- United States

- /

- Consumer Finance

- /

- NYSE:NNI

Why Investors Shouldn't Be Surprised By Nelnet, Inc.'s (NYSE:NNI) P/E

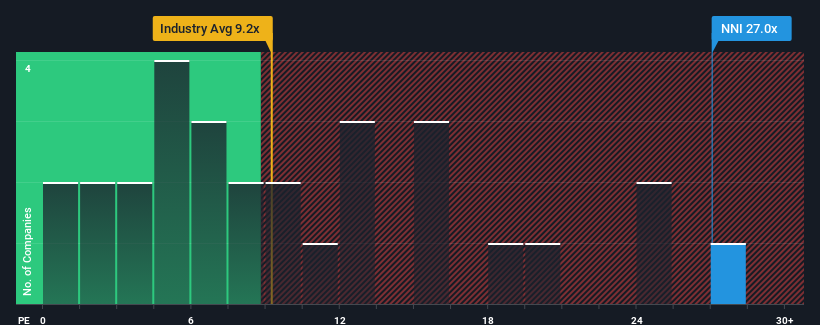

With a price-to-earnings (or "P/E") ratio of 27x Nelnet, Inc. (NYSE:NNI) may be sending very bearish signals at the moment, given that almost half of all companies in the United States have P/E ratios under 16x and even P/E's lower than 9x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Recent times haven't been advantageous for Nelnet as its earnings have been falling quicker than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. If not, then existing shareholders may be very nervous about the viability of the share price.

See our latest analysis for Nelnet

Is There Enough Growth For Nelnet?

In order to justify its P/E ratio, Nelnet would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 44%. As a result, earnings from three years ago have also fallen 72% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 65% during the coming year according to the only analyst following the company. Meanwhile, the rest of the market is forecast to only expand by 12%, which is noticeably less attractive.

In light of this, it's understandable that Nelnet's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Nelnet maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

You need to take note of risks, for example - Nelnet has 2 warning signs (and 1 which is a bit concerning) we think you should know about.

If these risks are making you reconsider your opinion on Nelnet, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Nelnet, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nelnet might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NNI

Nelnet

Engages in loan servicing, education technology services, and payment businesses worldwide.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives