- United States

- /

- Capital Markets

- /

- NYSE:OWL

Should Income Investors Look At Blue Owl Capital Inc. (NYSE:OWL) Before Its Ex-Dividend?

Blue Owl Capital Inc. (NYSE:OWL) is about to trade ex-dividend in the next 4 days. The ex-dividend date is one business day before a company's record date, which is the date on which the company determines which shareholders are entitled to receive a dividend. The ex-dividend date is important as the process of settlement involves two full business days. So if you miss that date, you would not show up on the company's books on the record date. In other words, investors can purchase Blue Owl Capital's shares before the 19th of November in order to be eligible for the dividend, which will be paid on the 30th of November.

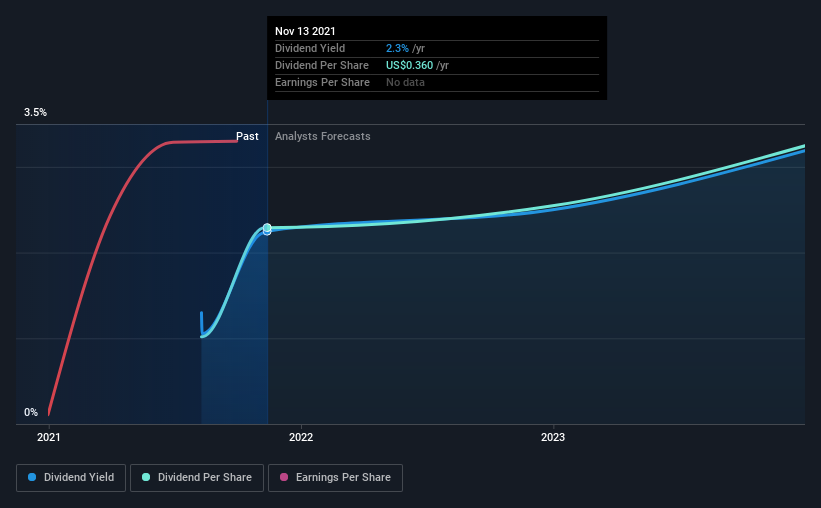

The company's next dividend payment will be US$0.09 per share. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. As a result, readers should always check whether Blue Owl Capital has been able to grow its dividends, or if the dividend might be cut.

Check out our latest analysis for Blue Owl Capital

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Blue Owl Capital reported a loss last year, so it's not great to see that it has continued paying a dividend.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Stocks with flat earnings can still be attractive dividend payers, but it is important to be more conservative with your approach and demand a greater margin for safety when it comes to dividend sustainability. If earnings fall far enough, the company could be forced to cut its dividend.

This is Blue Owl Capital's first year of paying a dividend, which is exciting for shareholders - but it does mean there's no dividend history to examine.

We update our analysis on Blue Owl Capital every 24 hours, so you can always get the latest insights on its financial health, here.

The Bottom Line

Should investors buy Blue Owl Capital for the upcoming dividend? It's definitely not great to see that it paid a dividend despite reporting a loss last year. Worse, the general trend in its earnings looks negative in recent times. All things considered, we're not optimistic about its dividend prospects, and would be inclined to leave it on the shelf for now.

Although, if you're still interested in Blue Owl Capital and want to know more, you'll find it very useful to know what risks this stock faces. To help with this, we've discovered 1 warning sign for Blue Owl Capital that you should be aware of before investing in their shares.

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

If you're looking to trade Blue Owl Capital, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Blue Owl Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:OWL

Blue Owl Capital

Operates as an alternative asset manager in the United States.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives