- United States

- /

- Capital Markets

- /

- NYSE:OPY

Do Oppenheimer Holdings's (NYSE:OPY) Earnings Warrant Your Attention?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In contrast to all that, I prefer to spend time on companies like Oppenheimer Holdings (NYSE:OPY), which has not only revenues, but also profits. While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Oppenheimer Holdings

Oppenheimer Holdings's Improving Profits

Over the last three years, Oppenheimer Holdings has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. As a result, I'll zoom in on growth over the last year, instead. Like a firecracker arcing through the night sky, Oppenheimer Holdings's EPS shot from US$4.10 to US$9.73, over the last year. You don't see 137% year-on-year growth like that, very often.

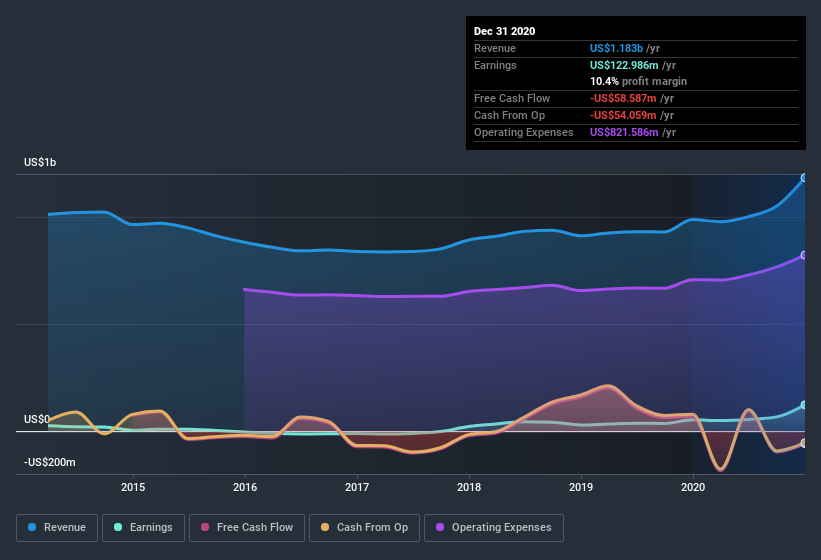

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Not all of Oppenheimer Holdings's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. Oppenheimer Holdings maintained stable EBIT margins over the last year, all while growing revenue 20% to US$1.2b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Oppenheimer Holdings Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We haven't seen any insiders selling Oppenheimer Holdings shares, in the last year. With that in mind, it's heartening that Albert Lowenthal, the Chairman & CEO of the company, paid US$22k for shares at around US$28.86 each.

On top of the insider buying, it's good to see that Oppenheimer Holdings insiders have a valuable investment in the business. Notably, they have an enormous stake in the company, worth US$153m. That equates to 29% of the company, making insiders powerful and aligned with other shareholders. Very encouraging.

Is Oppenheimer Holdings Worth Keeping An Eye On?

Oppenheimer Holdings's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. The cherry on top is that insiders own a bunch of shares, and one has been buying more. Because of the potential that it has reached an inflection point, I'd suggest Oppenheimer Holdings belongs on the top of your watchlist. It is worth noting though that we have found 3 warning signs for Oppenheimer Holdings (2 are concerning!) that you need to take into consideration.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Oppenheimer Holdings, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading Oppenheimer Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Oppenheimer Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:OPY

Oppenheimer Holdings

Operates as a middle-market investment bank and full-service broker-dealer in the Americas, Europe, the Middle East, and Asia.

Acceptable track record with mediocre balance sheet.