- United States

- /

- Capital Markets

- /

- NYSE:OWL

Blue Owl Capital Inc.'s (NYSE:OWL) Popularity With Investors Is Clear

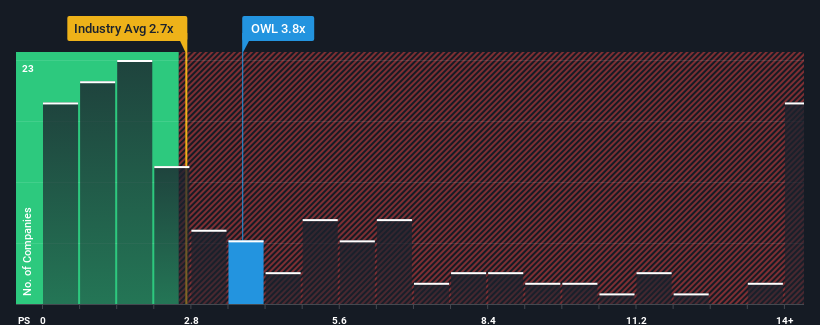

When close to half the companies in the Capital Markets industry in the United States have price-to-sales ratios (or "P/S") below 2.7x, you may consider Blue Owl Capital Inc. (NYSE:OWL) as a stock to potentially avoid with its 3.8x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Blue Owl Capital

What Does Blue Owl Capital's Recent Performance Look Like?

Blue Owl Capital certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Blue Owl Capital's future stacks up against the industry? In that case, our free report is a great place to start.How Is Blue Owl Capital's Revenue Growth Trending?

Blue Owl Capital's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 29%. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 19% per annum during the coming three years according to the nine analysts following the company. That's shaping up to be materially higher than the 5.6% each year growth forecast for the broader industry.

With this information, we can see why Blue Owl Capital is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Blue Owl Capital's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

It is also worth noting that we have found 2 warning signs for Blue Owl Capital (1 doesn't sit too well with us!) that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Blue Owl Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:OWL

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives