- United States

- /

- Mortgage REITs

- /

- NYSE:NREF

Undervalued Small Caps With Insider Buying Across Regions

Reviewed by Simply Wall St

As the U.S. markets experience a wave of optimism with major indices like the Dow Jones, S&P 500, and Nasdaq on track for weekly and monthly gains, small-cap stocks are drawing attention amid this broader upward trend. In such an environment, identifying promising small-cap opportunities often involves looking at companies with strong fundamentals and potential insider confidence, which can be indicators of future growth potential.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Limbach Holdings | 31.6x | 2.0x | 37.99% | ★★★★★★ |

| PCB Bancorp | 8.6x | 2.8x | 34.14% | ★★★★★☆ |

| Peoples Bancorp | 10.0x | 1.8x | 47.07% | ★★★★★☆ |

| Industrial Logistics Properties Trust | NA | 0.8x | 29.22% | ★★★★★☆ |

| Trinity Capital | 7.6x | 4.1x | 13.86% | ★★★★☆☆ |

| Farmland Partners | 6.8x | 8.2x | -40.71% | ★★★★☆☆ |

| First Northern Community Bancorp | 10.1x | 2.9x | 45.60% | ★★★★☆☆ |

| Citizens & Northern | 11.2x | 2.8x | 44.14% | ★★★☆☆☆ |

| Shore Bancshares | 9.1x | 2.4x | -2.28% | ★★★☆☆☆ |

| Citizens Community Bancorp | 12.0x | 2.6x | 43.90% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

Ategrity Specialty Insurance Company Holdings (ASIC)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Ategrity Specialty Insurance Company Holdings operates in the insurance sector with a focus on specialty insurance products, and its market capitalization is approximately $1.2 billion.

Operations: ASIC's primary revenue stream is derived from its insurance business, with recent figures showing a revenue of $405.66 million. Over several periods, the company has seen its gross profit margin increase to 24.29%, reflecting an improvement in cost management relative to revenue growth. Operating expenses have remained relatively low compared to total revenues, contributing positively to the company's financial performance.

PE: 13.3x

Ategrity Specialty Insurance Company Holdings, a smaller player in the insurance industry, recently reported a third-quarter net income of US$22.66 million, up from US$12.86 million last year. This growth is reflected in their earnings per share increase to US$0.47 from US$0.36. Added to multiple Russell indices in September 2025, this inclusion highlights market recognition despite reliance on external borrowing for funding. Insider confidence remains strong with recent share purchases indicating positive sentiment towards future prospects.

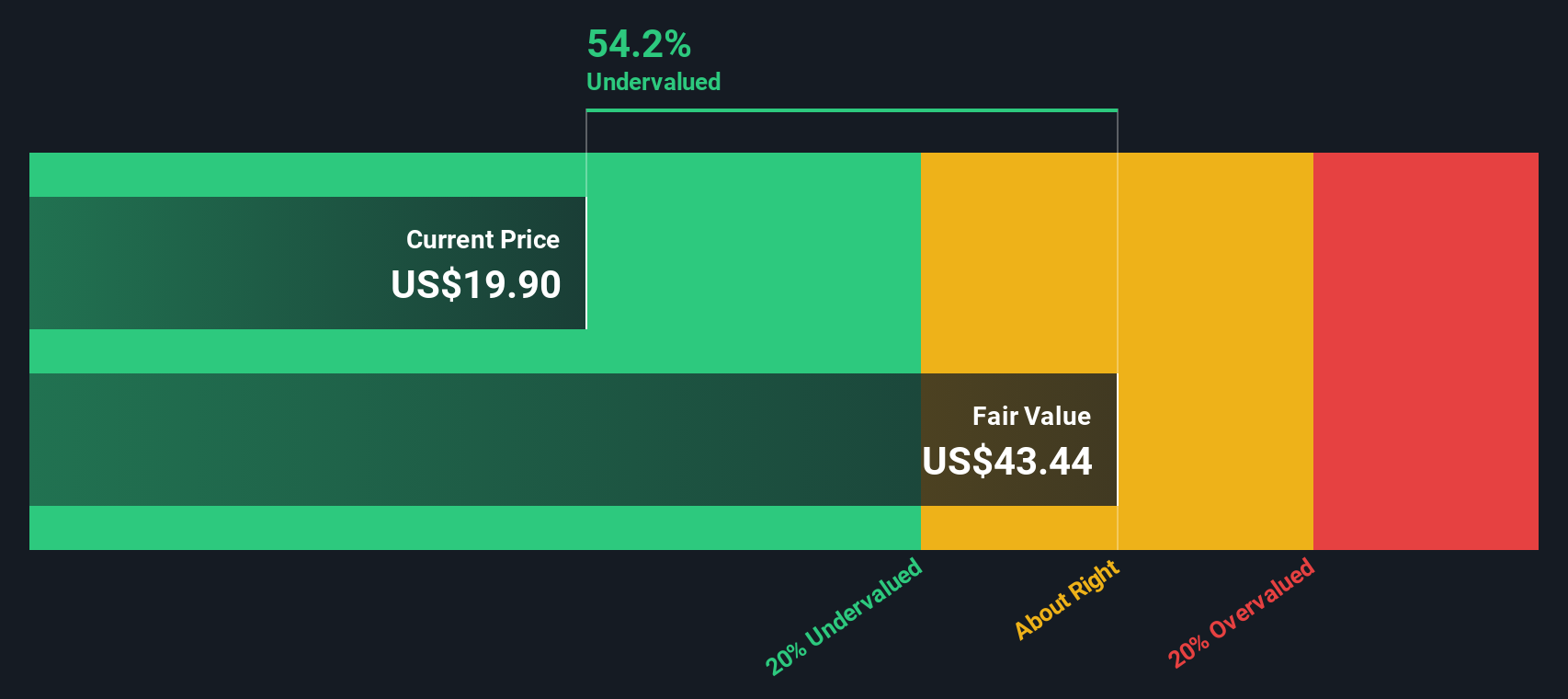

NexPoint Real Estate Finance (NREF)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: NexPoint Real Estate Finance operates as a real estate investment trust focusing on mortgage-related assets, with a market capitalization of approximately $0.57 billion.

Operations: The company's revenue is primarily derived from its REIT - Mortgage segment. It has experienced fluctuations in net income, with a notable net income margin of 43.69% as of March 2025, reflecting significant profitability at that time. Operating expenses have varied across periods, impacting overall financial performance.

PE: 4.5x

NexPoint Real Estate Finance, operating in a niche market, recently reported a Q3 net income of US$43.08 million with earnings per share at US$1.14. Despite facing an earnings decline forecast of 20.6% annually over the next three years, insider confidence is evident from recent share purchases by insiders within the past few months. The company relies entirely on external borrowing for funding, which carries higher risk compared to customer deposits. Looking ahead, Q4 guidance suggests decreased net income and EPS compared to last year, indicating potential challenges amidst their dividend affirmations and strategic moves in real estate finance.

- Get an in-depth perspective on NexPoint Real Estate Finance's performance by reading our valuation report here.

Gain insights into NexPoint Real Estate Finance's past trends and performance with our Past report.

Origin Bancorp (OBK)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Origin Bancorp operates as a financial holding company primarily engaged in community banking services, with a market capitalization of approximately $1.34 billion.

Operations: Origin Bancorp's primary revenue stream is derived from its community banking segment, with a recent revenue figure of $327.69 million. The company consistently reports a gross profit margin of 100%, indicating no cost of goods sold data available or applicable. Operating expenses, particularly general and administrative costs, have shown significant figures such as $368.26 million in the latest period. The net income margin has varied over time, with the most recent figure at 18.30%.

PE: 18.0x

Origin Bancorp, a smaller U.S. financial institution, is catching attention with its projected 30% annual earnings growth. Despite recent net charge-offs of US$31 million in Q3 2025, the company maintains shareholder confidence by affirming a US$0.15 per share dividend and completing a share buyback of 401,647 shares for US$13.89 million since July 2022. Insider confidence remains high as insiders continue to purchase shares, hinting at potential value recognition within the market's current landscape.

- Take a closer look at Origin Bancorp's potential here in our valuation report.

Examine Origin Bancorp's past performance report to understand how it has performed in the past.

Summing It All Up

- Explore the 59 names from our Undervalued US Small Caps With Insider Buying screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NexPoint Real Estate Finance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NREF

NexPoint Real Estate Finance

Operates as a commercial mortgage real estate investment trust in the United States.

Fair value with acceptable track record.

Similar Companies

Market Insights

Community Narratives