoing exposure to MSR-related earnings swings as a natural byproduct of growth in servicing activities.

However, investors should also be aware that, conversely, periods of sustained higher rates could have outsized consequences for MSR values and...

Read the full narrative on PennyMac Financial Services (it's free!)

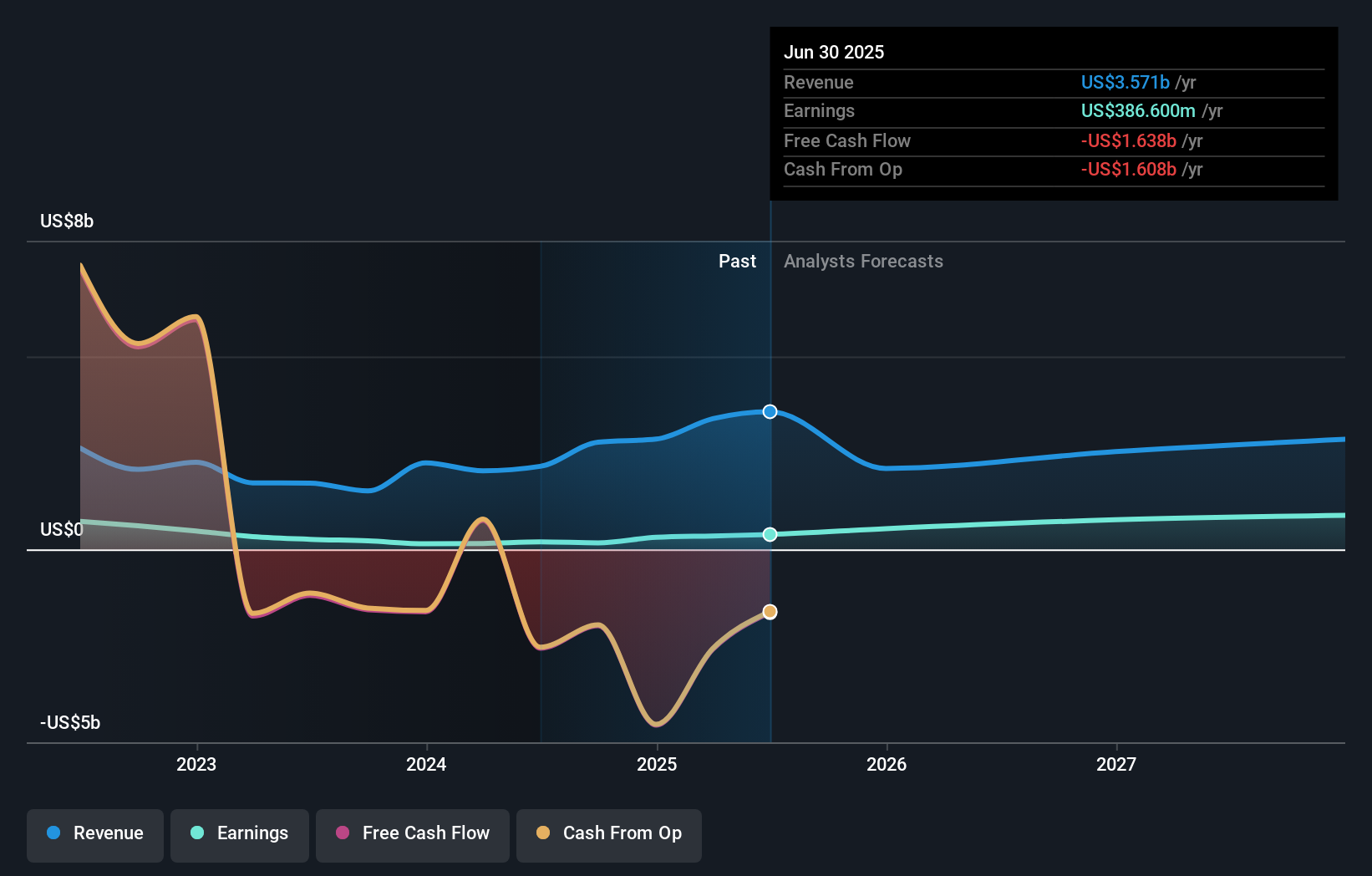

PennyMac Financial Services is projected to reach $2.5 billion in revenue and $1.1 billion in earnings by 2028. This outlook requires a yearly revenue decline of 11.0% and an earnings increase of $713.4 million from current earnings of $386.6 million.

Uncover how PennyMac Financial Services' forecasts yield a $125.86 fair value, a 7% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community submitted one fair value estimate for PennyMac Financial Services, at US$125.86. With recurring revenue from servicing agreements facing potential swings due to interest rate exposure, these community viewpoints remind you that market participants can see opportunity and risk from very different angles.

Explore another fair value estimate on PennyMac Financial Services - why the stock might be worth just $125.86!

Build Your Own PennyMac Financial Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PennyMac Financial Services research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free PennyMac Financial Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PennyMac Financial Services' overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PFSI

PennyMac Financial Services

Through its subsidiaries, engages in the mortgage banking and investment management activities in the United States.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives