- United States

- /

- Capital Markets

- /

- NYSE:MSCI

How Investors Are Reacting To MSCI (MSCI) Expanding Credit Facility and Boosting Financial Flexibility

Reviewed by Simply Wall St

- On August 20, 2025, MSCI Inc. increased its aggregate revolving credit commitments to US$1.60 billion and extended the facility's availability to August 20, 2030, following the full repayment of borrowings under its prior credit agreement using proceeds from a senior notes offering.

- This move is expected to enhance MSCI's financial flexibility as analysts recently revised earnings estimates upward and expressed a strong growth outlook for the company.

- We'll explore how MSCI's expanded credit facility and enhanced liquidity profile influence its outlook and investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

MSCI Investment Narrative Recap

To be a shareholder in MSCI, you need to believe in the persistent global demand for indexing, ETF products, and advanced analytics, supported by continued innovation in climate, ESG, and private assets solutions. The recently expanded US$1.60 billion credit facility enhances near-term financial flexibility but does not materially affect the main catalyst, continued growth in asset-based and high-margin subscription revenues, or fully address the ongoing risks around active asset manager consolidation and retention rates.

Among recent announcements, MSCI’s partnership with PNC Bank to offer Wealth Manager provides digital tools and analytics for portfolio management, supporting the company’s push into institutional wealth channels. This expansion aligns with one of the key growth catalysts: capitalizing on the institutionalization of wealth management and increased demand for advanced analytics solutions.

But in contrast to this momentum, investors should also be aware of the ongoing risk posed by persistent industry consolidation and budget constraints among active asset managers, which...

Read the full narrative on MSCI (it's free!)

MSCI's narrative projects $3.8 billion revenue and $1.6 billion earnings by 2028. This requires 8.5% yearly revenue growth and a $0.4 billion earnings increase from $1.2 billion today.

Uncover how MSCI's forecasts yield a $617.40 fair value, a 8% upside to its current price.

Exploring Other Perspectives

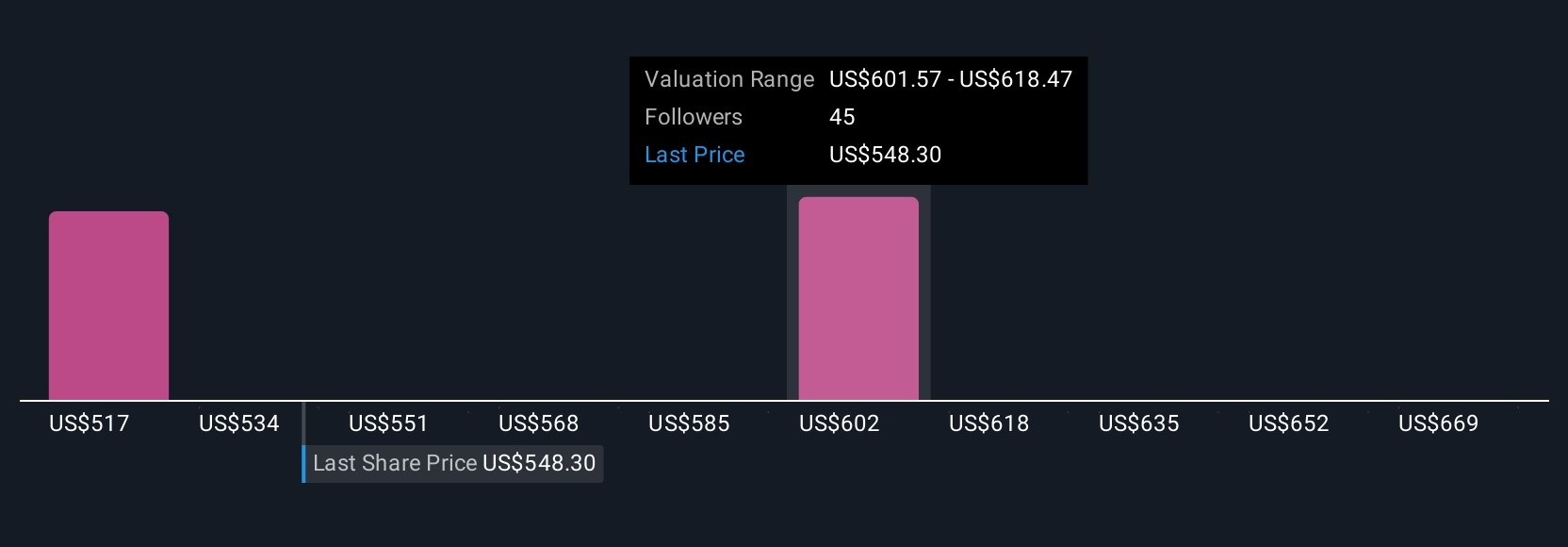

Seven Simply Wall St Community members estimate MSCI’s fair value between US$516 and US$686 per share. Views diverge, especially as ongoing risks tied to client retention and industry trends weigh on future performance.

Explore 7 other fair value estimates on MSCI - why the stock might be worth 10% less than the current price!

Build Your Own MSCI Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MSCI research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free MSCI research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MSCI's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MSCI

MSCI

Provides critical decision support tools and solutions for the investment community to manage investment processes worldwide.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives