- United States

- /

- Consumer Finance

- /

- NYSE:NNI

Will Nelnet’s (NNI) Diversification Drive Shape Its Long-Term Capital Allocation Story?

Reviewed by Sasha Jovanovic

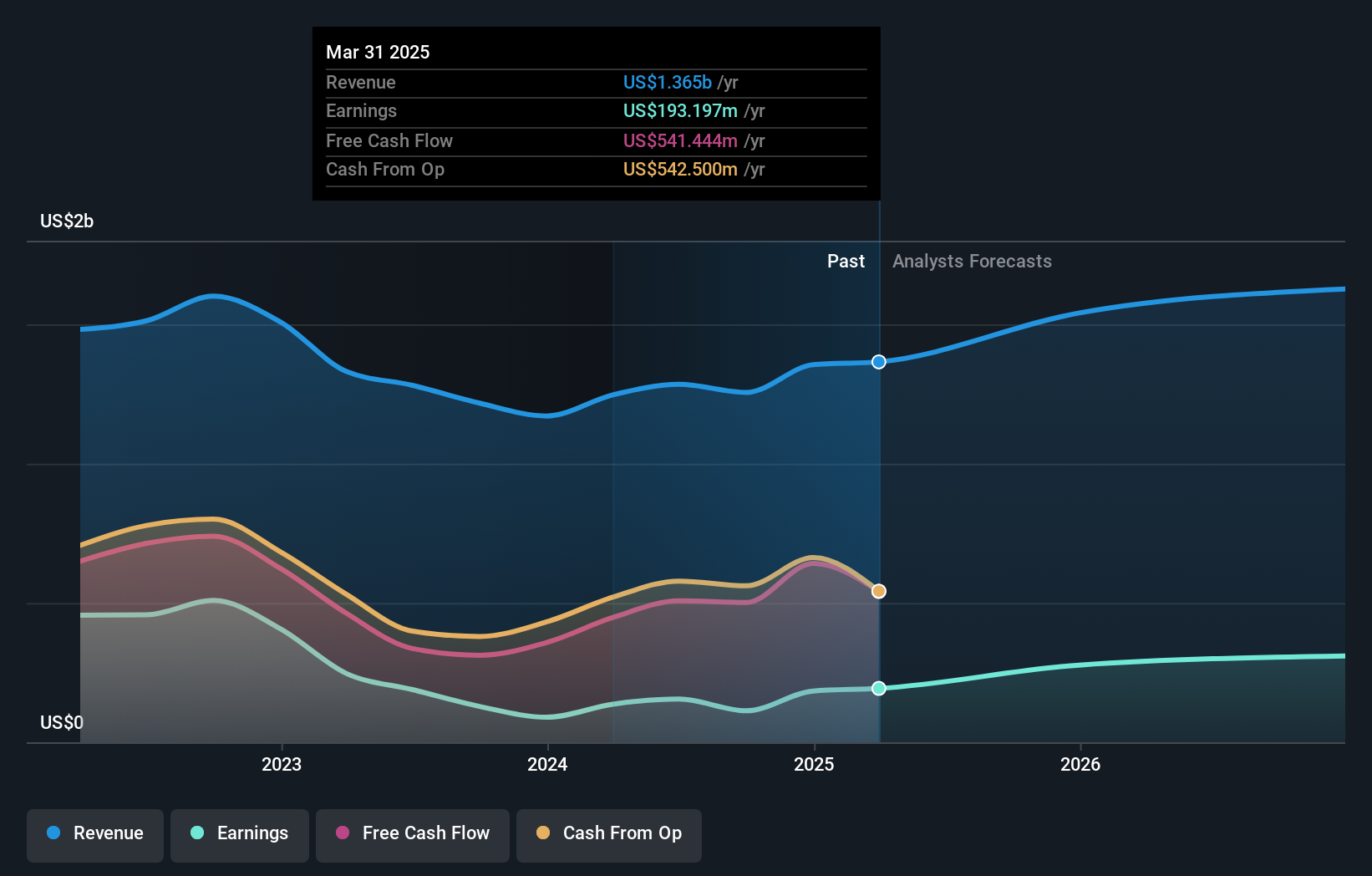

- Recent coverage has highlighted Nelnet's evolving business model, drawing attention to its investments in educational software, payment processing, and a significant ownership stake in private start-up Hudl.

- An interesting aspect is how these underlying assets, coupled with ongoing share repurchases and steady cash flow, are shaping investor expectations for future dividend growth.

- We'll explore how Nelnet's software assets and hidden investments are influencing its investment narrative and long-term outlook.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

What Is Nelnet's Investment Narrative?

To see Nelnet as a promising investment right now, I think you'd need to believe in its long-term repositioning, moving from its roots in student loan servicing to a more diversified model, with educational software and payment processing taking center stage. The recent spotlight on Nelnet’s hidden investments like its Hudl stake and robust buyback activity does seem to reinforce its efforts to drive future shareholder value, potentially lifting expectations for dividend growth. This news doesn’t materially alter the immediate catalysts, such as upcoming earnings, continued software expansion, or further buyback execution. However, it could bring greater attention to the value beneath the surface, heightening both interest and scrutiny. The main risk continues to be that these assets, while promising, are not guaranteed to deliver the returns some investors now may anticipate. But, risks around monetizing private investments remain something investors should keep front of mind.

Nelnet's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 2 other fair value estimates on Nelnet - why the stock might be worth as much as $130.00!

Build Your Own Nelnet Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nelnet research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Nelnet research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nelnet's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nelnet might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NNI

Nelnet

Engages in loan servicing, education technology services, and payment businesses worldwide.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives