- United States

- /

- Consumer Finance

- /

- NYSE:NNI

Nelnet (NNI): Revisiting Valuation After Latest U.S. Department of Education Payment and Technology Initiatives

Reviewed by Kshitija Bhandaru

The U.S. Department of Education recently made a $74 million payment to Nelnet (NNI) for student loan servicing operations. This highlights the company's ongoing role in managing federal student loans and its established government partnerships.

See our latest analysis for Nelnet.

This latest Department of Education payment comes on the back of several government contracts and Nelnet’s ongoing efforts to modernize its offerings, including the upcoming Virtual Client Summit and the launch of Project Horizon in its Campus Commerce division. After a string of steady updates and major customer wins, Nelnet’s 1-year total shareholder return stands at a modest 19.2%, while its 5-year figure has built strongly to 108%. This demonstrates a company with solid long-term momentum, even if the recent share price has moved more gradually.

If you’re interested in uncovering more fast-movers and under-the-radar gems, now’s a perfect moment to broaden your horizon and check out fast growing stocks with high insider ownership

With its steady government revenue and consistent long-term returns, is Nelnet’s current share price reflecting untapped potential, or has the market already factored in all future growth and value for investors?

Price-to-Earnings of 14.4x: Is it justified?

Nelnet currently trades at a price-to-earnings (P/E) ratio of 14.4x, positioning its shares as more expensive than both its industry peers and the broader sector averages at the last close of $131.40.

The price-to-earnings ratio reflects how much investors are willing to pay for a dollar of earnings, making it a common yardstick for valuing consumer finance companies like Nelnet. In this context, a higher P/E could signal expectations of above-average growth, superior profitability, or simply a premium for stability and reputation.

In Nelnet’s case, the P/E ratio stands markedly above the US Consumer Finance industry average of 10x and similarly exceeds the peer group benchmark. This suggests that the stock commands a premium pricing in the current market, possibly due to its robust earnings rebound over the most recent year. However, with subdued revenue growth forecasts ahead, the premium may be harder to justify unless profit momentum is sustained.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 14.4x (OVERVALUED)

However, with revenue growth slowing and Nelnet trading just above analyst targets, any slip in execution or regulatory changes could quickly alter investor sentiment.

Find out about the key risks to this Nelnet narrative.

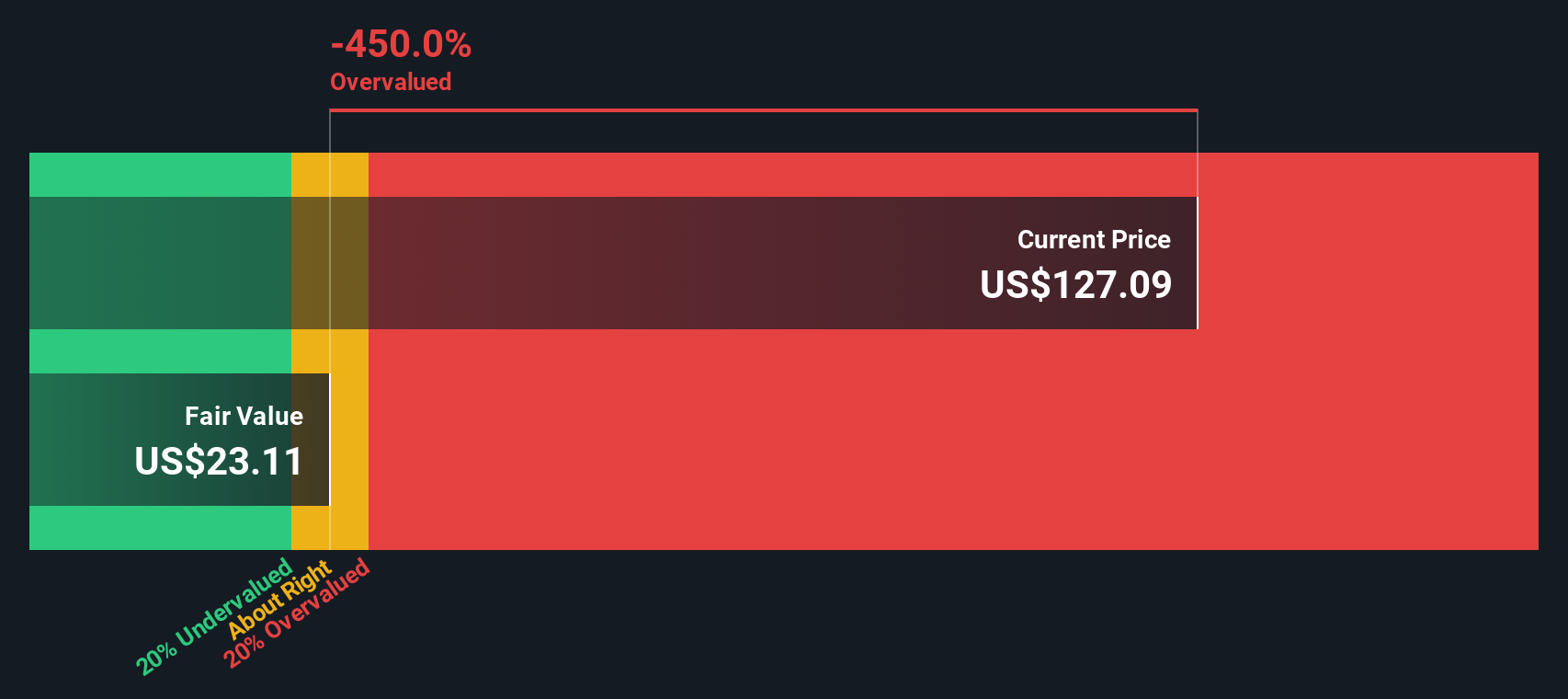

Another View: Discounted Cash Flow Puts Valuation in Sharper Focus

Looking at Nelnet through the lens of our SWS DCF model, a different story unfolds. The shares appear to be trading well above our estimated fair value, suggesting investors may be paying a premium far beyond what future cash flows justify. This could signal heightened risk if growth expectations are not met.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nelnet for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nelnet Narrative

If you want to check the numbers for yourself or prefer to shape your own investment story, it only takes a few minutes to dive in, Do it your way

A great starting point for your Nelnet research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Compelling Investment Ideas?

The market is full of hidden gems. Don’t let great opportunities slip away. Broaden your research and strengthen your portfolio by acting on these standout themes:

- Capitalize on strong yield potential as you review these 19 dividend stocks with yields > 3% offering consistent income above 3%.

- Ride the wave of innovation by checking out these 24 AI penny stocks capturing the momentum in artificial intelligence breakthroughs.

- Access deep value with these 904 undervalued stocks based on cash flows that have room to grow according to robust cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nelnet might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NNI

Nelnet

Engages in loan servicing, education technology services, and payment businesses worldwide.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives